- United States

- /

- Construction

- /

- NYSE:FIX

Insiders At Comfort Systems USA Sold US$45m In Stock, Alluding To Potential Weakness

The fact that multiple Comfort Systems USA, Inc. (NYSE:FIX) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, if numerous insiders are selling, shareholders should investigate more.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Comfort Systems USA

Comfort Systems USA Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the CEO, President & Director, Brian Lane, for US$6.7m worth of shares, at about US$449 per share. So we know that an insider sold shares at around the present share price of US$435. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

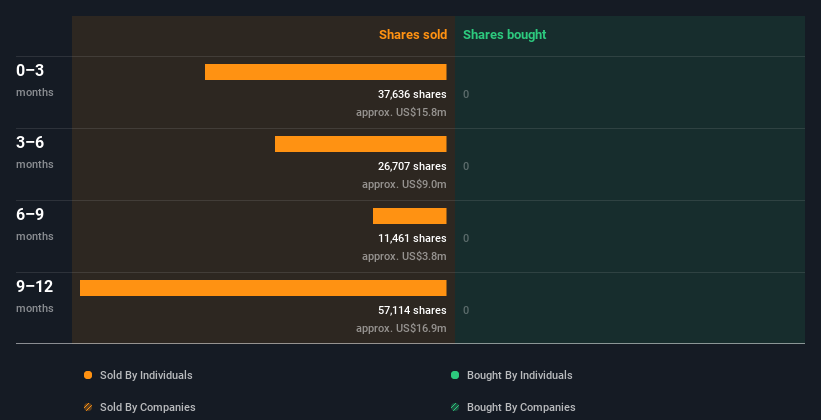

Insiders in Comfort Systems USA didn't buy any shares in the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insiders At Comfort Systems USA Have Sold Stock Recently

The last three months saw significant insider selling at Comfort Systems USA. In total, insiders sold US$16m worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Does Comfort Systems USA Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Comfort Systems USA insiders own about US$210m worth of shares (which is 1.4% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Comfort Systems USA Insiders?

Insiders sold Comfort Systems USA shares recently, but they didn't buy any. And even if we look at the last year, we didn't see any purchases. But since Comfort Systems USA is profitable and growing, we're not too worried by this. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Comfort Systems USA. While conducting our analysis, we found that Comfort Systems USA has 1 warning sign and it would be unwise to ignore this.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.