- United States

- /

- Construction

- /

- NYSE:FIX

Comfort Systems USA (FIX): Assessing Valuation After New Analyst Outperform Rating and Record Backlog Growth

Reviewed by Simply Wall St

Comfort Systems USA (FIX) is back in the spotlight after a new analyst report initiated coverage with an Outperform rating, highlighting the company’s central role in the U.S. industrial reshoring push. This updated perspective has sparked conversations among investors about where the business is headed next, particularly given the strategic importance of its services for large-scale manufacturing and infrastructure projects. The recent analysis builds on an existing narrative of upbeat earnings and record project backlogs, which suggest Comfort Systems USA is firmly on the radar for those tracking industrial growth trends in America.

Over the past year, Comfort Systems USA has quietly outperformed expectations. Its share price has more than doubled, with momentum building further after strong second-quarter results and management consistently topping forecasts. Alongside the record project backlog and double-digit annual revenue growth, these factors have helped maintain investor interest despite sector headwinds related to slowing tech demand and labor pressures. The tone from recent coverage amplifies optimism about the company’s ability to capture long-term growth amid ongoing capital investment in U.S. industry.

After such a steady run and with new attention from analysts, is Comfort Systems USA still trading at an attractive entry point, or is the market already reflecting the full potential of its reshoring upside?

Most Popular Narrative: 2.9% Undervalued

According to the most widely followed narrative, Comfort Systems USA is trading just below its estimated fair value, with analysts pricing in continued growth and strong underlying fundamentals.

“Robust and expanding project backlog, currently at a record $8.1 billion with 37% same-store growth year over year, demonstrates sustained customer demand for new builds and retrofit or modernization projects. This directly supports future revenue and earnings growth as the company executes on this pipeline.”

This narrative hints at ambitious assumptions underpinning the valuation. What specific growth rates are supporting this premium status? The real secret lies in the blend of projected profit margins and anticipated industry demand. Curious about the exact roadmap to this strategic price target? Unlock the full thesis for the crucial details driving Comfort Systems USA's valuation.

Result: Fair Value of $800.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in technology-driven projects or persistent labor shortages could quickly challenge the growth assumptions behind today's optimistic outlook.

Find out about the key risks to this Comfort Systems USA narrative.Another View: A Cash Flow Perspective

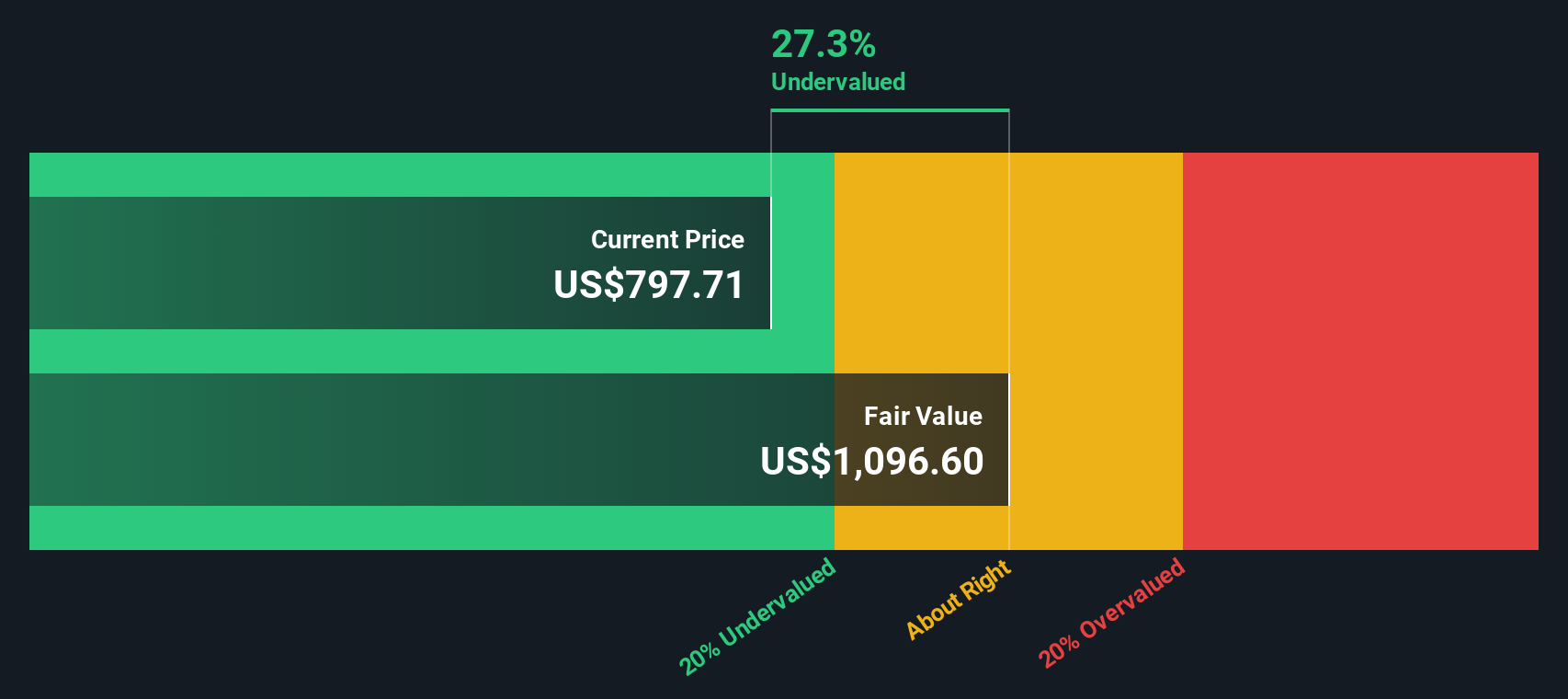

While multiples suggest Comfort Systems USA could be undervalued, our DCF model reaches a similar conclusion. By focusing on future cash flows rather than market pricing, this approach can either confirm or challenge the optimism.

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Comfort Systems USA to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Comfort Systems USA Narrative

If you see the numbers differently or want to dive deeper into your own analysis, you can develop a unique narrative for Comfort Systems USA in just a few minutes. Do it your way

A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

There’s no need to miss out on the next big winner. Power up your portfolio by targeting companies that fit your own strategy, and see what is possible when you put the right tools to work.

- Unlock attractive yields as you uncover market leaders paying consistent returns with dividend stocks with yields > 3%.

- Spot tomorrow’s tech giants in the making by scanning breakthrough innovations and trailblazing potential with AI penny stocks.

- Find hidden gems trading below their true worth, and pursue real value opportunities using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives