- United States

- /

- Construction

- /

- NYSE:DY

Dycom Industries (DY): Evaluating Valuation After Strong Financials, Growth Markets, and Renewed Investor Optimism

Reviewed by Kshitija Bhandaru

Dycom Industries (NYSE:DY) shares have climbed higher over the past month, driven by upbeat financial results and solid growth metrics. The company’s long-term profit reinvestment and expanding footprint in digital infrastructure are fueling renewed investor interest.

See our latest analysis for Dycom Industries.

Momentum has been gathering for Dycom Industries, with a strong 9.7% 1-month share price return and the stock surging over 60% year-to-date. This rally comes on the back of robust financials, a record project backlog, and positive sentiment following Phillip Gallagher’s board appointment, all fueling confidence in Dycom’s long-term growth story. Over the past three and five years, total shareholder returns have soared 181% and 323% respectively, reflecting a powerful performance both recently and over the long run.

If Dycom’s growth trajectory interests you, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With such a sharp rally and consistently strong fundamentals, investors now face a critical question: is Dycom undervalued at current levels, or is the stock’s recent surge already reflecting its growth prospects?

Most Popular Narrative: 4.6% Undervalued

Shares recently closed at $284.33, which is still below the narrative's fair value of $297.89. This positions the stock as an intriguing proposition, prompting investors to weigh whether projected earnings and profit margins can drive further upside.

“The accelerating buildout of fiber-to-the-home and data center connectivity, driven by surging AI workloads and hyperscaler investments, is creating multi-year, visibility-rich opportunities for Dycom. This is expected to support robust backlog growth and sustained double-digit revenue expansion as these build cycles ramp into 2027 and beyond.”

Curious what aggressive growth levers analysts are betting on? The core calculation here assumes some bold revenue increases, rising profit margins, and a future earnings multiple that rivals Wall Street’s most optimistic bets. Want to see the quantitative leap behind that price target? Explore the hidden variables driving this valuation. One surprising metric could change how you view the stock’s prospects.

Result: Fair Value of $297.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Dycom’s heavy reliance on a few major telecom customers and possible delays in large-scale infrastructure projects could still threaten this growth narrative.

Find out about the key risks to this Dycom Industries narrative.

Another View: Multiples Comparison Raises Questions

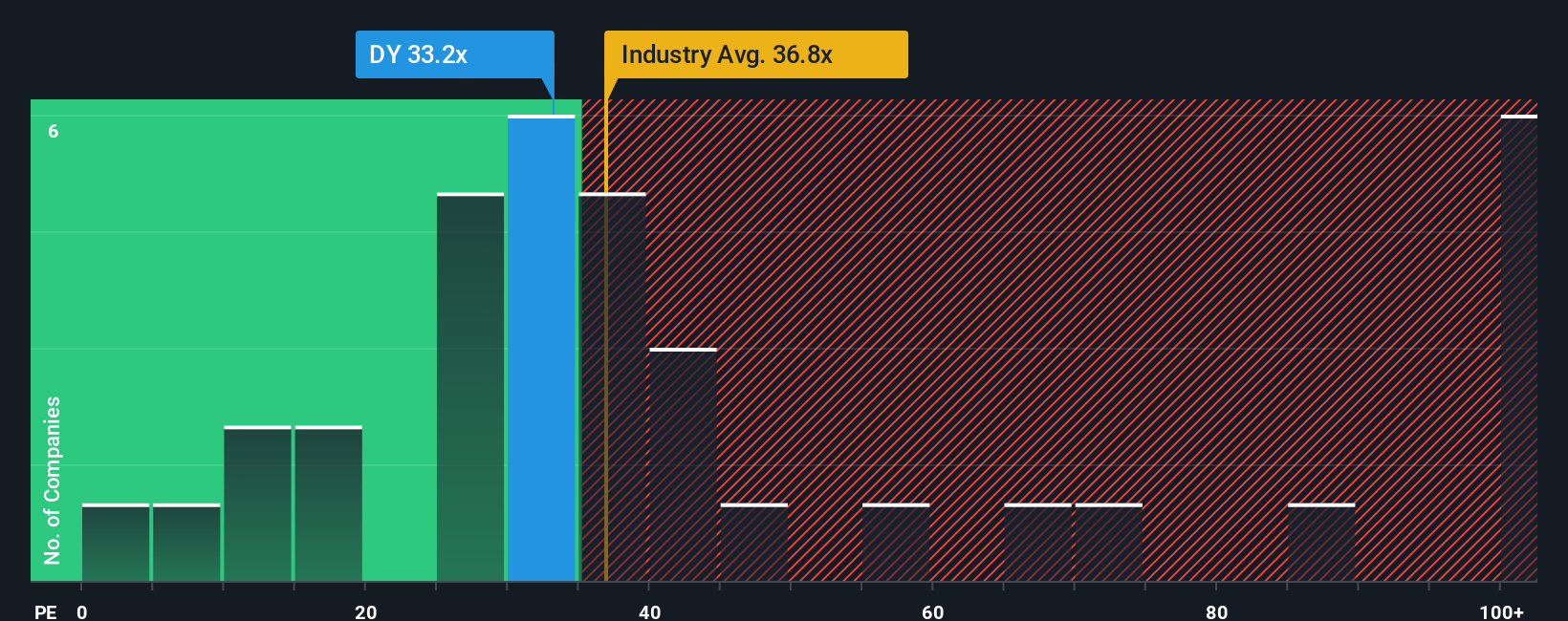

While analysts see Dycom as undervalued based on earnings growth, a look at price-to-earnings ratios tells a different story. Dycom trades at 31.5 times earnings, which is cheaper than the US Construction industry average of 36.7, but higher than its peer group at 23.6. Compared to the fair ratio of 29.5, the market could be assigning a premium. Is this extra optimism justified, or are investors setting themselves up for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dycom Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dycom Industries Narrative

If you want to chart your own path or challenge the consensus, sift through the numbers and shape your perspective in just minutes. Do it your way.

A great starting point for your Dycom Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your next opportunity and don’t let standout stocks pass you by. Try these expertly-curated screens to give your investment strategy a powerful boost today.

- Catch the momentum of fast-growing technology by checking out these 24 AI penny stocks, focused on artificial intelligence breakthroughs and future-ready innovation.

- Strengthen your portfolio with steady cash flow by targeting these 19 dividend stocks with yields > 3%, offering attractive yields and dependable returns.

- Tap into the potential of blockchain and digital asset businesses with these 79 cryptocurrency and blockchain stocks, delivering exposure to a rapidly evolving sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DY

Dycom Industries

Provides specialty contracting services to the telecommunications infrastructure and utility industries in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives