- United States

- /

- Construction

- /

- NYSE:ECG

Assessing Everus Construction Group’s (ECG) Valuation Following Top Analyst Upgrades and Strong Earnings Momentum

Reviewed by Kshitija Bhandaru

Everus Construction Group (ECG) has drawn attention in the construction sector after a recent jump to a top Zacks Rank, with upward earnings estimate revisions and improving analyst sentiment driving the story this week.

See our latest analysis for Everus Construction Group.

Everus Construction Group’s share price momentum stands out in an industry wrestling with cost pressures and tariffs. Despite a brief dip of about 5.6% in the last session, the stock remains up nearly 20% year-to-date and over 20% in the last 90 days. This reflects a clear build-up of optimism as investors reward its earnings momentum and exposure to infrastructure spending.

If construction’s renewed spark has you thinking bigger, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

After such strong gains and a flurry of bullish analyst activity, investors must now ask if Everus Construction Group remains undervalued, or if the market is already fully pricing in its growth prospects.

Price-to-Earnings of 25.5x: Is it justified?

Everus Construction Group is currently trading at a price-to-earnings (P/E) ratio of 25.5x, which positions it attractively against its industry peers, especially given the last closing price of $82.85.

The P/E ratio measures how much investors are willing to pay today for each dollar of a company's earnings. For construction companies like Everus, this metric is vital since the industry is often valued on the basis of future earnings potential and cyclical profitability.

Compared to the US Construction industry average of 36.7x, Everus trades at a substantial discount. The company also trades lower than the peer average of 35.7x, signaling that the market may not be fully appreciating its current earnings profile. However, when compared with our estimated fair P/E ratio of 25.3x, Everus appears slightly expensive. This may suggest limited upside if the market adjusts toward this level.

Explore the SWS fair ratio for Everus Construction Group

Result: Price-to-Earnings of 25.5x (ABOUT RIGHT)

However, slower net income growth or a pullback in construction spending could quickly reduce Everus Construction Group's upward momentum.

Find out about the key risks to this Everus Construction Group narrative.

Another View: What Does the SWS DCF Model Say?

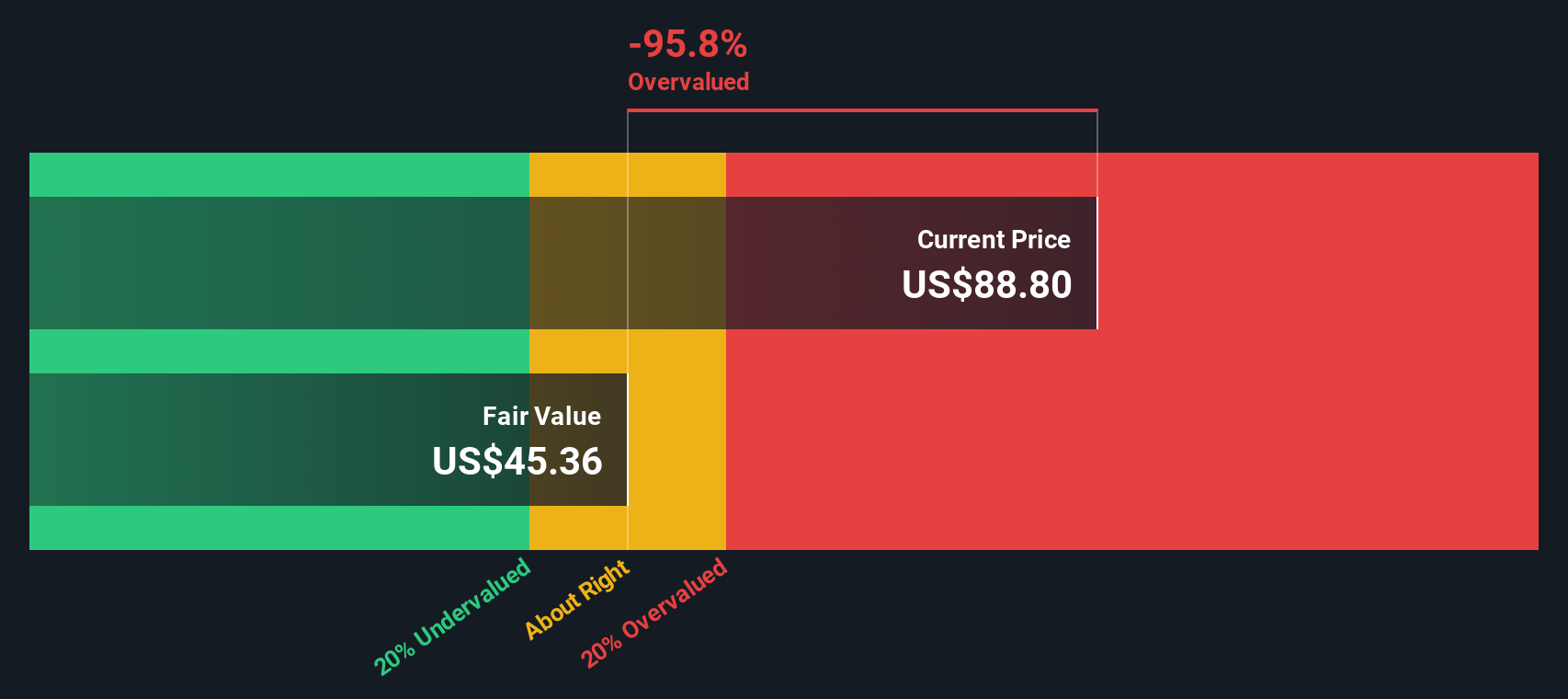

Looking from a different angle, our DCF model suggests Everus Construction Group is actually overvalued. The current share price of $82.85 is trading well above our estimate of fair value at $45.36. This stands in clear contrast to the optimism reflected by the P/E ratio and adds a layer of risk if expectations change.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you see things differently or want to investigate the data on your terms, it’s quick and easy to craft your own view of Everus Construction Group. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Everus Construction Group.

Looking for more investment ideas?

Now is your chance to get ahead of the crowd by targeting unique sectors and hidden gems using Simply Wall Street’s powerful screeners. Don’t settle for the ordinary. Take your portfolio to the next level.

- Tap into long-term potential by targeting steady income opportunities through these 19 dividend stocks with yields > 3% with yields above 3%.

- Be part of the next technological breakthrough by uncovering market leaders pioneering artificial intelligence via these 24 AI penny stocks.

- Seek out undervalued stocks poised for growth by harnessing the insight of these 899 undervalued stocks based on cash flows based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everus Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECG

Everus Construction Group

Provides contracting services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives