- United States

- /

- Trade Distributors

- /

- NYSE:CTOS

Custom Truck One Source, Inc. (NYSE:CTOS) Looks Just Right With A 30% Price Jump

Custom Truck One Source, Inc. (NYSE:CTOS) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

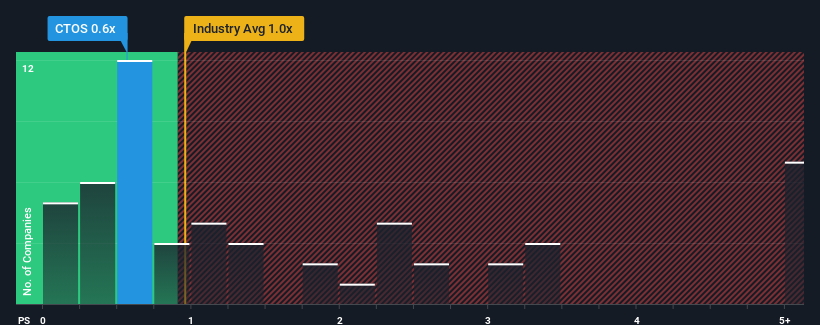

Even after such a large jump in price, there still wouldn't be many who think Custom Truck One Source's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Trade Distributors industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Custom Truck One Source

What Does Custom Truck One Source's P/S Mean For Shareholders?

Custom Truck One Source could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Custom Truck One Source.Is There Some Revenue Growth Forecasted For Custom Truck One Source?

Custom Truck One Source's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 1.5% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 102% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.3% as estimated by the six analysts watching the company. That's shaping up to be similar to the 4.8% growth forecast for the broader industry.

With this information, we can see why Custom Truck One Source is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Its shares have lifted substantially and now Custom Truck One Source's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Custom Truck One Source maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Custom Truck One Source with six simple checks.

If you're unsure about the strength of Custom Truck One Source's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTOS

Custom Truck One Source

Provides specialty equipment rental and sale services to electric utility transmission and distribution, telecommunications, rail, forestry, waste management, and other infrastructure-related industries in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.