- United States

- /

- Machinery

- /

- NYSE:FSS

Federal Signal (FSS): Margin Holds at 11.2%, Supporting Ongoing Premium Valuation Debate

Reviewed by Simply Wall St

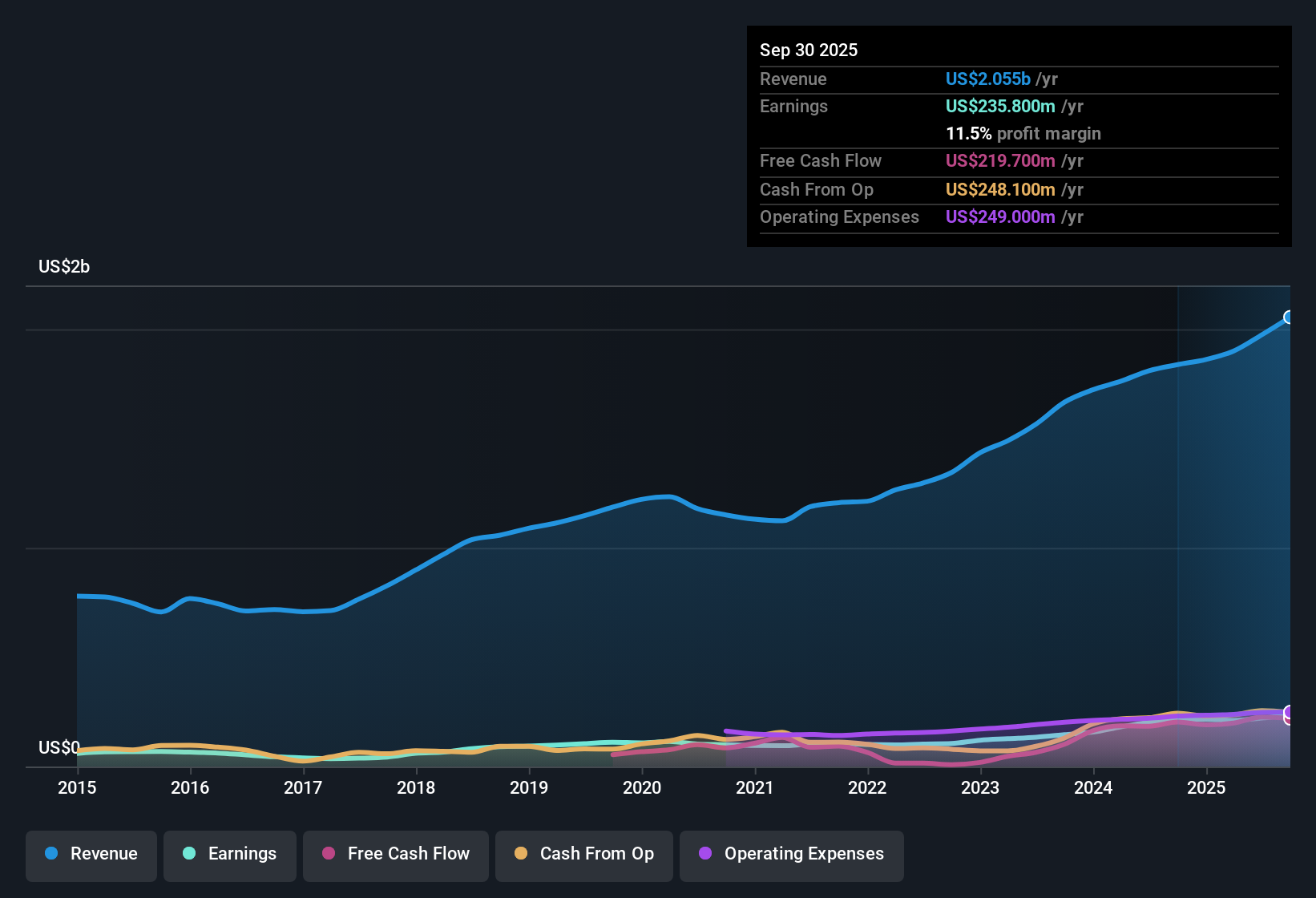

Federal Signal (FSS) maintained a steady net profit margin of 11.2% year over year, underscoring consistent profitability. Over the last five years, the company’s earnings have grown at an average rate of 21.2% annually, but growth eased to 9.6% in the most recent year. Looking forward, analysts expect earnings to climb 11.8% per year and revenue to grow at 10.8% per year, outpacing the broader US market’s 10.3% forecast. With its current share price below DCF-based fair value and trading at a price-to-earnings ratio above industry peers, Federal Signal’s results show solid operational performance set against a premium market valuation.

See our full analysis for Federal Signal.Now, let's see how this outcome stacks up against the current market narratives and community expectations. Some biases may be confirmed, while others might need a rethink.

See what the community is saying about Federal Signal

Aftermarket Revenue Shares Hit New High

- Rising parts and rental sales are now a larger portion of Federal Signal's ESG business, which boosts both net margins and supports more predictable, recurring revenue streams.

- According to the analysts' consensus view, accelerated new product development, capacity expansions, and integration of strategic acquisitions like Hog and TowHaul are unlocking new customer segments. These efforts are driving top-line growth above industry rates and putting the company in a strong position to benefit from operating leverage and efficiency gains.

- Consensus narrative notes that expanded offerings and ongoing efficiency gains are improving margins and fueling long-term earnings expansion beyond what the typical US machinery company is delivering.

- Execution on backlog visibility, especially reaching into 2026, is creating confidence that these higher-margin revenue streams are not just a short-term boost but a fundamental structural advantage.

- To see how community consensus ties these drivers into the broader outlook, read the full consensus narrative for Federal Signal: 📊 Read the full Federal Signal Consensus Narrative.

Analyst Price Target Implies Modest Upside

- With the current share price at $115.77 and the latest analyst consensus price target at $133.00, Federal Signal is priced roughly 15% below where analysts think it could trade on their projected 2028 earnings of $336.9 million and margin expansion toward 13.1%.

- Consensus narrative highlights that, for these target prices to materialize, the company would need to deliver outsized growth in both revenue, projected to reach $2.6 billion in 2028, and earnings. The company would also need to sustain a premium valuation multiple, with a forecasted PE of 29.1x still higher than the US machinery industry average.

- Consensus view points out that while the upside appears limited compared to some higher volatility peers, forecasts for declining shares outstanding and robust profit margin gains are core to this fair value thesis.

- What's surprising is the lack of any major disagreements among analysts, with even the most bullish and bearish targets relatively close together. This signals broad agreement that the shares are reasonably valued at today's level.

Trading at a Premium to Peers Despite DCF Discount

- Federal Signal's price-to-earnings ratio of 31.8x stands well above both the US machinery industry average (24.6x) and direct peers (14.8x), yet the shares are trading below a DCF fair value estimate of $163.20. This highlights tension between market enthusiasm and intrinsic valuation.

- Analysts' consensus narrative emphasizes that investors are weighing robust operating performance and forecasted growth against the reality that, by traditional multiples, shares appear expensive.

- The premium PE suggests the market is already pricing in much of the positive outlook, and future upside depends on Federal Signal outpacing industry returns, supported by both margin and recurring revenue gains as outlined in the consensus view.

- Still, the significant DCF valuation gap may attract value-focused investors who see further upside if the company's cash flow quality endures and exceeds baseline projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Federal Signal on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot opportunities in the data others might overlook? You can craft your own narrative and shape your viewpoint in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Federal Signal.

Explore Alternatives

Despite Federal Signal’s solid growth outlook, its high price-to-earnings ratio signals a premium valuation that could limit future upside compared to peers.

If overpaying worries you, look for better value and long-term opportunity by screening for companies trading below intrinsic value using these 831 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FSS

Federal Signal

Designs, manufactures, and supplies a suite of products and integrated solutions for municipal, governmental, industrial, and commercial customers in the United States, Canada, Europe, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)