- United States

- /

- Construction

- /

- NYSE:DY

Dycom Industries (DY): Revisiting Valuation After a Strong Year of Share Price Gains

Reviewed by Simply Wall St

Dycom Industries (DY) has quietly turned into one of the market’s stronger infrastructure names, with the stock up about 21% over the past month and nearly doubling investors’ money over the past year.

See our latest analysis for Dycom Industries.

That kind of move is not happening in a vacuum, with Dycom’s roughly 21% 1 month share price return feeding into a triple digit year to date share price gain and a nearly fourfold 5 year total shareholder return. This suggests momentum is still very much in the stock’s favor.

If Dycom’s surge has you thinking about where else growth may be hiding, this could be a good moment to explore fast growing stocks with high insider ownership.

Yet with Dycom now trading near record highs and sitting only modestly below analyst targets, the key question is whether the market is underestimating its earnings power or has already priced in years of future growth.

Most Popular Narrative: 7.7% Undervalued

With Dycom closing at 355.83 dollars against a narrative fair value near 385.56 dollars, the story hinges on aggressive but structured growth assumptions.

The accelerating buildout of fiber to the home and data center connectivity, driven by surging AI workloads and hyperscaler investments, is creating multiyear, visibility rich opportunities for Dycom. This is expected to support robust backlog growth and sustained double digit revenue expansion as these build cycles ramp into 2027 and beyond.

Want to see what is powering that optimism? The narrative leans on faster top line expansion, higher margins, and a lower future earnings multiple to unlock that upside.

Result: Fair Value of $385.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could fray if key telecom customers curb capex, or if broadband stimulus and data center projects face prolonged regulatory delays.

Find out about the key risks to this Dycom Industries narrative.

Another Lens on Valuation

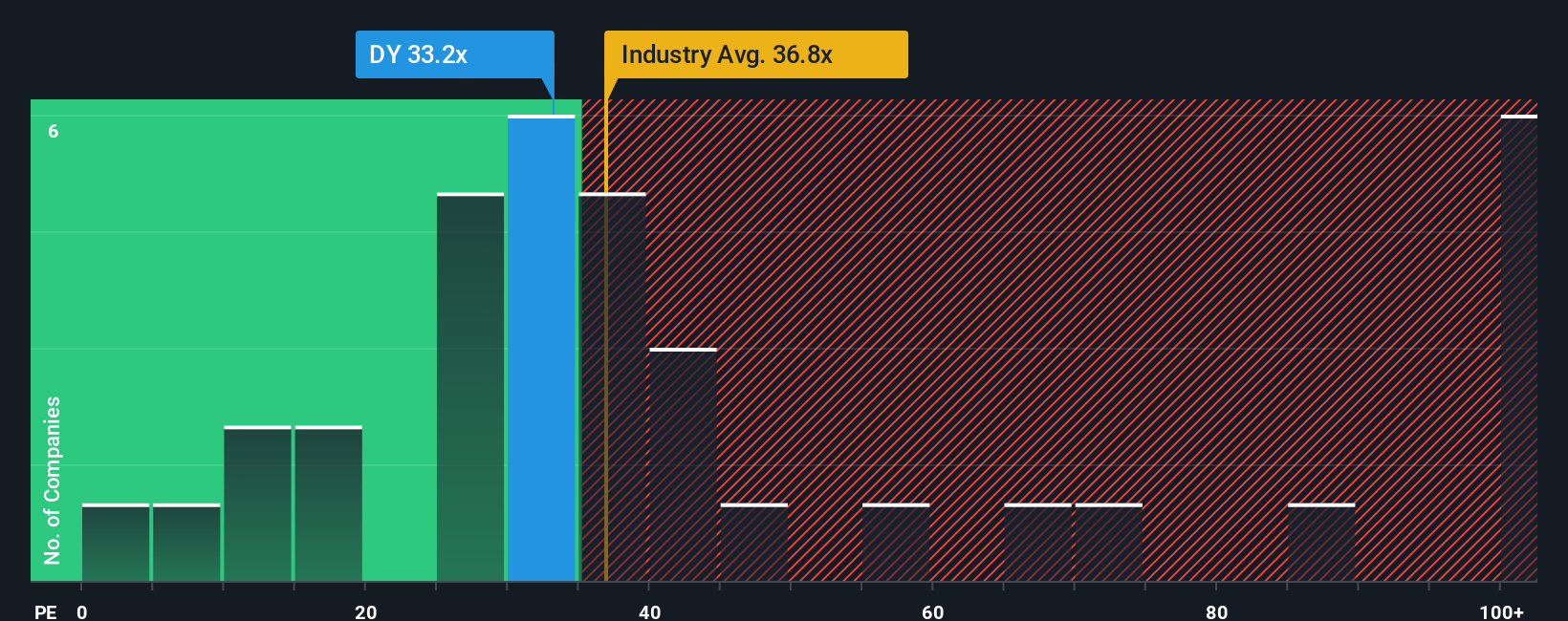

On a simple earnings multiple, Dycom looks far less forgiving. The stock trades at about 34.6 times earnings, above both the US Construction industry at 33.8 times and peers at 21.4 times, and even above a fair ratio of 30.3 times. This points to clear valuation risk if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dycom Industries Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes, starting with Do it your way.

A great starting point for your Dycom Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, give yourself the edge by lining up your next opportunities with hand picked stock ideas tailored to different strategies and market themes.

- Capitalize on mispriced opportunities by reviewing these 906 undervalued stocks based on cash flows that look attractive based on future cash flows and fundamentals.

- Position yourself at the heart of the next tech wave by focusing on these 26 AI penny stocks with strong exposure to artificial intelligence growth.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that combine reliable payouts with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DY

Dycom Industries

Provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026