- United States

- /

- Construction

- /

- NYSE:FLR

Assessing Fluor’s Valuation After Share Price Pullback and Low Earnings Multiple

Reviewed by Bailey Pemberton

How Fluor's Share Price Has Been Moving

To understand whether Fluor's current price really reflects its underlying worth, it helps to look at how the stock has been behaving over different time frames. The share price tells a story about shifting expectations and risk appetite in the market.

Over the very short term, Fluor has nudged higher, with a 1.9% gain over the last 7 days, suggesting a bit of renewed interest after a rough patch. Zooming out to one month and year to date, however, the stock is still down about 12.5% and 13.4% respectively. This indicates that recent strength is more of a bounce than a full trend change.

The longer term picture is more nuanced. While the share price has fallen roughly 22.0% over the last year, Fluor is still up around 24.2% over three years and 128.8% over five years. This hints that the market has rewarded a multi year turnaround even if the latest 12 months have been choppy.

These mixed returns across different horizons set up an important question for investors. Is the recent pullback a warning that fundamentals are deteriorating, or is it a chance to buy a structurally improved business at a discount? The rest of this article will examine that by weighing multiple valuation lenses against Fluor's track record, before circling back to a more intuitive way of thinking about what the stock might really be worth.

Find out why Fluor's -22.0% return over the last year is lagging behind its peers.

Approach 1: Fluor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting its future cash flows and then discounting those back to a present value. For Fluor, the model is based on a 2 Stage Free Cash Flow to Equity approach, using cash flow projections as the key input.

Fluor generated trailing twelve month free cash flow of about $189.5 Million, and analysts see this stepping up over time, with projections such as roughly $390.9 Million in 2026 and $477.5 Million in 2027. Simply Wall St then extrapolates beyond the explicit analyst horizon, with free cash flow expected to be around $505 Million by 2035, all in $. These future figures are discounted back to today to arrive at an estimated intrinsic value of about $44.67 per share.

Compared with the current market price, this implies Fluor is trading at roughly a 4.5% discount to its DCF fair value, suggesting the shares are only slightly below what the cash flow model indicates they are worth.

Result: ABOUT RIGHT

Fluor is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Fluor Price vs Earnings

For companies that are consistently profitable, the price to earnings ratio, or PE, is often the most intuitive way to think about valuation because it directly links what you pay to the earnings the business is generating today.

What counts as a normal PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and more predictable profits usually justify a higher multiple, while cyclical or uncertain earnings tend to trade on lower PE ratios.

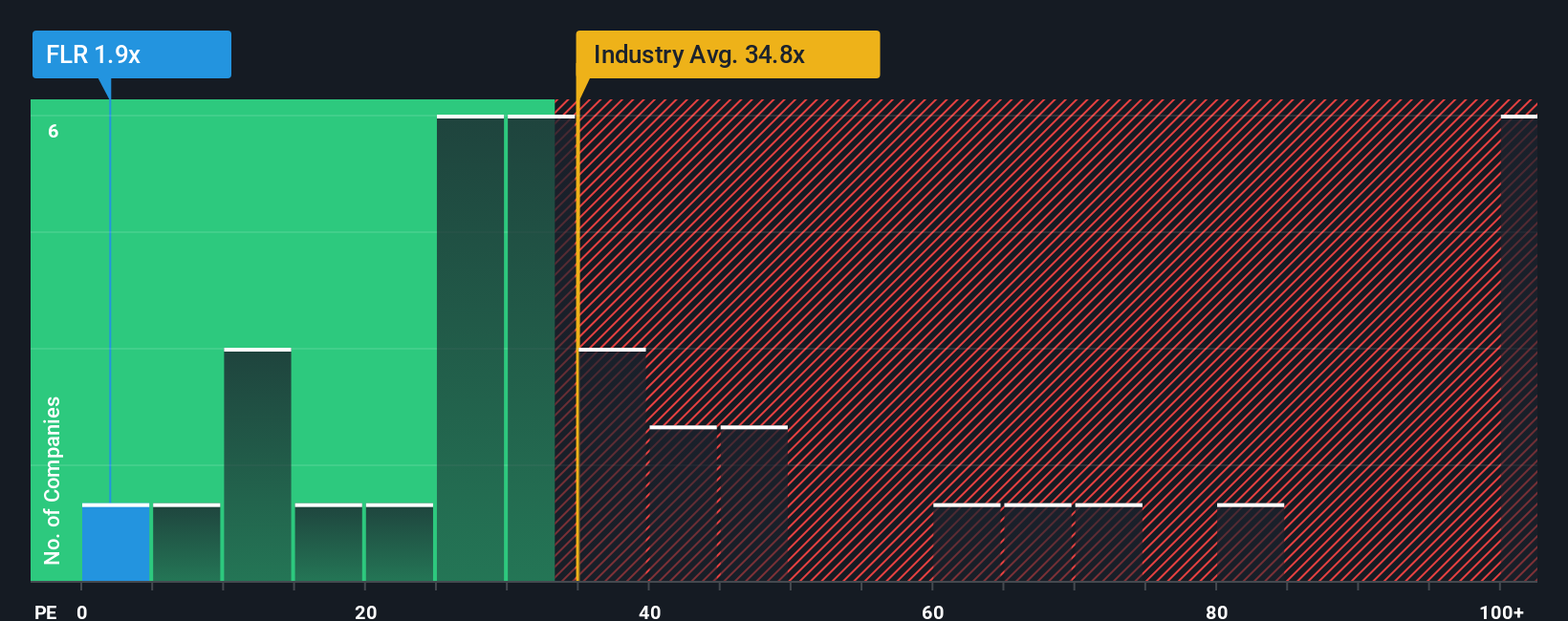

Fluor currently trades on a PE of about 2.0x, which is dramatically below both the Construction industry average of roughly 33.3x and the peer average of around 30.0x. At first glance that kind of discount might suggest the market is pricing in significant risk or a sharp drop in earnings, but comparisons with simple averages can be misleading.

Simply Wall St addresses this with its Fair Ratio, a proprietary estimate of what PE Fluor should trade on after factoring in its growth outlook, profitability, risk profile, industry, and market cap. For Fluor, the Fair Ratio is about 5.2x. That is still well above the current 2.0x and indicates the shares look undervalued even after adjusting for company specific risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fluor Narrative

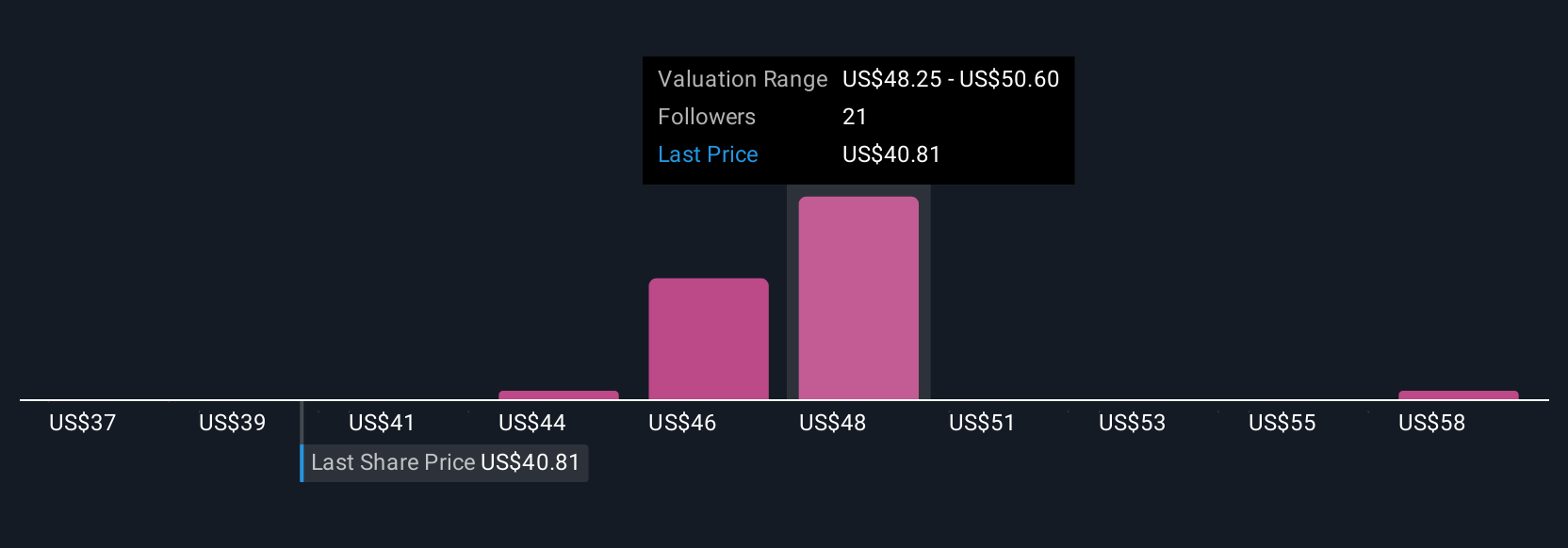

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to link your view of Fluor’s story to a financial forecast and then to a fair value estimate. You can turn your assumptions about future revenue, earnings and margins into a clear fair value that you can compare with today’s price, all within an easy tool on Simply Wall St’s Community page that millions of investors already use. Narratives stay up to date as news or earnings land. For example, one bullish Fluor investor might build a Narrative around the upper end of analyst assumptions, expecting revenue to reach about $19.6 billion, earnings of roughly $511.6 million and a fair value near $57 per share. A more cautious investor might lean toward lower earnings closer to $420 million and a fair value around $40, helping each decide whether the current price of about $40.71 looks like a buy, a hold, or a signal to take profits.

Do you think there's more to the story for Fluor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026