- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Is the Launch of All-Electric Equipment at Utility Expo Recharging the CTOS Investment Thesis?

Reviewed by Sasha Jovanovic

- Custom Truck One Source, along with its manufacturing arm Load King, recently introduced a new range of advanced equipment and an all-electric bucket truck at Utility Expo 2025, emphasizing innovation and electrification in utility and infrastructure sectors.

- This unveiling underscores the company's push for sustainable solutions and new technology, potentially strengthening its reputation in key growth markets despite ongoing unprofitability.

- We'll explore how Custom Truck One Source's debut of next-generation electric equipment at Utility Expo could shape its investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Custom Truck One Source Investment Narrative Recap

To be a shareholder in Custom Truck One Source, you need to believe in the long-term impact of utility modernization and infrastructure investment, especially as the company pushes into electrification and new technologies. While recent product launches highlight continued innovation, the most important near-term catalyst remains broadening order growth and recurring rental revenue; meanwhile, sustained unprofitability and pressure on margins from a high leverage ratio continue to be the main risks. The latest news on new electric equipment supports the company’s focus on sustainable solutions, but does not materially change these key drivers for investors at this stage. The unveiling of the all-electric bucket truck at Utility Expo 2025 closely aligns with the catalyst of rising demand for grid upgrades and infrastructure renewal. This move showcases Custom Truck’s investment in equipment tailored for evolving energy and utility needs, which could reinforce customer relationships and bolster order momentum if interest in electric solutions accelerates. However, the unveiling alone does not resolve fundamental profitability challenges or margin pressures if underlying demand trends falter. Yet, even with strong product releases, investors should be aware that ongoing losses and high leverage could become a concern if sector spending weakens…

Read the full narrative on Custom Truck One Source (it's free!)

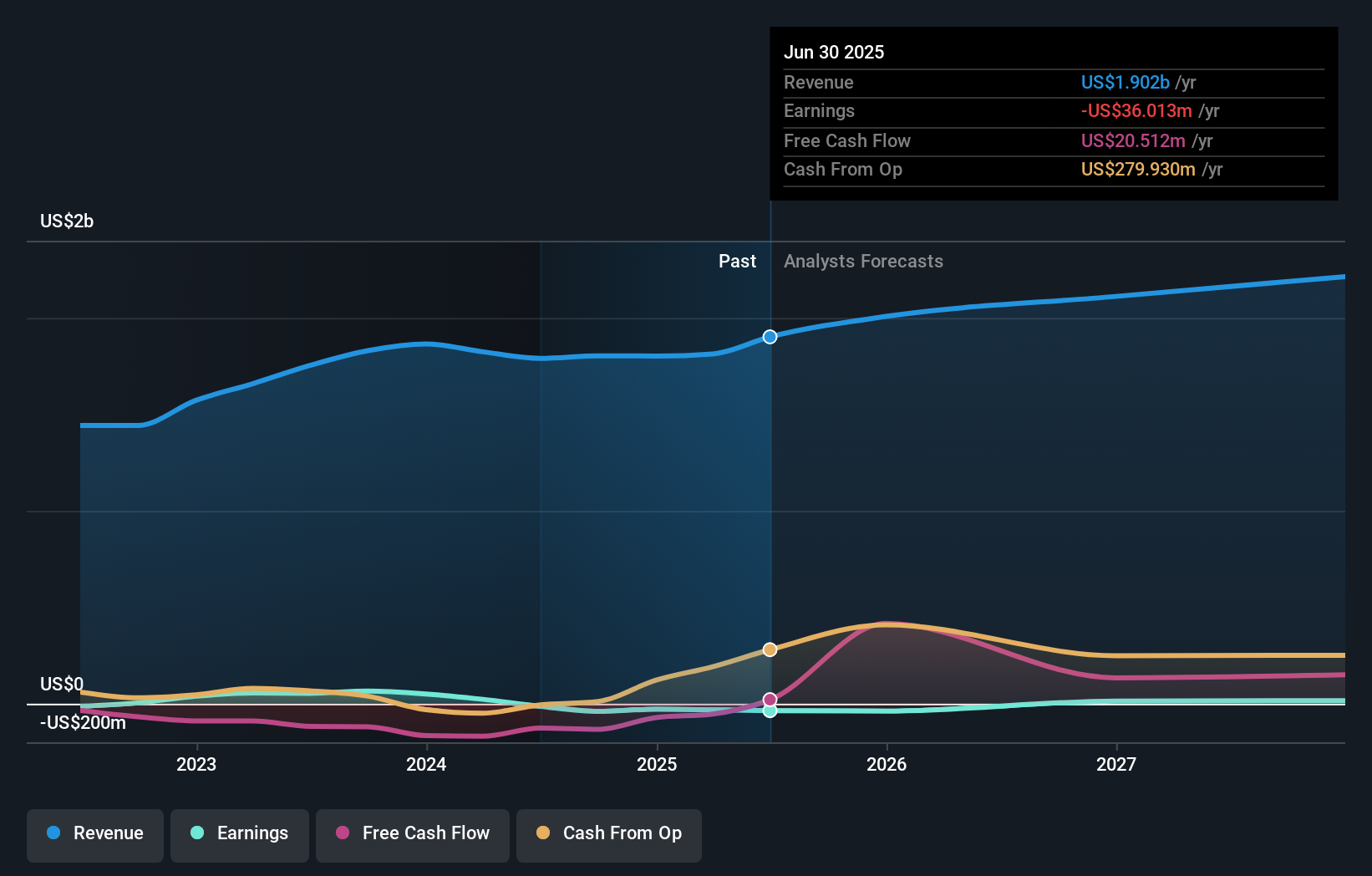

Custom Truck One Source's narrative projects $2.3 billion revenue and $28.6 million earnings by 2028. This requires 6.6% yearly revenue growth and a $64.6 million increase in earnings from the current -$36.0 million.

Uncover how Custom Truck One Source's forecasts yield a $7.10 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates ranging from US$5.50 to US$7.10 per share. This diversity reflects differing forecasts on recurring rental revenue, a main catalyst for the company’s long-term performance, inviting you to consider several perspectives.

Explore 2 other fair value estimates on Custom Truck One Source - why the stock might be worth as much as 15% more than the current price!

Build Your Own Custom Truck One Source Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Custom Truck One Source research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Custom Truck One Source research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Custom Truck One Source's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026