- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Assessing Eve Holding After Strong 16.7% Rally and Urban Air Mobility Industry News

Reviewed by Bailey Pemberton

Thinking about what to do with your Eve Holding shares, or eyeing them for a fresh position? You are not alone. The stock has kept even seasoned investors on their toes, especially after some eye-catching moves. Over the past month, Eve Holding climbed a robust 16.7%, a performance that stands out against its modest dip of 0.9% in the past week. The bigger picture is equally intriguing. The stock is up 36.6% over the last year, yet still carries a hefty three-year loss of 43.1%. Clearly, there is a tug-of-war happening in the market’s perception of Eve Holding, with recent optimism starting to balance out the heavier long-term losses.

Some of these swings tie back to wider market trends in urban air mobility, where even a snippet of regulatory progress or competitor news can send shares moving in either direction. As market developments continue to shape investor sentiment, Eve’s value proposition becomes a compelling puzzle. By traditional valuation methods, it scores a 2 out of 6 on our undervaluation scale, which suggests it is not exactly a screaming bargain but not overhyped either.

So, how do those valuation metrics stack up, and are they the best way to judge Eve Holding’s real potential? Let’s break down the numbers. Before wrapping up, here is a smarter approach to finding real value in a stock like this.

Eve Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eve Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the underlying value of Eve Holding by projecting its future cash flows and discounting them to today's value. This method reflects what investors would pay now to receive those future cash flows, using what we know and expect about the company's performance.

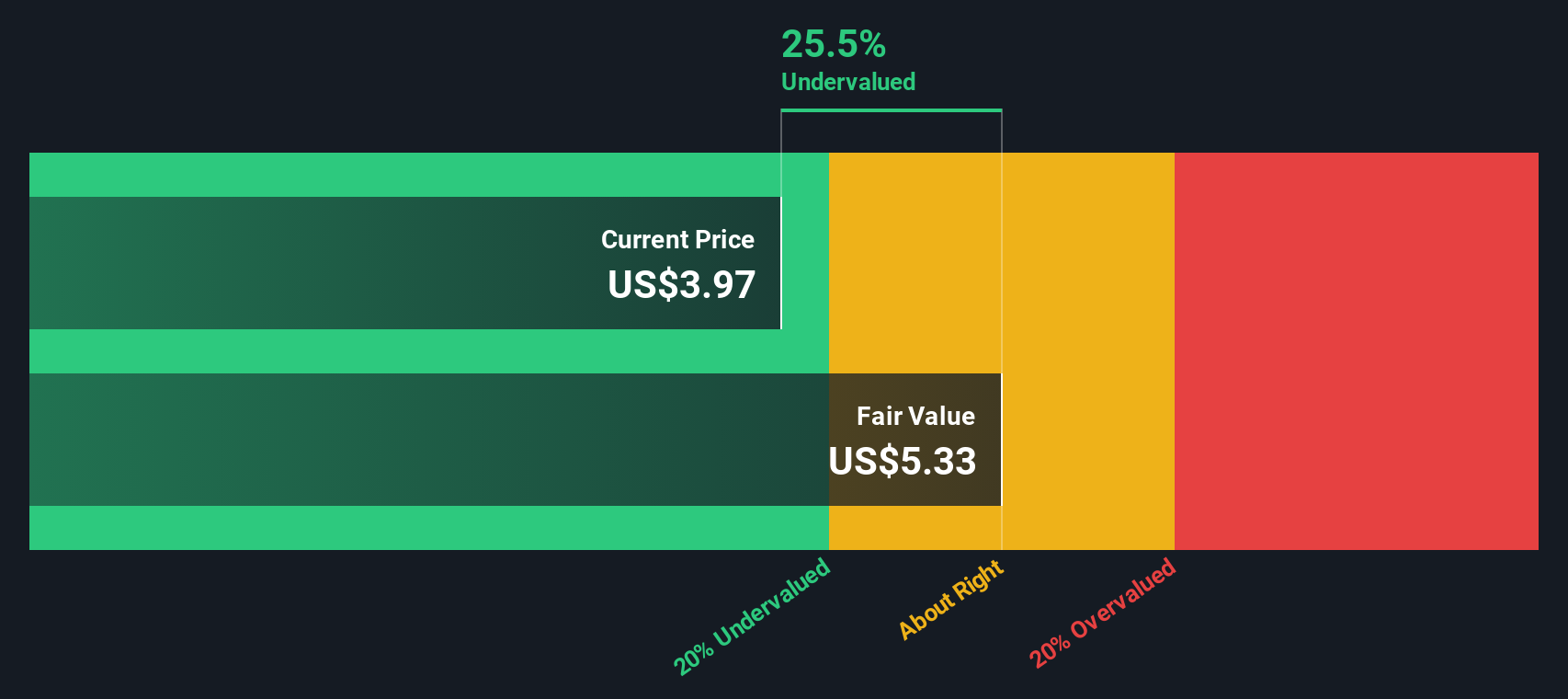

Currently, Eve Holding’s Free Cash Flow stands at -$156.1 million. Analysts expect negative cash flows for several years, with projections up to 2029 still in the red until a projected turnaround. By 2029, Eve’s Free Cash Flow is forecast to reach $46.7 million. Simply Wall St extends these projections even further, anticipating continued growth through 2035.

Based on this DCF model, the intrinsic fair value for Eve Holding’s shares comes out to $5.32. Given the current market price, the stock appears to trade at a 14.5% discount to its intrinsic value. In other words, according to the DCF approach, the stock is about 14.5% undervalued right now. This suggests that investors curious about future growth may be getting in at an attractive price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eve Holding is undervalued by 14.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Eve Holding Price vs Book (P/B) Ratio

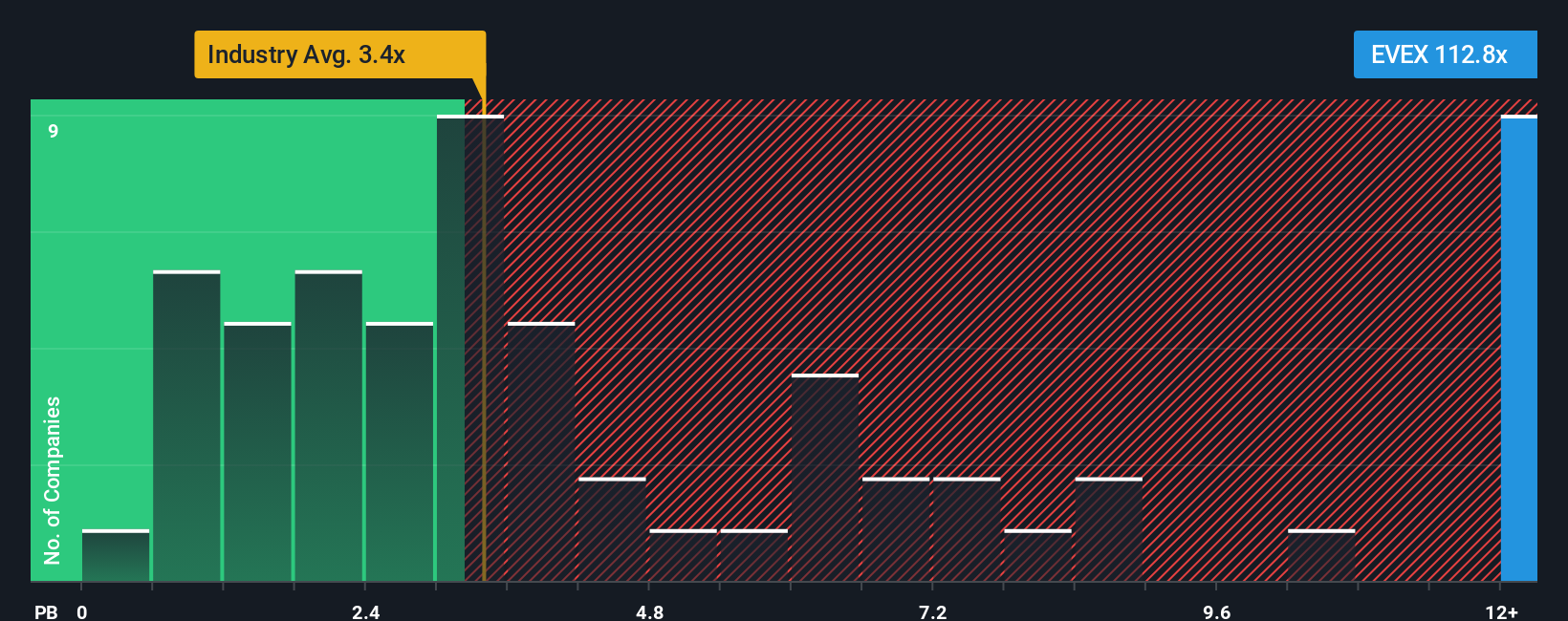

The price-to-book (P/B) ratio is a widely used metric to evaluate companies, especially when they are not yet profitable or have negative earnings. For Eve Holding, which is still building its business and not generating positive net income, the P/B ratio offers a clearer sense of what investors are willing to pay for each dollar of the company’s net assets.

It is important to note that what counts as a "fair" P/B ratio depends on various factors including a company’s expected growth, underlying risks, and how its industry typically trades. Higher growth prospects and lower risk usually justify a higher P/B ratio, while more risk or slower growth put downward pressure on what investors consider reasonable.

Currently, Eve Holding trades at a lofty P/B ratio of 118x. This is dramatically higher than both the Aerospace & Defense industry average of 3.52x and the average of its closest peers at 3.53x. Simply Wall St provides a “Fair Ratio” baseline. This baseline is tailored to each company, considering its specific growth outlook, profit margin, risks, industry dynamics, and market cap. This holistic approach offers a much more accurate picture than simply comparing Eve to industry or peer averages, which may ignore what makes Eve unique.

When comparing Eve Holding’s actual P/B multiple with the Fair Ratio, the figures are not close. This suggests the current price investors are paying for Eve’s book value is materially ahead of what would be considered justified by its fundamentals and risks.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eve Holding Narrative

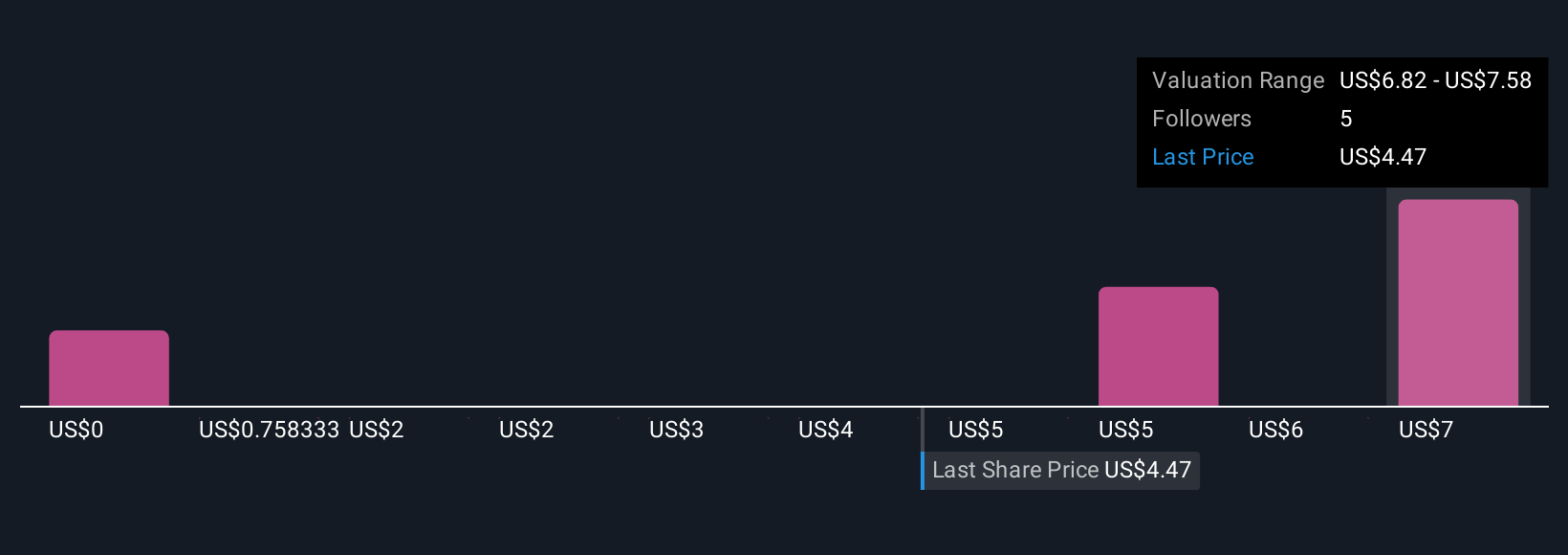

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a story that investors create to explain how and why they believe a company like Eve Holding will perform in the future, translating their point of view directly into concrete forecasts such as future revenue, margins, and fair value.

These Narratives connect the bigger picture of Eve Holding’s journey to specific financial outcomes, making investment decisions more relevant and personal. On Simply Wall St's Community page, millions of investors can easily create, share, and compare Narratives. This makes sophisticated analysis much more approachable.

Using Narratives, you can quickly see whether your fair value estimate signals Eve Holding is a buy or sell at today’s price. As new news or quarterly results emerge, your Narrative and its fair value update in real time. For example, one investor’s bullish Narrative may set Eve’s fair value far above the current price, while another’s more cautious view could place it well below.

Do you think there's more to the story for Eve Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with slight risk.

Market Insights

Community Narratives