- United States

- /

- Machinery

- /

- NYSE:DOV

Dover (DOV): Fresh Look at Valuation Following Ongoing Share Weakness

Reviewed by Simply Wall St

Dover (DOV) caught the attention of investors this week after its shares slipped another 0.5% in a single day, extending a downtrend that has been unfolding quietly but steadily over the past month. There was no headline-grabbing event behind this latest move. The drop appears to be a continuation of the market’s current lukewarm view on the stock rather than a direct reaction to fresh news. Still, Dover’s wide reach across industrial markets means that even drifting price action can reflect shifting sentiment about growth or risk for the year ahead.

Zooming out, Dover’s stock is now down almost 4% since January and is treading water compared to a year ago, even as revenue and net income managed stable single-digit growth. Momentum, which once helped deliver double-digit gains over three and five years, appears to be on pause right now. Meanwhile, the broader capital goods sector has seen more mixed action, with some peers catching tailwinds from economic reopening or manufacturing optimism while Dover’s shares remain range-bound. The absence of a major incident this week only highlights the market’s cautious mood toward the company after years of outperformance.

This raises a key question for investors: is the recent pullback on muted news opening up a rare value opportunity, or is the market already factoring in everything Dover might achieve in the foreseeable future?

Most Popular Narrative: 15.8% Undervalued

According to community narrative, Dover is currently seen as undervalued, with analysts estimating significant future upside based on secular trends and operational strengths.

Expanding in automation, clean energy, and biopharma positions Dover to participate in high-growth, high-margin markets and supports long-term revenue and margin growth. Strategic acquisitions, divestitures, and operational improvements improve cost efficiency, profit predictability, and business focus on innovative, recurring revenue streams.

Curious why analysts believe Dover deserves a higher valuation? The answer may lie in their bold assumptions about future market expansion and Dover’s evolving profit engine. What is driving these high targets, and how much growth is factored in? It may be worth looking more closely at the ambitious financial projections supporting this valuation.

Result: Fair Value of $212.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing supply chain disruptions or rising competition in key segments could quickly undercut these optimistic growth assumptions for Dover.

Find out about the key risks to this Dover narrative.Another View: Discounted Cash Flow Perspective

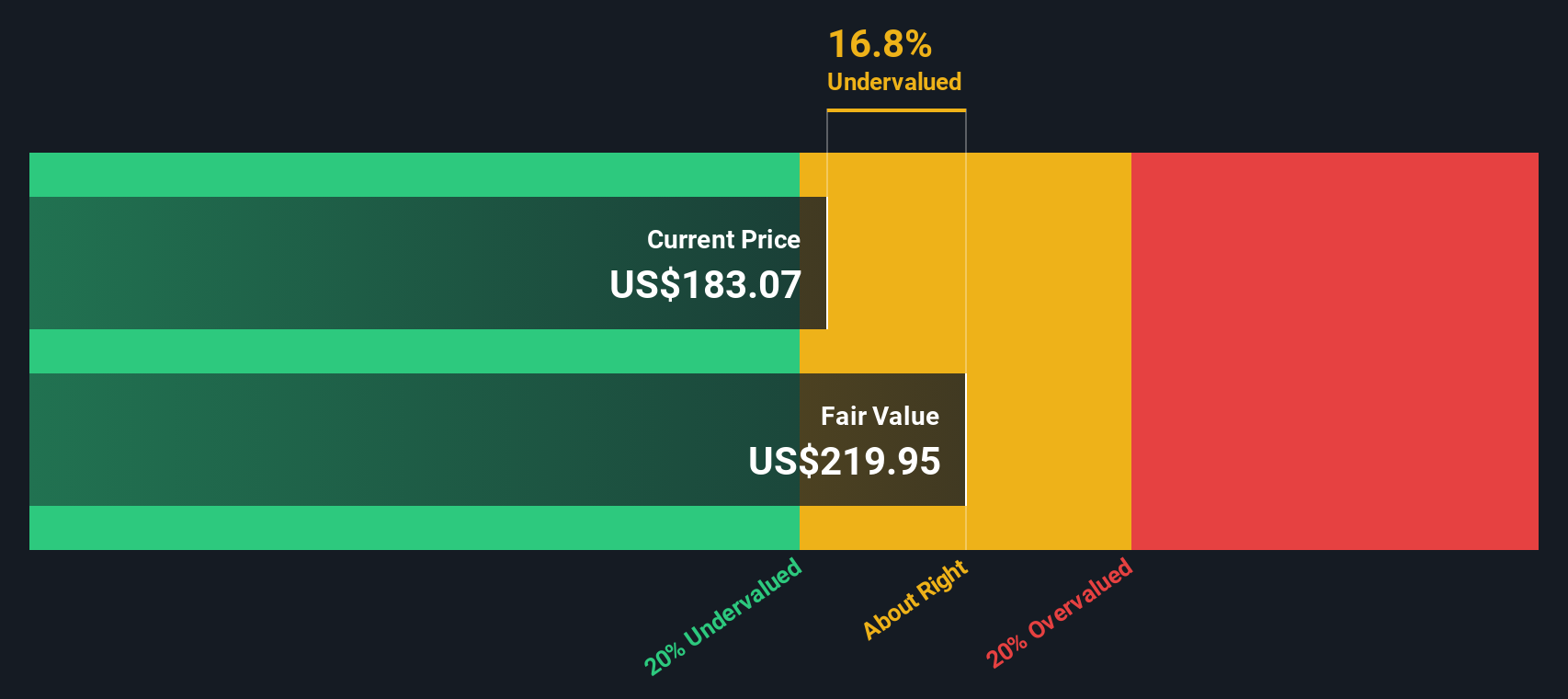

Looking at things another way, our DCF model also points to the shares being undervalued at current prices. However, even this method relies on future cash flow estimates, which is never an exact science. What happens if those assumptions miss the mark?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dover Narrative

If you have a different perspective or want to dive deeper into Dover’s story, you can quickly build your own view and share your insights. So why not do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dover.

Looking for More Smart Investment Ideas?

Why stop at one stock when a world of potential winners is just a click away? Take charge of your financial future by focusing your search on standout opportunities tailored to your interests. Here are three energizing ways to keep your momentum going:

- Seize the chance for reliable income by checking out dividend stocks with yields > 3%, where you’ll find companies with dividend yields above 3% and a track record of rewarding shareholders.

- Harness breakthroughs in medical technology and innovation by exploring healthcare AI stocks, featuring healthcare businesses at the forefront of the artificial intelligence revolution.

- Unearth hidden gems in the market by targeting undervalued stocks based on cash flows, a curated set of stocks trading at compelling discounts based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOV

Dover

Provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives