- United States

- /

- Machinery

- /

- NYSE:DOV

Will Dover's (DOV) Compact Compressor Kit Reshape Its Mobile LPG Solutions Narrative?

Reviewed by Simply Wall St

- Earlier this week, Blackmer, a Dover (NYSE: DOV) company, introduced a new Hydraulic Adapter Kit for its LB080 and LB160 Series Reciprocating Gas Compressors, enabling a more compact, hydraulically-driven system for mobile LPG applications.

- The retrofit and factory-installed kit eliminates flywheels, offering significant space savings, easier installation, and aims to lower operating costs for customers seeking greater efficiency in mobile setups.

- We'll now explore how the launch of this compact compressor kit could influence Dover's future growth prospects in industrial solutions.

Find companies with promising cash flow potential yet trading below their fair value.

Dover Investment Narrative Recap

Shareholders in Dover typically believe in the company’s long-term ability to shift its portfolio toward higher-growth, higher-margin components, while maintaining operational excellence and capital discipline. The launch of Blackmer’s compact Hydraulic Adapter Kit for mobile LPG applications demonstrates ongoing product innovation, though its near-term financial impact on Dover’s largest catalysts and “big picture” risks, such as earnings volatility from delayed infrastructure builds and cyclical exposure, appears limited for now.

One of the more directly related recent announcements is the debut of OPW Retail Fueling’s 71SO Segmented Overfill Valve last month. This underscores Dover’s ongoing focus on developing advanced, efficiency-focused industrial solutions, an area that continues to support its multi-year push for margin expansion and improved cash flow generation.

However, investors should also consider that, despite product launches, persistent macroeconomic uncertainties continue to threaten...

Read the full narrative on Dover (it's free!)

Dover's outlook anticipates $9.0 billion in revenue and $1.2 billion in earnings by 2028. This implies a 4.8% annual revenue growth rate and a $0.1 billion earnings increase from the current earnings of $1.1 billion.

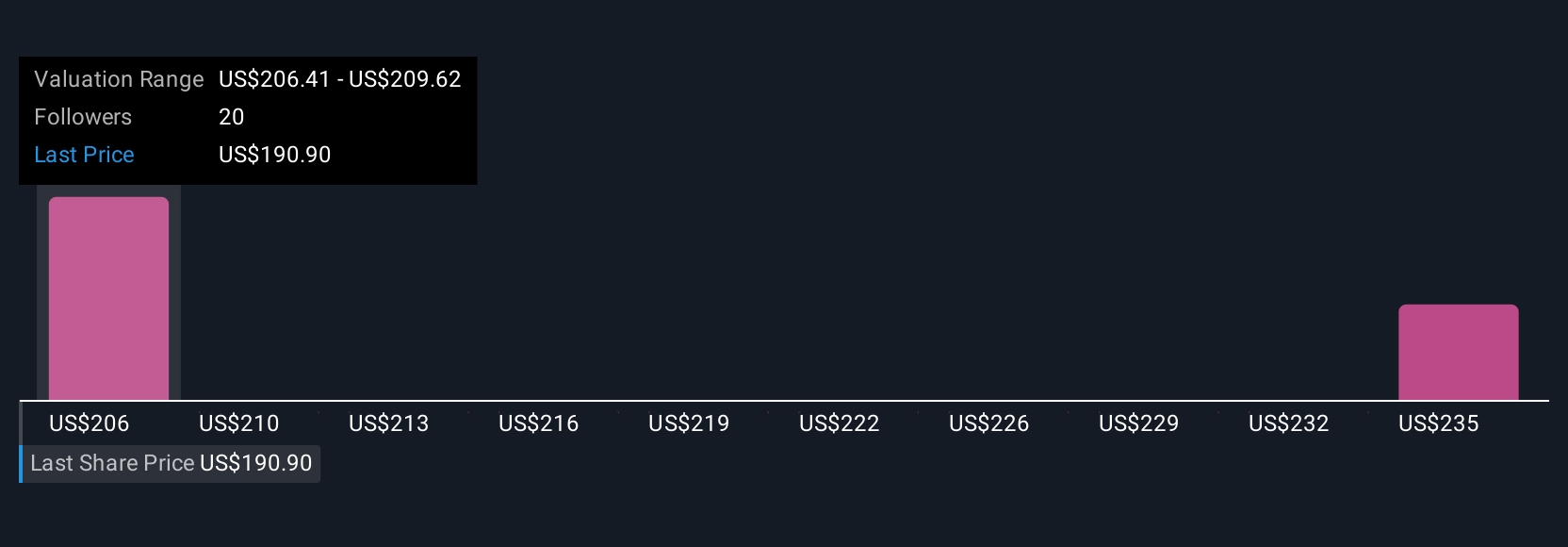

Uncover how Dover's forecasts yield a $212.26 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span US$176 to US$219.95 per share. While some see upside, others still focus on competition and short-cycle exposure that could impact Dover’s progress; explore all perspectives for a well-rounded view.

Explore 3 other fair value estimates on Dover - why the stock might be worth just $176.00!

Build Your Own Dover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dover research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Dover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dover's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives