- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Does Eve Holding’s US$230 Million Raise and eVTOL Backlog Momentum Reinforce the Bull Case for EVEX?

Reviewed by Sasha Jovanovic

- Earlier this month, Eve Holding announced it had raised US$230 million in capital and reported a growing backlog of Letters of Intent for its eVTOL aircraft, signaling ongoing momentum in urban air mobility solutions.

- The capital infusion not only strengthens Eve’s financial flexibility but also highlights deepening commercial interest in next-generation electric aviation technologies beyond traditional aircraft sales.

- We’ll explore how Eve Holding’s strengthened capital base supports its investment narrative in the fast-evolving eVTOL sector.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Eve Holding's Investment Narrative?

Owning shares in Eve Holding means buying into the vision that electric vertical takeoff and landing (eVTOL) aircraft can reshape urban mobility, and betting that Eve will carve out a meaningful position in the Advanced Air Mobility sector. The recent US$230 million capital raise and growth in Letters of Intent could be an important catalyst, reducing near-term liquidity concerns and supporting continued R&D. However, Eve remains early stage: revenues are non-existent and losses have widened, while share price volatility and past dilution underline ongoing risks. Being added to the S&P Global BMI Index and announcing new commercial agreements are encouraging signs, but until Eve can convert its backlog to revenues and move closer to profitability, uncertainty remains elevated. The recent capital injection provides a financial cushion, but does not eliminate execution and commercialization risks.

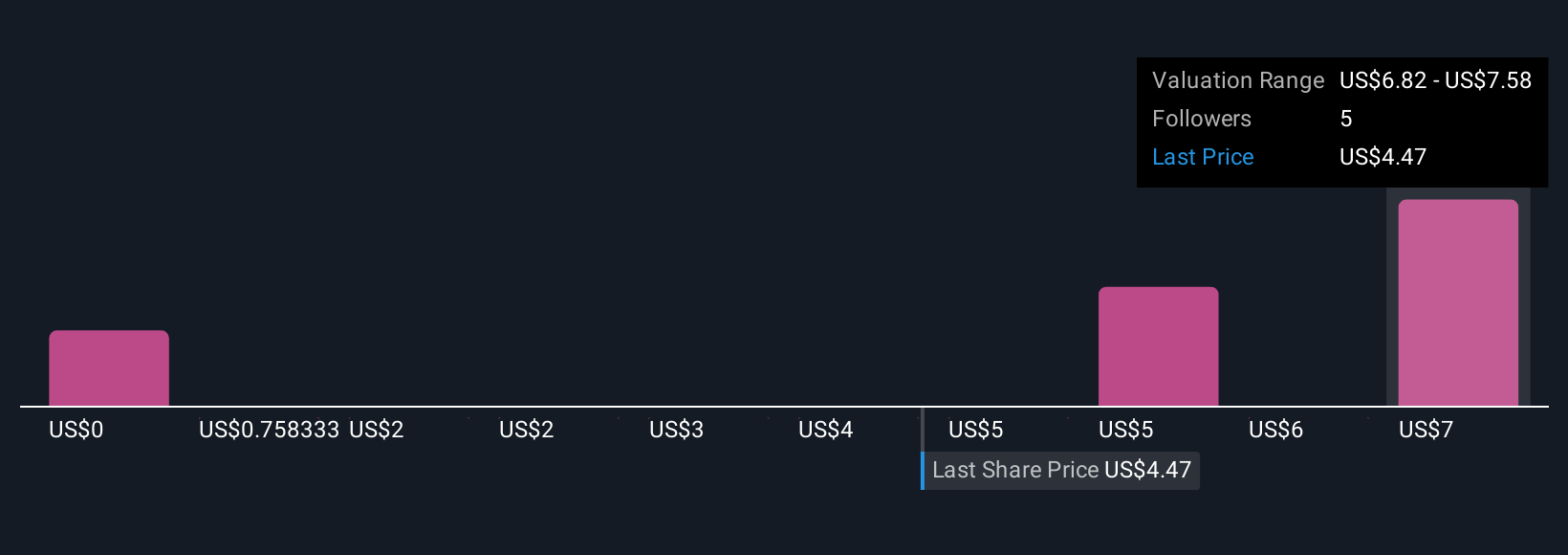

On the other hand, capital raises can signal future dilution risks that investors should watch closely. Eve Holding's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Eve Holding - why the stock might be worth less than half the current price!

Build Your Own Eve Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Eve Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eve Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with slight risk.

Market Insights

Community Narratives