- United States

- /

- Machinery

- /

- NYSE:DCI

Donaldson (DCI): Exploring Current Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Donaldson Company (DCI) shares have delivered steady gains over the past few months, climbing 16% in the past 3 months and 22% so far this year. Investors seem to be responding to consistent results and improving financials.

See our latest analysis for Donaldson Company.

Donaldson’s latest share price gains reflect growing investor optimism, supported by ongoing improvements in its financials and positive annual momentum. With a one-year total shareholder return of 13.5% and an impressive 63.6% total return over three years, the company is showing that its blend of consistent performance and renewed growth prospects is paying off.

If Donaldson’s momentum has you thinking broader, why not see what else is gathering steam and discover fast growing stocks with high insider ownership

With such strong gains and improved fundamentals, the key question is whether Donaldson is still trading below its true value or if recent results mean future growth is already factored into the current price.

Most Popular Narrative: Fairly Valued

Donaldson's last close of $82.40 matches closely with the consensus narrative fair value of $80.00, suggesting that the market is closely tracking the narrative's assumptions. A deeper look at the underlying drivers reveals the key themes shaping this valuation.

Global expansion of environmental regulations and emissions standards is increasing demand for advanced filtration across industrial and transportation sectors. This is positioning Donaldson to achieve record sales in both Industrial Solutions and Mobile Solutions, with a direct positive impact on revenue and earnings growth in FY26 and beyond.

Curious what record-breaking projections and sector trends support this valuation? There are bold revenue and margin moves woven into this narrative. The real surprise lies in the future earnings assumptions and just how much sector shifts can influence perceived value. Take a look inside to uncover the numbers with the greatest weight in this fair value story.

Result: Fair Value of $80.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in bioprocessing and a heavy reliance on aftermarket sales could limit Donaldson’s revenue growth and earnings stability if trends shift unexpectedly.

Find out about the key risks to this Donaldson Company narrative.

Another View: Multiples Tell a Different Story

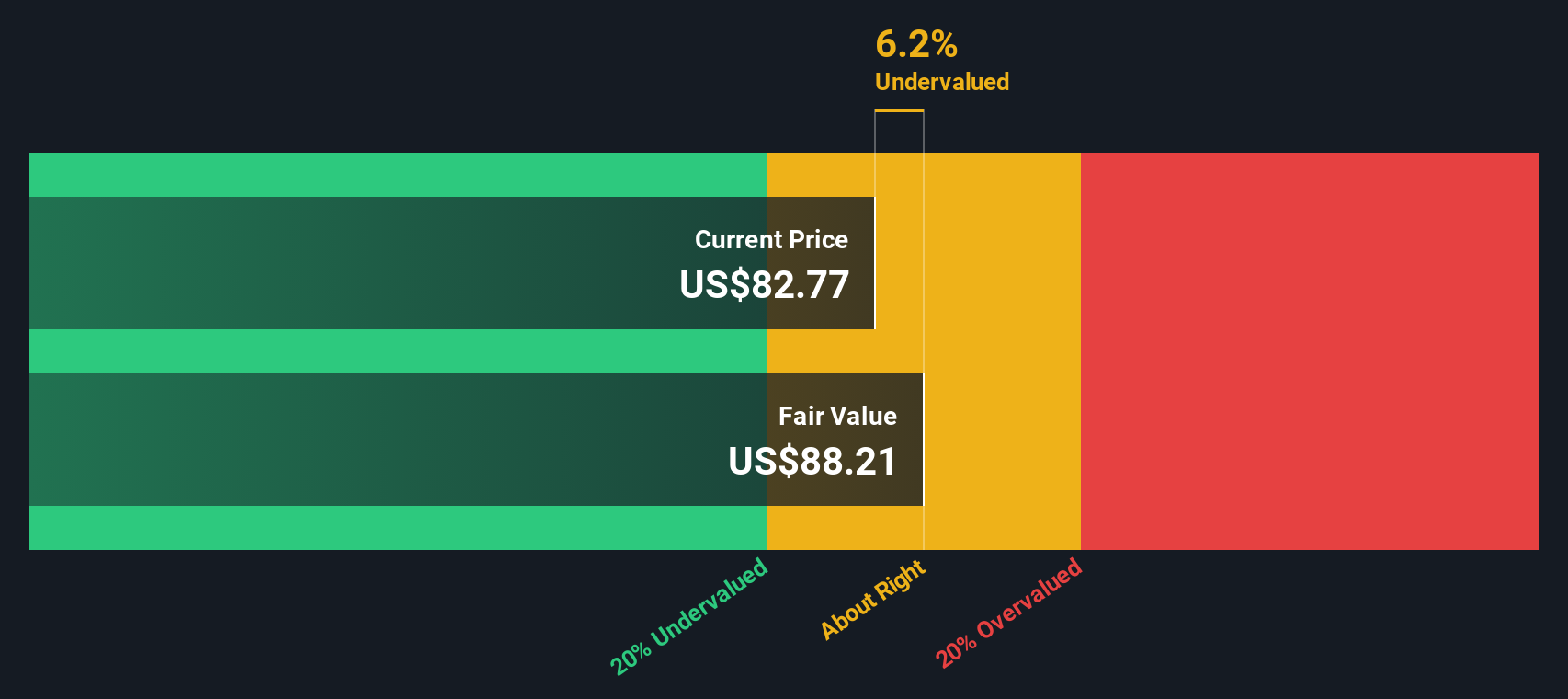

Looking beyond the consensus narrative, our SWS DCF model actually suggests that Donaldson is trading 6.6% below its fair value estimate of $88.23. This signals undervaluation using the DCF approach, while multiples indicate the stock is on the expensive side. Could this be a hidden opportunity that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Donaldson Company Narrative

If our interpretations do not quite match your perspective or you prefer to reach your own conclusions, you can dive in and build your own analysis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Donaldson Company.

Looking for More Investment Ideas?

If you want to stay ahead of the crowd and spot the next market movers, don’t just stop at Donaldson. Take control of your investing future by checking out these handpicked opportunities:

- Unlock real potential with steady payouts and see how your portfolio could benefit from these 18 dividend stocks with yields > 3% offering yields above 3%.

- Tap into rapid growth trends by checking out these 24 AI penny stocks reshaping entire industries through artificial intelligence breakthroughs.

- Stay on the cutting edge of finance by seeing what is possible with these 79 cryptocurrency and blockchain stocks as blockchain and digital assets redefine tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DCI

Donaldson Company

Manufactures and sells filtration systems and replacement parts worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives