- United States

- /

- Electrical

- /

- NYSE:EMR

Will Investor Optimism for Emerson (EMR) Automation Growth Align With Upcoming Earnings Realities?

Reviewed by Sasha Jovanovic

- In recent days, Emerson Electric has drawn heightened attention as investors anticipate its upcoming earnings report, with analyst forecasts projecting earnings of US$1.62 per share and revenue of US$4.9 billion, both indicating growth over the same quarter last year.

- The surge in investor interest is also being fueled by robust demand for Emerson’s advanced automation and AI-enabled products, which is leading to strong order growth across global industrial markets.

- With this in mind, we'll review how investor expectations for continued growth in Emerson's automation and AI segments impact its investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Emerson Electric Investment Narrative Recap

To be a shareholder of Emerson Electric, you need to believe in the company’s ability to leverage rising demand for automation and AI-driven industrial solutions, enabling sustainable growth as markets modernize. The recent momentum in analyst forecasts, anticipating EPS of US$1.62 and revenue of US$4.9 billion, reinforces order growth as the most important short-term catalyst, but margin pressures in certain segments remain a meaningful risk. For now, the headlines don't materially alter either the core catalyst or the most pressing risk.

Among Emerson’s recent announcements, the launch of the Guardian Virtual Advisor in September stands out as especially relevant. This new AI-powered lifecycle management platform reflects the company’s commitment to delivering advanced automation tools, supporting optimism around software-driven revenue growth and recurring business models that could shape upcoming earnings results.

However, while automation demand is strong, it’s important to watch for unexpected FX headwinds that could quietly challenge segment margins...

Read the full narrative on Emerson Electric (it's free!)

Emerson Electric's outlook anticipates $21.3 billion in revenue and $3.3 billion in earnings by 2028. This scenario assumes a 6.2% annual revenue growth rate and a $1.1 billion increase in earnings from today's $2.2 billion.

Uncover how Emerson Electric's forecasts yield a $150.84 fair value, a 20% upside to its current price.

Exploring Other Perspectives

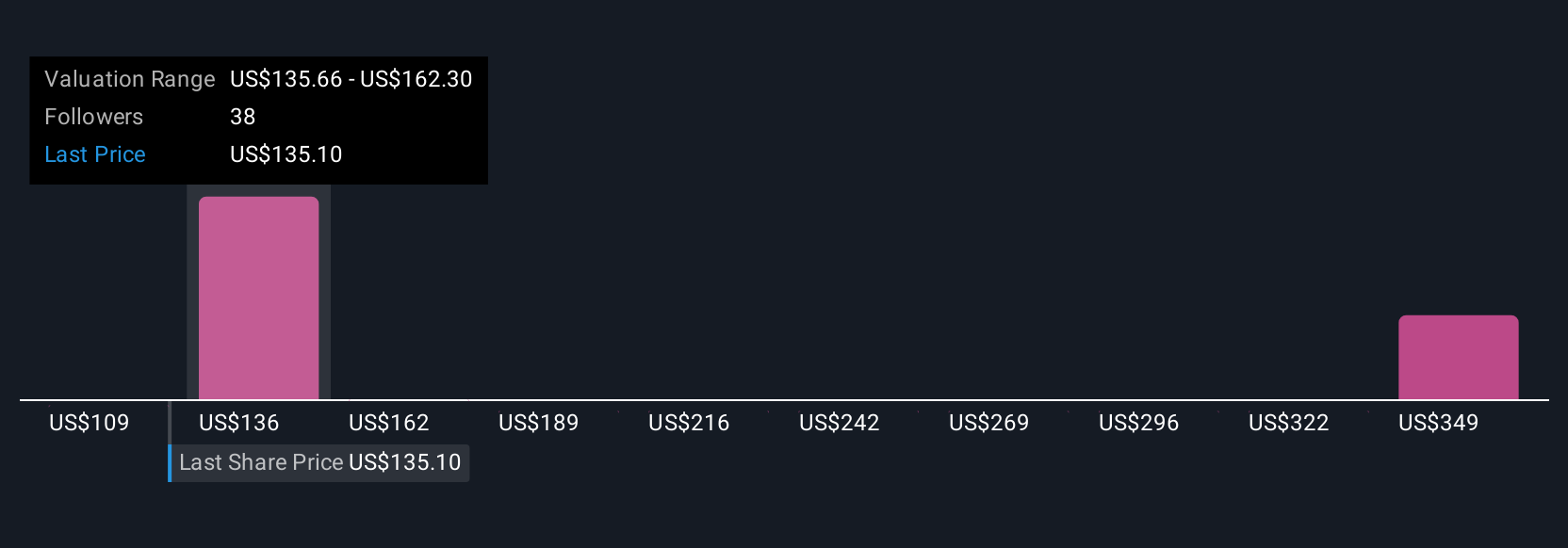

Simply Wall St Community members submitted five fair value estimates for Emerson Electric, ranging from US$109.01 to US$361.45. While opinions diverge significantly, recent analyst news has focused on robust automation demand as a key driver, so be sure to compare these views before forming your outlook.

Explore 5 other fair value estimates on Emerson Electric - why the stock might be worth over 2x more than the current price!

Build Your Own Emerson Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Emerson Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerson Electric's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives