- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Does Strong Aerospace Demand and Upward Earnings Estimates Reshape the Bull Case for Carpenter Technology (CRS)?

Reviewed by Sasha Jovanovic

- In recent weeks, Carpenter Technology received multiple upward earnings estimate revisions for fiscal 2026 following continued strong demand in its aerospace and defense end-markets and a robust booking pipeline.

- An important insight is that the company is positioned to capitalize on emerging technologies in additive manufacturing and soft magnetics due to solid financial flexibility and ongoing cost-reduction initiatives.

- With analysts raising estimates amid strong demand momentum, we'll consider how this influences Carpenter Technology's earnings growth prospects and competitive positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Carpenter Technology Investment Narrative Recap

To be a shareholder in Carpenter Technology, you need to believe in persistent aerospace and defense demand, alongside the company’s ability to capture value in emerging materials segments like additive manufacturing. The latest upward earnings revisions reinforce current demand momentum as the main short-term catalyst; however, they do not significantly diminish the biggest risk, execution on the capital-intensive brownfield expansion, which still depends on market conditions and project delivery.

Of the recent announcements, Carpenter’s scheduled October 23, 2025, earnings release stands out, as it will shed light on both the progress in their core aerospace-driven revenues and management’s confidence around future guidance. This event is closely watched, given that near-term results could influence sentiment on Carpenter’s capacity investments and future margins.

By contrast, investors should be aware of execution risks tied to Carpenter’s major expansion project, particularly if...

Read the full narrative on Carpenter Technology (it's free!)

Carpenter Technology's projections indicate $3.6 billion in revenue and $672.3 million in earnings by 2028. This implies a 7.7% annual revenue growth rate and an increase in earnings of $296.5 million from the current $375.8 million.

Uncover how Carpenter Technology's forecasts yield a $325.72 fair value, a 32% upside to its current price.

Exploring Other Perspectives

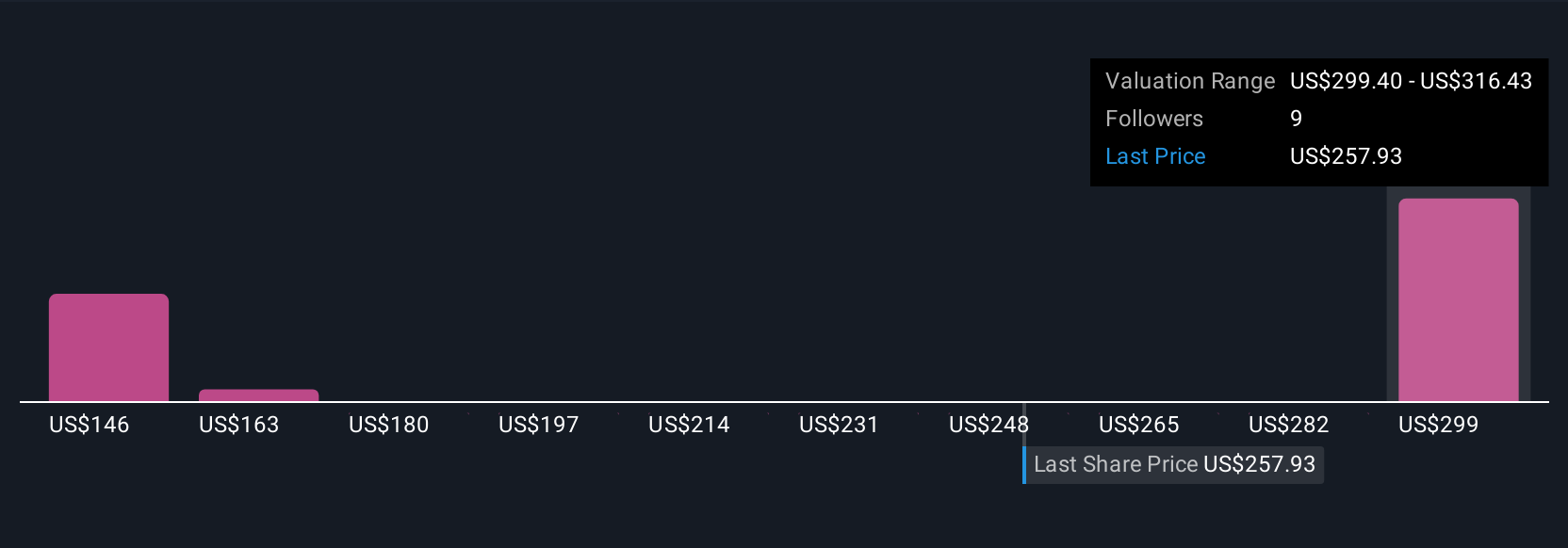

Simply Wall St Community members have identified fair values for Carpenter Technology ranging from US$128 to US$326, highlighting three distinct perspectives. With analyst earnings estimates on the rise, the path ahead could see sentiment shift quickly, review multiple viewpoints to better understand potential outcomes.

Explore 3 other fair value estimates on Carpenter Technology - why the stock might be worth 48% less than the current price!

Build Your Own Carpenter Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carpenter Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carpenter Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carpenter Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives