- United States

- /

- Construction

- /

- NYSE:ECG

Everus Construction Group (NYSE:ECG): How the Latest 6% Gain Stacks Up Against Valuation

Reviewed by Kshitija Bhandaru

See our latest analysis for Everus Construction Group.

Everus Construction Group’s 1-month share price return of 6% builds on solid momentum that has steadily grown through the year. This hints at renewed investor confidence and optimism around future earnings growth after a period of relative quiet.

If you’re looking for more stocks showing positive momentum, this is the perfect chance to discover fast growing stocks with high insider ownership

With shares trading close to analyst targets and recent growth already factored in, investors must decide if Everus Construction Group still offers an attractive entry point or if the market has already fully valued its future prospects.

Price-to-Earnings of 24.6x: Is it justified?

Everus Construction Group is trading on a price-to-earnings (P/E) ratio of 24.6x, which is significantly below both its industry and peer averages. With the last close at $80.07, the stock appears attractively valued relative to other construction companies.

The P/E ratio tells investors how much they are paying for each dollar of the company's earnings. For capital-intensive sectors like construction, this metric is a key way to compare profitability and growth expectations across companies.

In Everus Construction Group's case, the notably lower P/E ratio compared to the industry average (35.6x) and peer average (36.6x) stands out. This suggests the market may be underestimating Everus' future growth potential or the quality of its recent earnings momentum. Compared to the estimated fair P/E of 25.2x, the company is essentially fairly priced. However, the gap with industry norms hints at possible upside if the market adjusts its view.

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 24.6x (UNDERVALUED)

However, slower net income growth and recent short-term share weakness could challenge confidence if these trends continue in the coming quarters.

Find out about the key risks to this Everus Construction Group narrative.

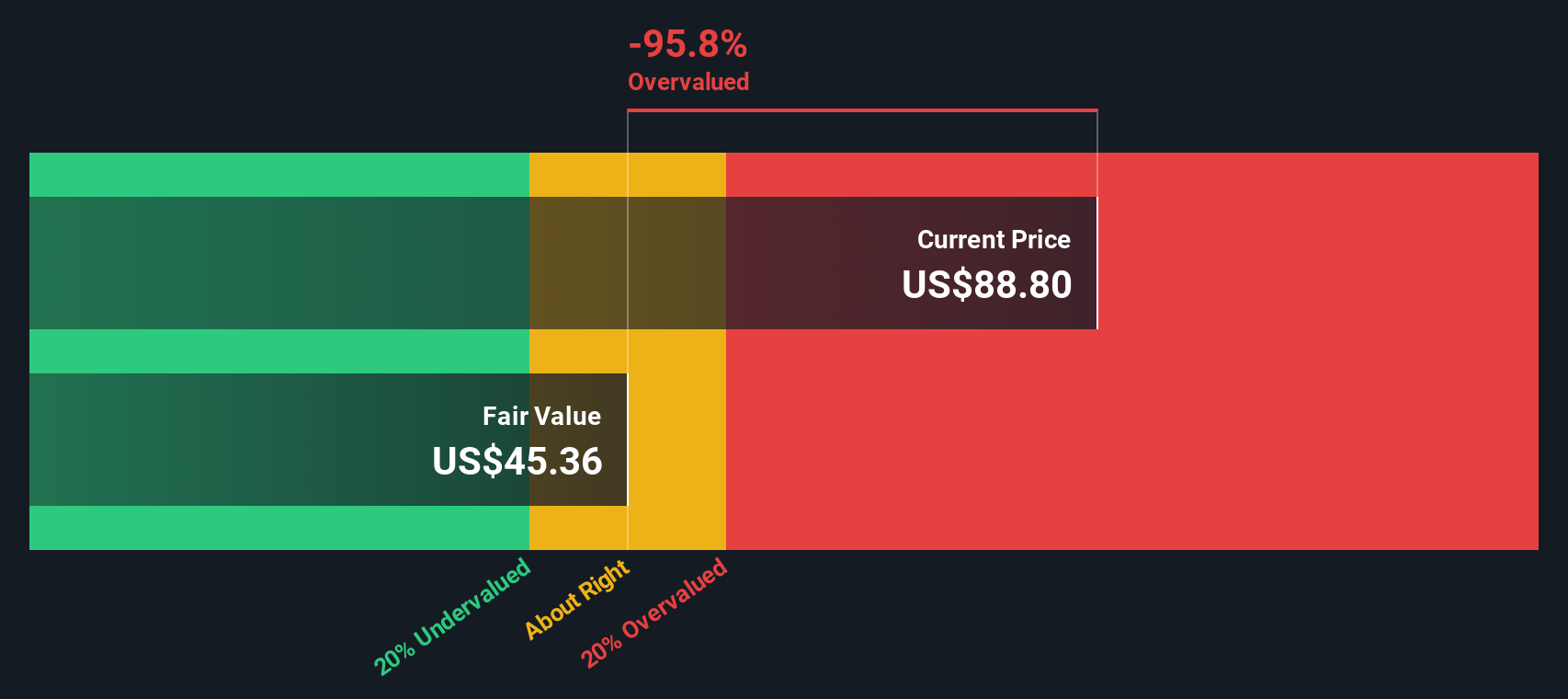

Another View: Discounted Cash Flow Suggests Overvaluation

While Everus Construction Group appears undervalued based on its price-to-earnings ratio, our DCF model offers a different perspective. The SWS DCF model estimates a fair value of $45.19, which is well below the current share price of $80.07. This may indicate potential overvaluation. Which measure tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you want to dig deeper, explore the numbers first-hand and craft your own perspective, you can create a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Everus Construction Group.

Looking for more investment ideas?

Act now and unlock advantages you might be missing. There are powerful stock opportunities that could transform your portfolio, and others are already taking notice.

- Target reliable income streams by checking out these 19 dividend stocks with yields > 3% for stocks with attractive yields that can strengthen your returns.

- Spot companies redefining artificial intelligence as you browse these 24 AI penny stocks and see how innovation is driving new market leaders.

- Catch hidden value in the market by reviewing these 896 undervalued stocks based on cash flows and uncover stocks trading below their intrinsic worth before the crowd does.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everus Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECG

Everus Construction Group

Provides contracting services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives