- United States

- /

- Machinery

- /

- NYSE:CYD

Assessing China Yuchai International (NYSE:CYD) Valuation Following Upgraded Analyst Estimates and Strong Earnings Momentum

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 17.8% Overvalued

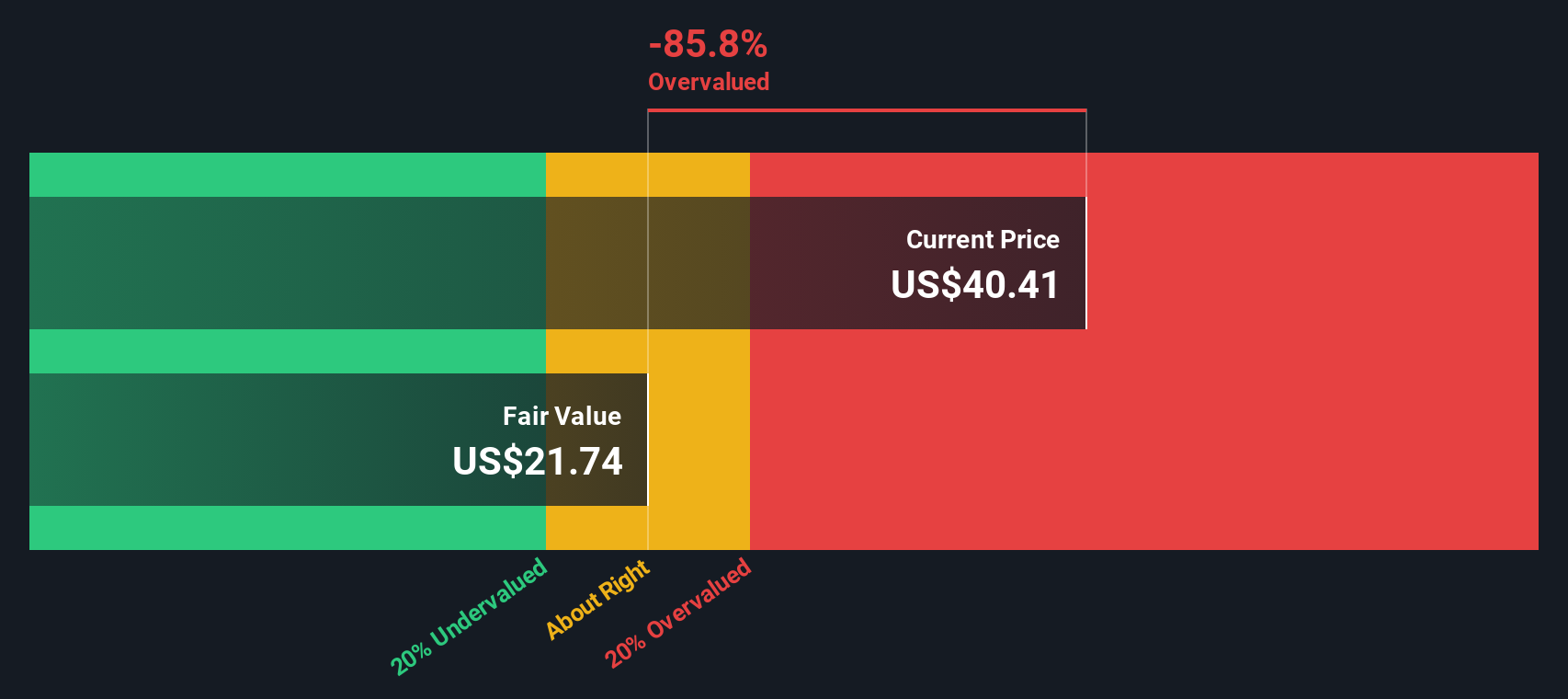

The most widely followed narrative currently considers China Yuchai International to be overvalued, estimating the company's fair value to be notably lower than its current market price.

"Recent results may be benefiting from a temporary surge in demand for diesel and gas engines for data center backup power due to rapid digitalization and infrastructure build-out. However, over the long term, global shifts towards electric vehicles and zero-emissions regulations could significantly reduce addressable markets and pressure topline revenue."

Want to know the controversial catalyst pushing this narrative into “overvalued” territory? The numbers behind this perspective are built on bold earnings forecasts, profit margin adjustments, and a projected valuation multiple well below today’s level. Which financial metric really tips the scales in this overvaluation call? The answers and the quantitative logic await inside the full narrative.

Result: Fair Value of $33.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, robust outperformance in export markets and strategic investments in alternative fuels could challenge the current view of overvaluation for China Yuchai International.

Find out about the key risks to this China Yuchai International narrative.Another View: Our DCF Model

Looking at China Yuchai through the lens of our SWS DCF model, a different story emerges. This method also suggests the stock is trading above its fair value, reinforcing the overvalued call from a different angle. What will tip the scale for investors: future cash flows or market multiples?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding China Yuchai International to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own China Yuchai International Narrative

If you see things differently or want to dive into your own analysis, it’s quick and easy to craft a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding China Yuchai International.

Looking for More Actionable Investment Ideas?

Don’t let great opportunities pass you by. Take charge of your portfolio by tapping into handpicked stock ideas that go beyond the obvious names and trends.

- Uncover hidden gems with strong fundamentals and get ahead of the crowd using our undervalued stocks based on cash flows.

- Capture growth from the AI boom by harnessing stock ideas uniquely positioned within transformative sectors. Explore these opportunities with our AI penny stocks.

- Lock in reliable income streams by targeting companies that deliver consistent yields. Find these options easily with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYD

China Yuchai International

Manufactures, assembles, and sells diesel and natural gas engines for trucks, buses, pickups, construction and agricultural equipment, and marine and power generation applications.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives