- United States

- /

- Electrical

- /

- NYSE:EMR

Is Emerson Electric's (EMR) Margin Strength Offsetting Growth Concerns Amid Mixed Quarterly Results?

Reviewed by Simply Wall St

- Emerson Electric recently reported mixed third-quarter results, with net sales falling short of expectations but adjusted earnings per share exceeding estimates, underscoring strong profitability and resilient cash generation amid broader economic challenges.

- Despite the top-line miss, analyst consensus remains constructive, highlighting enduring optimism grounded in Emerson's margin strength and robust operational performance even during times of industry uncertainty.

- We'll explore how Emerson's better-than-expected profitability in a challenging quarter may influence its investment outlook and future prospects.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Emerson Electric Investment Narrative Recap

To own shares in Emerson Electric, investors need to be confident in the company’s ongoing transformation into a pure-play automation leader, driven by robust operational execution, margin expansion, and higher-quality recurring revenue. The recent mixed Q3 results do little to change the near-term outlook: profitability remains a key catalyst, while margin pressure and exposure to tariffs in Intelligent Devices still stand as significant short-term risks; these impacts appear contained for now, given steady cash generation and positive earnings guidance.

Among recent developments, Emerson’s launch of Nigel AI Advisor supports its focus on expanding advanced automation and artificial intelligence solutions, a catalyst spotlighted by the Q3 performance. This initiative may help the company further capitalize on software-driven growth and bolster resilience against cycles in more traditional industrial markets, reinforcing one of the most important drivers for future performance.

But in contrast, investors should be mindful of continuing headwinds from tariffs and unpredictable currency shifts that could affect segment margins…

Read the full narrative on Emerson Electric (it's free!)

Emerson Electric's narrative projects $21.3 billion revenue and $3.3 billion earnings by 2028. This requires 6.2% yearly revenue growth and a $1.1 billion earnings increase from $2.2 billion today.

Uncover how Emerson Electric's forecasts yield a $149.69 fair value, a 13% upside to its current price.

Exploring Other Perspectives

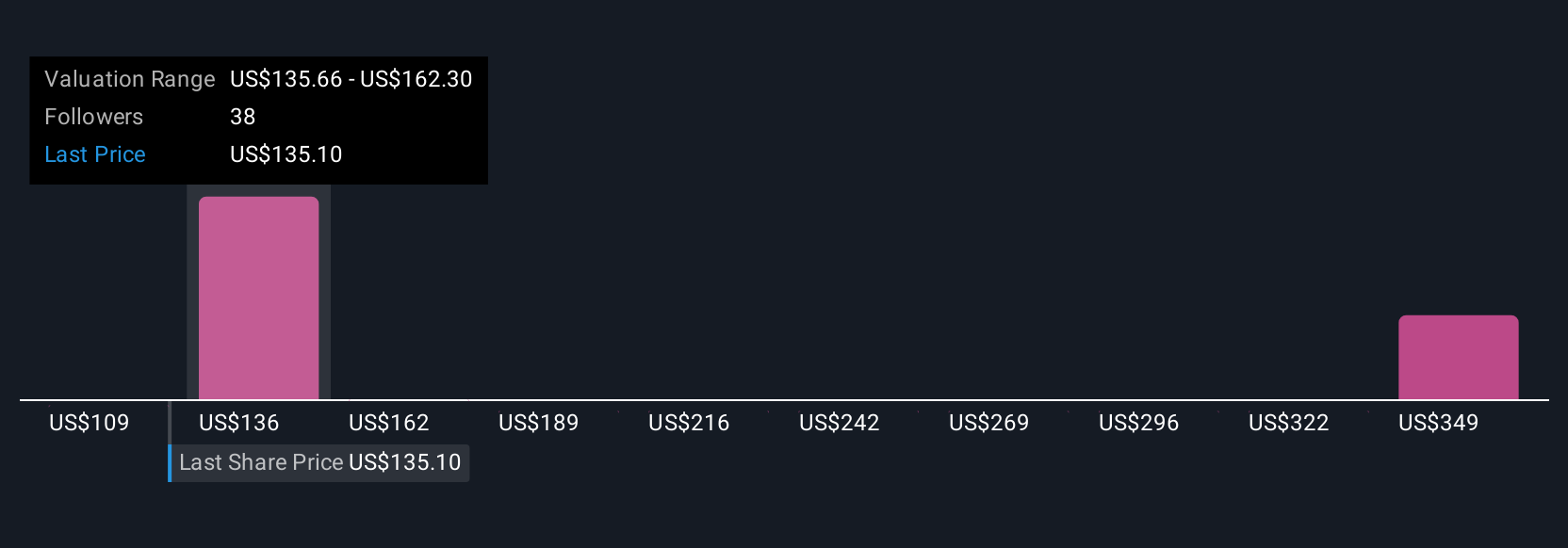

Five fair value estimates from the Simply Wall St Community span a wide US$109 to US$377 range, capturing both conservative and highly optimistic growth assumptions. With margin strength emerging as a recent catalyst, these varied viewpoints highlight why it pays to compare different projections about Emerson’s future.

Explore 5 other fair value estimates on Emerson Electric - why the stock might be worth 18% less than the current price!

Build Your Own Emerson Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Emerson Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emerson Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives