- United States

- /

- Machinery

- /

- NYSE:DOV

Dover (NYSE:DOV) Unveils Next-Gen Reconnectable Swivel Breakaway With 30 Percent Less Reconnection Force

Reviewed by Simply Wall St

Dover (NYSE:DOV) recently introduced the 68EZSB Reconnectable Swivel Breakaway through its OPW Retail Fueling division, showcasing innovation in fuel delivery systems. Despite this product launch, Dover's share price fell 4.2% last week. This decline aligns with broader market trends, where the Dow Jones, S&P 500, and Nasdaq recorded significant drops due to concerns over economic conditions and tech sector downturns, including declines in major tech firms such as Tesla and Adobe. While these overall market conditions appear to have pressured Dover's shares, the innovative features of the 68EZSB, such as reduced leakage points and ease of reconnection, position the company favorably in its niche market. However, amid a market that slid 4.4%, even well-received new products may not have been sufficient to offset broader economic concerns and a general market slump influencing investor sentiment.

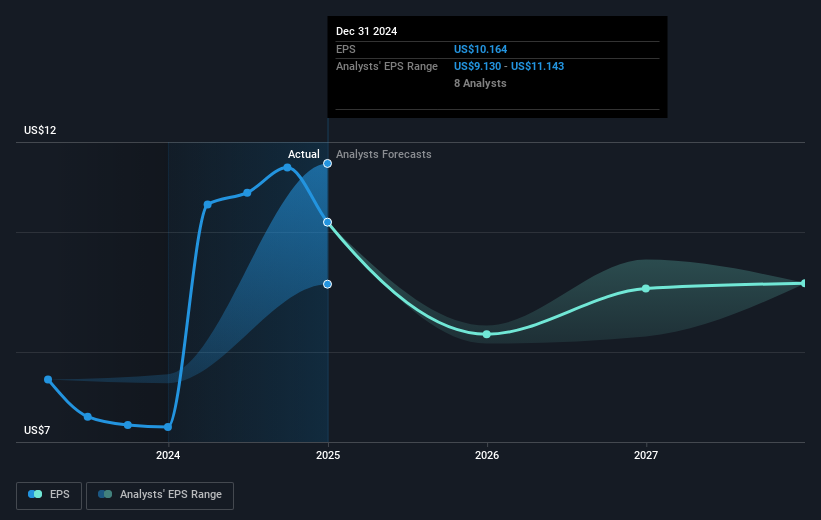

The last five years saw Dover Corporation achieve a total return of 178.82%, a significant increase for investors. This impressive growth was supported by a combination of steady earnings growth and consistent dividend payments. Dover's earnings have grown by an average of 15% annually, with a remarkable acceleration in the past year reaching 48.3%—far outperforming the machinery industry. Additionally, the company has maintained strong shareholder returns, emphasizing its capacity for long-term value.

Several key developments have contributed to Dover's robust performance. Strategic acquisitions and a focus on organic growth have bolstered their market position, as the company pursued further expansion opportunities. Additionally, Dover’s introduction of new products, like the Rotary Flex MAX Linker in August 2024, indicates a continued commitment to innovation and market leadership. Despite recent underperformance compared to the US market over the past year, Dover continues to exhibit strong fundamentals and ongoing shareholder-focused initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives