- United States

- /

- Trade Distributors

- /

- NYSE:FERG

Ferguson (NYSE:FERG) Q1 EPS Strength Reinforces Bullish Margin Expansion Narrative

Reviewed by Simply Wall St

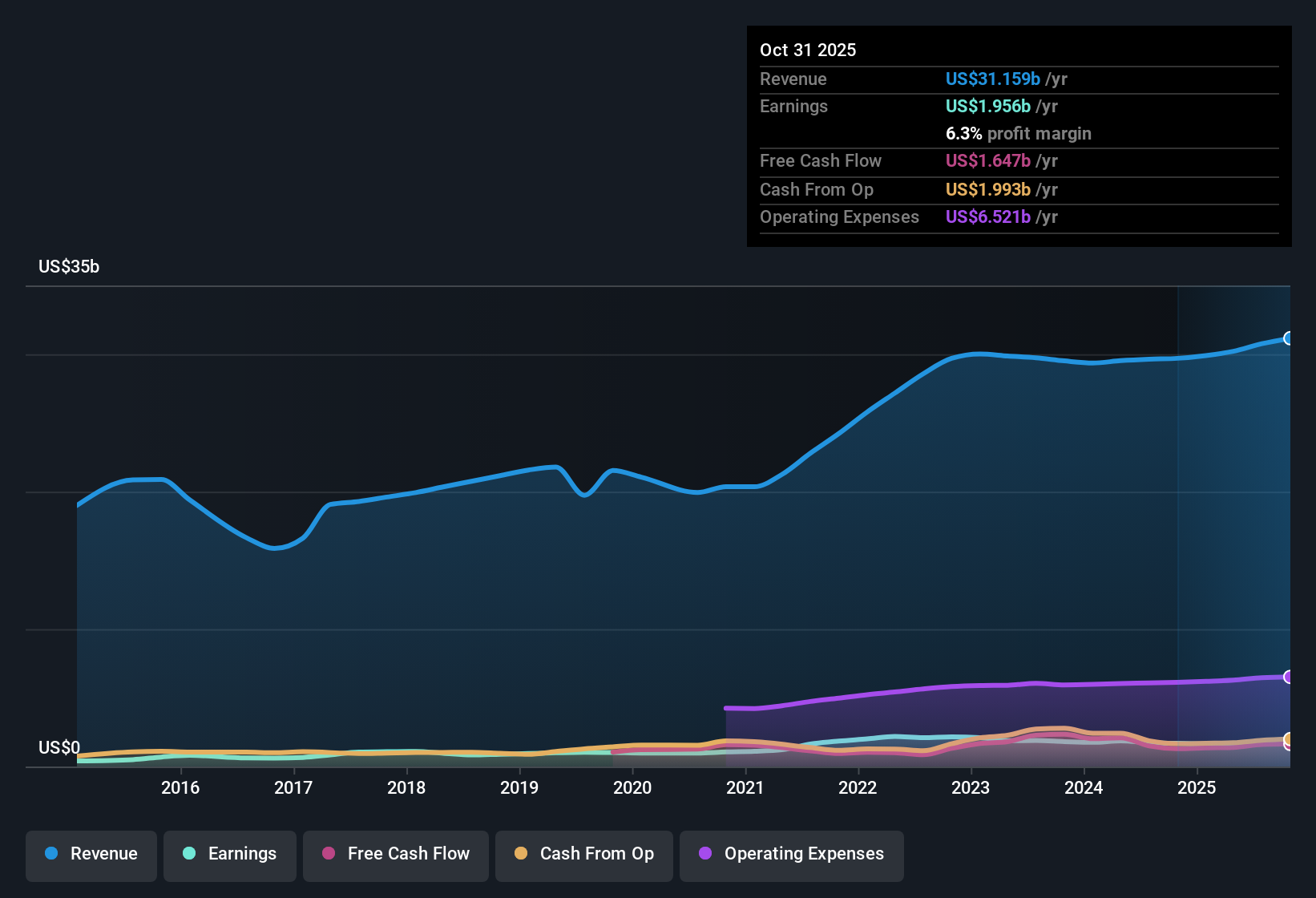

Ferguson Enterprises (FERG) just opened fiscal 2026 with Q1 revenue of about $8.2 billion and basic EPS of $2.91, setting the tone for how its earnings momentum is carrying into the new year. The company has seen quarterly revenue move from roughly $7.9 billion in Q4 2024 to $7.8 billion in Q1 2025 and now $8.2 billion in Q1 2026, while basic EPS has stepped up from $2.24 to $2.34 and then to $2.91 over the same periods. This gives investors a clear view of how earnings power is tracking the top line. With trailing 12 month earnings up 16% and net margins running in the mid single digits, the latest print keeps the focus on how sustainably Ferguson can defend and build on its current profitability profile.

See our full analysis for Ferguson Enterprises.With the numbers on the table, the next step is to set them against the key narratives investors follow around Ferguson, highlighting where the latest results support the story and where they begin to challenge it.

See what the community is saying about Ferguson Enterprises

Net margin lifts to 6.3 percent

- On a trailing basis, Ferguson generated $31.2 billion of revenue and $1.96 billion of net income, translating into a 6.3 percent net margin versus 5.7 percent a year ago.

- Consensus narrative expects margin gains from cost reduction and scale in areas like HVAC and Waterworks, and the shift from a 5.7 percent to 6.3 percent margin suggests those efficiency efforts are showing up in the numbers, even as:

- Trailing 12 month revenue is up from $29.6 billion to $31.2 billion, so margin improvement is coming alongside higher volume rather than just cost cuts.

- Net income over the same window has risen from $1.74 billion to $1.96 billion, indicating that profitability is growing faster than the top line.

Earnings up 16 percent, growth to slow

- Trailing 12 month earnings increased 16 percent year over year, and are forecast to grow about 9.95 percent per year, compared with a broader US market earnings growth forecast of 16.2 percent.

- Analysts' consensus view highlights strategic growth bets in HVAC and infrastructure as key EPS drivers, and the data partly backs this, because:

- Trailing EPS has climbed from $8.55 to $9.89, while trailing revenue moved from $29.6 billion to $31.2 billion, so earnings are outpacing sales for now.

- Forecast earnings growth of about 9.95 percent per year is still solid, but sits below the US market expectation, which means Ferguson needs its growth projects to execute well just to keep up with these more moderate assumptions.

Valuation sits between DCF upside and rich P E

- The stock trades at $226.02, around 7.4 percent below the DCF fair value of $244.04, yet on 22.6 times earnings compared with 19.5 times for the US Trade Distributors industry and 22.5 times for peers.

- Bears focus on this premium multiple and financial risks, and the figures give them points to work with, even though they also show support for the business case:

- The gap between the $226.02 share price and $244.04 DCF fair value hints at modest upside, but the higher P E versus the 19.5 times industry level shows investors are already paying above average for that potential.

- Minor flags such as elevated debt, an unstable dividend record, and recent insider selling sit alongside that premium valuation, so any stumble in the 7.2 percent revenue growth or 9.95 percent earnings growth outlook would leave less margin for error.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ferguson Enterprises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens? Use that angle to build your own narrative in just a few minutes, then Do it your way.

A great starting point for your Ferguson Enterprises research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Ferguson pairs solid recent earnings momentum with premium valuation, rising debt concerns, and growth forecasts that trail the broader US market outlook.

If you want stronger upside without paying up for balance sheet risk and insider selling noise, use our solid balance sheet and fundamentals stocks screener (1938 results) to quickly focus on financially stronger alternatives built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FERG

Ferguson Enterprises

Operates as a distributor serving the water and air specialized professional in the United States and Canada.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026