- United States

- /

- Aerospace & Defense

- /

- NYSE:DCO

Is Ducommun Poised for More Gains After 54% Surge and Defense Sector Optimism?

Reviewed by Bailey Pemberton

If you are trying to decide what to do with Ducommun stock, you are not alone. Many investors are weighing their options right now, wondering if the incredible run-up has more room to go or if it is time to be cautious. The numbers are certainly eye-catching: in just the last week, Ducommun climbed 2.9%, and over 30 days it added an impressive 8.3%. Year-to-date and over the past year, the stock has soared by more than 52% and 54% respectively. Looking even further back, that is a 131.1% gain over three years and a staggering 177.2% over five years. Clearly, something is moving the needle for this company.

Broader market dynamics and recent optimism in the industrial and defense sectors have contributed to this momentum. Investors have started to factor in stronger demand for the types of high-reliability solutions Ducommun provides. This has sparked renewed interest from institutions and individual investors alike, hinting at both the growth potential and a shifting perception of risk surrounding the stock.

But what about valuation? As tempting as it is to chase a stock on a hot streak, it is smart to check how Ducommun stacks up using a few traditional metrics. On this scorecard, the company clocks in with a value score of 2 out of 6 possible checks for being undervalued. That means it clears the bar in some areas, but not most. Next, we will dive into what those valuation approaches really mean, and lay out where Ducommun lands on each one. And, if you stick around, there is an even more insightful way to think about value that you will not want to miss.

Ducommun scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ducommun Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. For Ducommun, this approach uses future forecasts for Free Cash Flow (FCF), which reflects the actual cash the business can generate after spending on operations and investments.

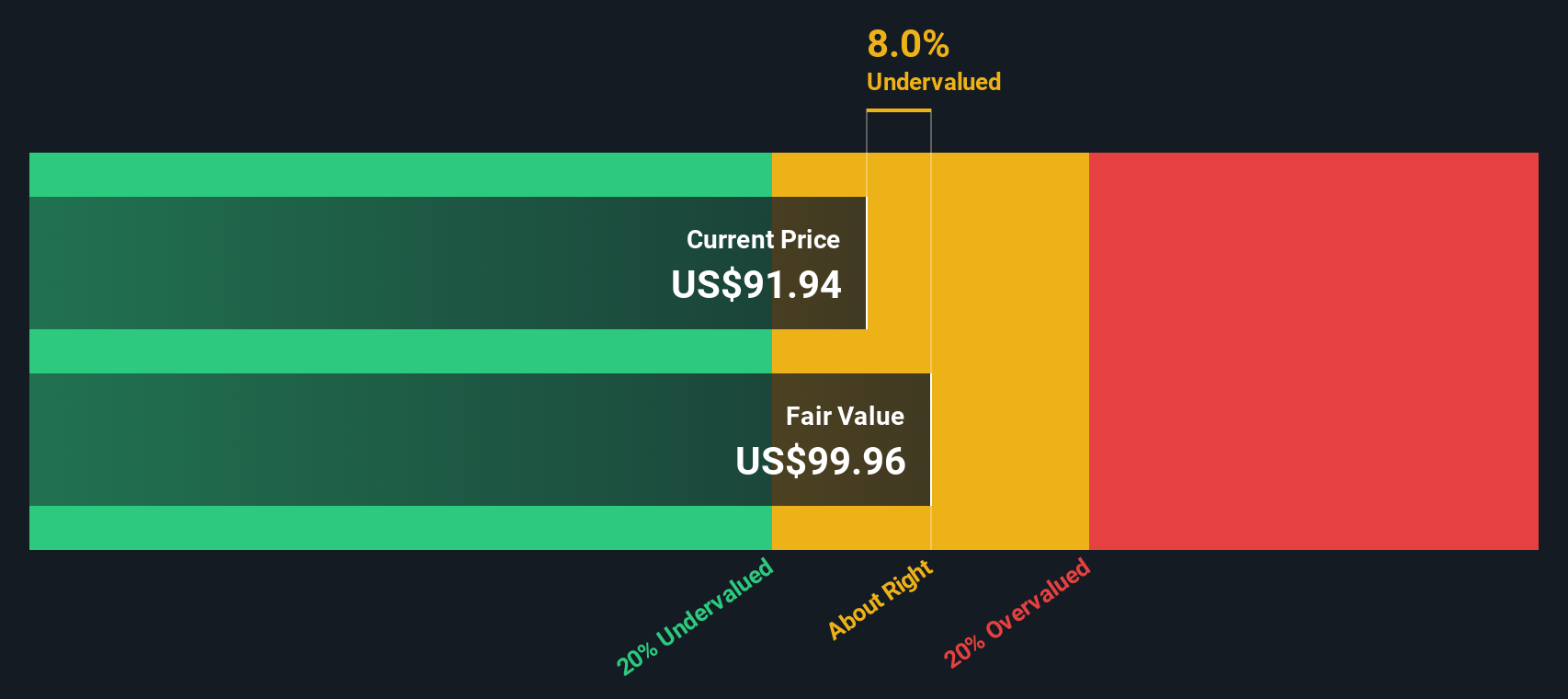

At present, Ducommun’s Free Cash Flow stands at $37.22 million, and analysts expect this number to grow over the coming years. In fact, by 2027, FCF is projected to reach $73.2 million. Ten-year forecasting by Simply Wall St indicates further gains, up to $93.96 million in 2035. These projections suggest steady, gradual growth in the company’s cash-generating ability.

Plugging these estimates into the DCF model gives an intrinsic fair value of $95.99 per share. Compared to the current share price, this valuation implies the stock is trading about 1.0% above its estimated worth. In other words, DCF suggests that Ducommun is priced just a little above its calculated value, but the gap is quite small.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Ducommun's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Ducommun Price vs Earnings

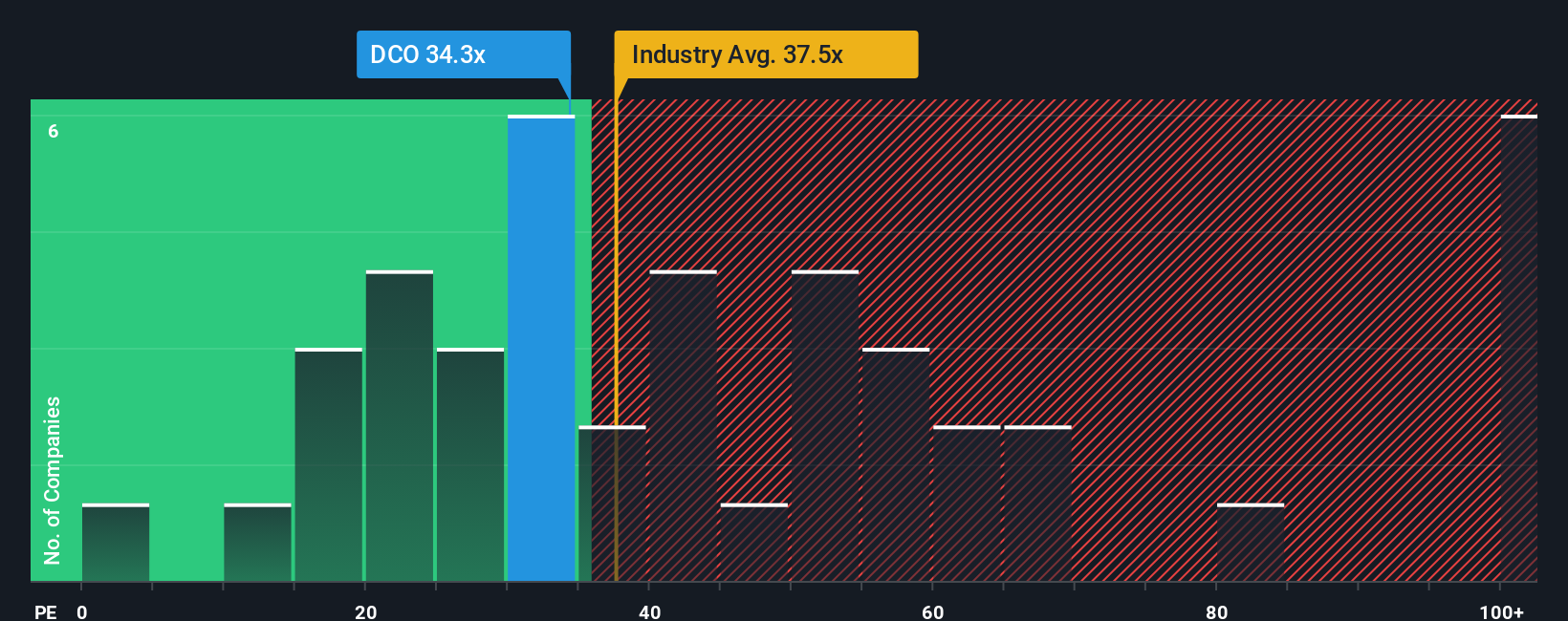

For profitable companies like Ducommun, the price-to-earnings (PE) ratio is a widely used and reliable tool for comparing valuations. PE ratios help investors understand how much they are paying for each dollar of current earnings, making it a clear metric for firms with steady profits.

Growth expectations and risk are two major factors that influence what counts as a “normal” or “fair” PE. Higher-growth or lower-risk companies often command higher PE ratios because of anticipated future earnings, while slower-growing or riskier firms typically trade at lower multiples.

Currently, Ducommun’s PE ratio stands at 36.2x. This is a little below the Aerospace & Defense industry average of 38.9x, and significantly below its peer group average of 49.5x. However, these benchmarks alone do not tell the whole story. That is where Simply Wall St’s “Fair Ratio” comes in. For Ducommun, this proprietary benchmark is 24.4x. The Fair Ratio distills factors like company-specific growth, risk, profitability, industry dynamics and size, providing a far more tailored yardstick than just a sector or peer comparison.

Comparing Ducommun’s actual PE ratio (36.2x) with its Fair Ratio (24.4x), the stock appears to be trading at a premium. This suggests the market has priced in higher growth or lower risk than the Fair Ratio model predicts. Using this perspective, Ducommun comes out as somewhat overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ducommun Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a dynamic way to invest: rather than relying solely on static numbers or formulas, you create a story that ties together your perspective on a company’s future, your assumptions for fair value, revenue, earnings and margins, with the financial forecasts that matter most.

What sets Narratives apart is that they connect a company’s story (for example, “defense modernization will fuel years of growth for Ducommun” or “margin gains will slow as industry tailwinds fade”) to a real set of financial expectations. This then feeds directly into a personalized fair value estimate. Narratives are accessible and easy to use within Simply Wall St’s Community page, where millions of investors share, compare and update their views as new data comes in, such as earnings results or big news releases.

Narratives help you decide when to buy or sell by letting you compare your own Fair Value against the current Price. They also stay alive and relevant, updating automatically when the world changes. For example, some investors see Ducommun’s fair value as high as $106.25, expecting defense growth and margin expansion, while others set it as low as $87.20, factoring in risks from volatility and competition. Your Narrative becomes your smartest, most responsive investment tool.

Do you think there's more to the story for Ducommun? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCO

Ducommun

Provides engineering and manufacturing services for products and applications used in the aerospace and defense, industrial, medical, and other industries in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives