- United States

- /

- Building

- /

- NYSE:CSW

Assessing CSW Industrials After 33% Drop and Lowered Earnings Forecast in 2025

Reviewed by Bailey Pemberton

If you are sitting on the fence about CSW Industrials, you are not alone. After a phenomenal three- and five-year run, delivering 115.1% and 196.8% returns respectively, the past year has left many investors scratching their heads. CSW Industrials’ stock closed most recently at $249.49, but it is down 33.8% over the last twelve months and has tumbled 29.0% year-to-date. Just in the past week, it slipped another 1.1%, capping off a 6.4% slide for the month. While part of this volatility can be traced to shifting investor sentiment across industrials and some broader market developments filtering into the sector, these moves might also tell us something about how risk is being re-evaluated here and possibly where growth expectations are settling.

So, are these declines an opportunity, or is there trouble under the hood? When we reach for the numbers, CSW Industrials currently earns a valuation score of 0 out of 6. That means the company is not undervalued by any of the six standard checks savvy analysts look at before making a move. If you rely on the usual valuation lenses, you might feel a bit underwhelmed, but what if there’s more to the story?

Let’s walk through what these valuation approaches actually tell us about CSW Industrials, and stay tuned for a smarter way to think about value—one that might help you see the company in a new light.

CSW Industrials scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CSW Industrials Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting all future cash flows and then discounting them back to today’s value. This helps investors determine what the business is fundamentally worth, regardless of current stock market swings.

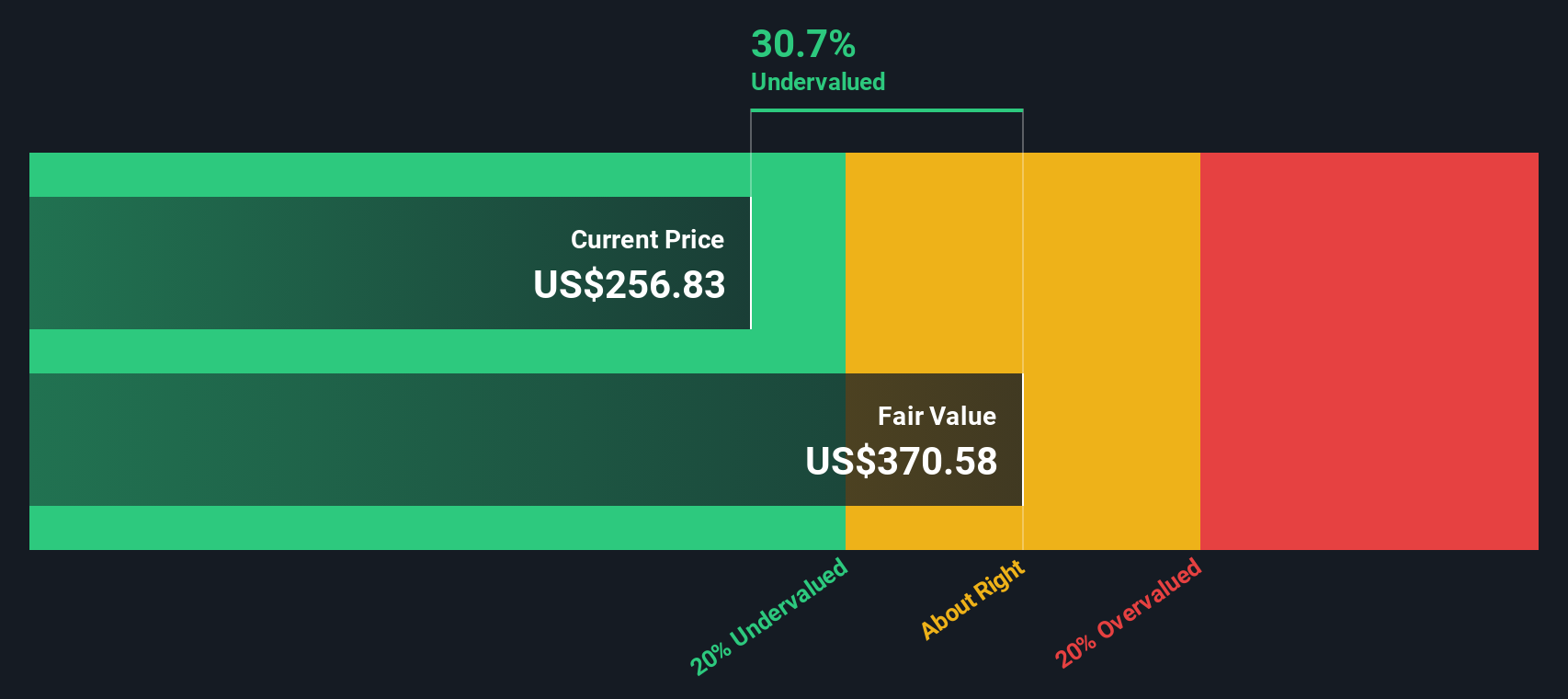

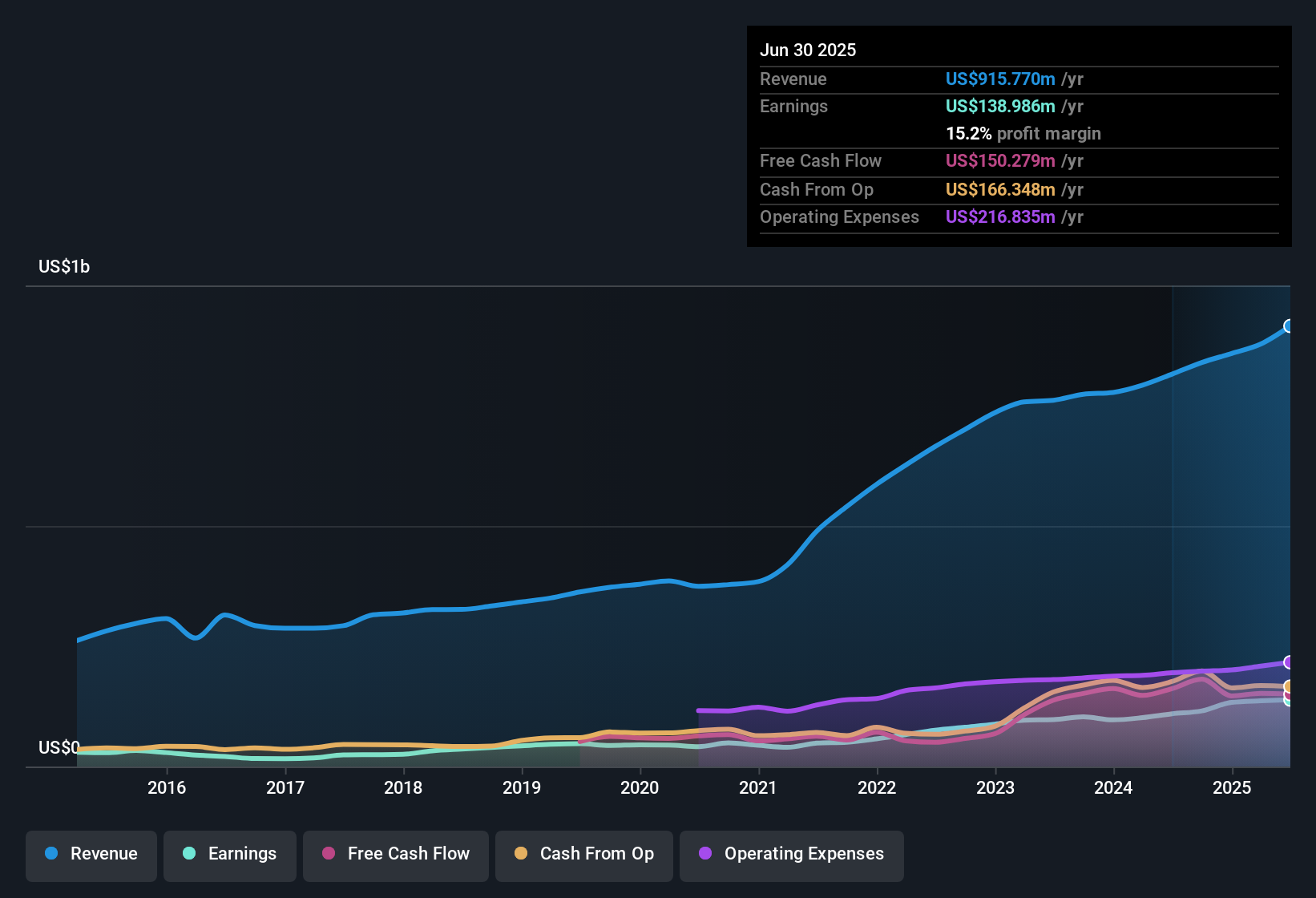

For CSW Industrials, the latest reported Free Cash Flow is $148.8 million. Analyst forecasts, available up to 2027, expect annual growth and project Free Cash Flow to reach $191 million by then. Beyond these official estimates, cash flows are extrapolated out to 2035 by data providers. For context, the ten-year forward projection for 2035 places Free Cash Flow at $242.5 million, all in USD. These numbers reflect steady, modest growth each year.

Based on these figures, the DCF analysis calculates an estimated intrinsic value of $216.77 per share. With the current share price at $249.49, the model suggests the stock is around 15.1% overvalued. This means that, according to the DCF, investors are paying a premium for future growth that may already be priced in.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CSW Industrials may be overvalued by 15.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CSW Industrials Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable businesses like CSW Industrials, as it quickly reveals how much investors are paying for each dollar of the company’s earnings. It is particularly useful because it balances reported profits with current share price, offering a clear snapshot of market expectations for growth and risk.

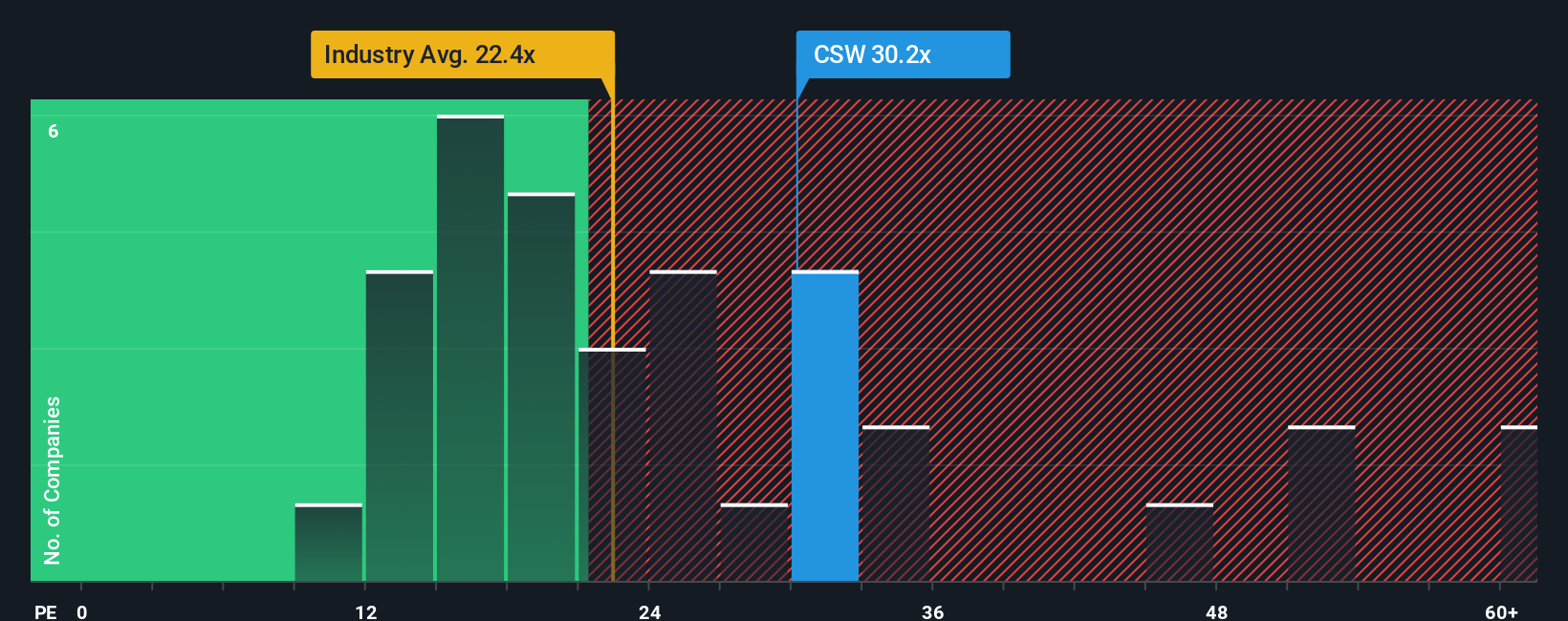

Of course, what counts as a “normal” PE ratio depends on several factors. Higher growth outlooks and lower risk profiles tend to justify higher PE ratios, while industries facing headwinds or mature growth might support lower numbers. As it stands, CSW Industrials is trading at a PE ratio of 30.2x, which is noticeably above the Building industry average of 22.6x, and above its peer group average of 23.9x.

This is where Simply Wall St’s “Fair Ratio” becomes important. The Fair Ratio, at 22.3x for CSW Industrials, incorporates not just industry standards, but also the company’s growth prospects, profit margins, market cap, and risk profile. This approach is more nuanced than comparing straight industry or peer averages, as it reflects what investors should reasonably pay given the specific qualities and risks that come with this business.

Comparing the Fair Ratio to CSW Industrials’ current PE ratio suggests the stock is trading well above what is justified by its fundamentals, meaning it appears overvalued at these levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CSW Industrials Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story, a way to explain how you see a company’s future, connecting your outlook on its prospects, growth, and risks directly to financial forecasts and an estimated fair value.

Narratives do not just present the numbers; they help you define what you believe will drive CSW Industrials’ results and justify your own fair value, making your investment thesis personal and actionable. With Simply Wall St’s Community page, Narratives are as accessible as joining millions of other investors in sharing or exploring forecasts that are automatically updated when new earnings, news, or market trends emerge.

Using Narratives, you can quickly compare what you think CSW Industrials is worth to the current share price, helping you make buy or sell decisions with up-to-date context. For example, one investor might believe CSW Industrials’ recurring demand and strategic acquisitions will power robust earnings growth and support a bullish price target of $340.0, while another might focus on margin pressures and set a more cautious value at $269.0. Narratives let you see, challenge, and refine your perspective, with every new development automatically reflected in your numbers.

Do you think there's more to the story for CSW Industrials? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSW

CSW Industrials

Provides various industrial products in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives