- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Carpenter Technology (CRS): Assessing Valuation After Strong Shareholder Returns

Reviewed by Simply Wall St

See our latest analysis for Carpenter Technology.

After posting a 41.88% year-to-date share price return and a remarkable 60.32% total shareholder return over the past year, Carpenter Technology’s latest climb to $249.00 suggests that investor optimism is holding steady, even as momentum has cooled off slightly from earlier highs. The stock’s strong multi-year gains still put it far ahead of where it started, which further reinforces its growth story in the capital goods space.

If you’re curious about other stocks showing strong upward trends, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply over the past year but still trading about 31 percent below the average analyst price target, the question remains: is Carpenter Technology undervalued at current levels, or has the market already factored in its future growth potential?

Most Popular Narrative: 23.6% Undervalued

Compared to its last close of $249.00, the narrative’s fair value for Carpenter Technology points to considerable upside and spotlights strong catalysts driving the consensus view.

The ongoing ramp in global aerospace demand, highlighted by extended lead times, urgent defense orders, and robust multi-year supply contracts, positions Carpenter to accelerate revenue growth as OEM build rates increase, particularly in next-generation and more fuel-efficient aircraft. This supports both top-line expansion and recurring revenues.

Want to know what’s supercharging analyst optimism? There is a bold prediction about profits and margins usually reserved for industry giants. The full narrative exposes which financial shifts fuel such a premium price target. Curious what’s behind these ambitious growth calls?

Result: Fair Value of $325.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company’s reliance on cyclical aerospace demand and the risks of costly capacity expansion could present challenges to the current upbeat outlook.

Find out about the key risks to this Carpenter Technology narrative.

Another View: Our DCF Model Tells a Different Story

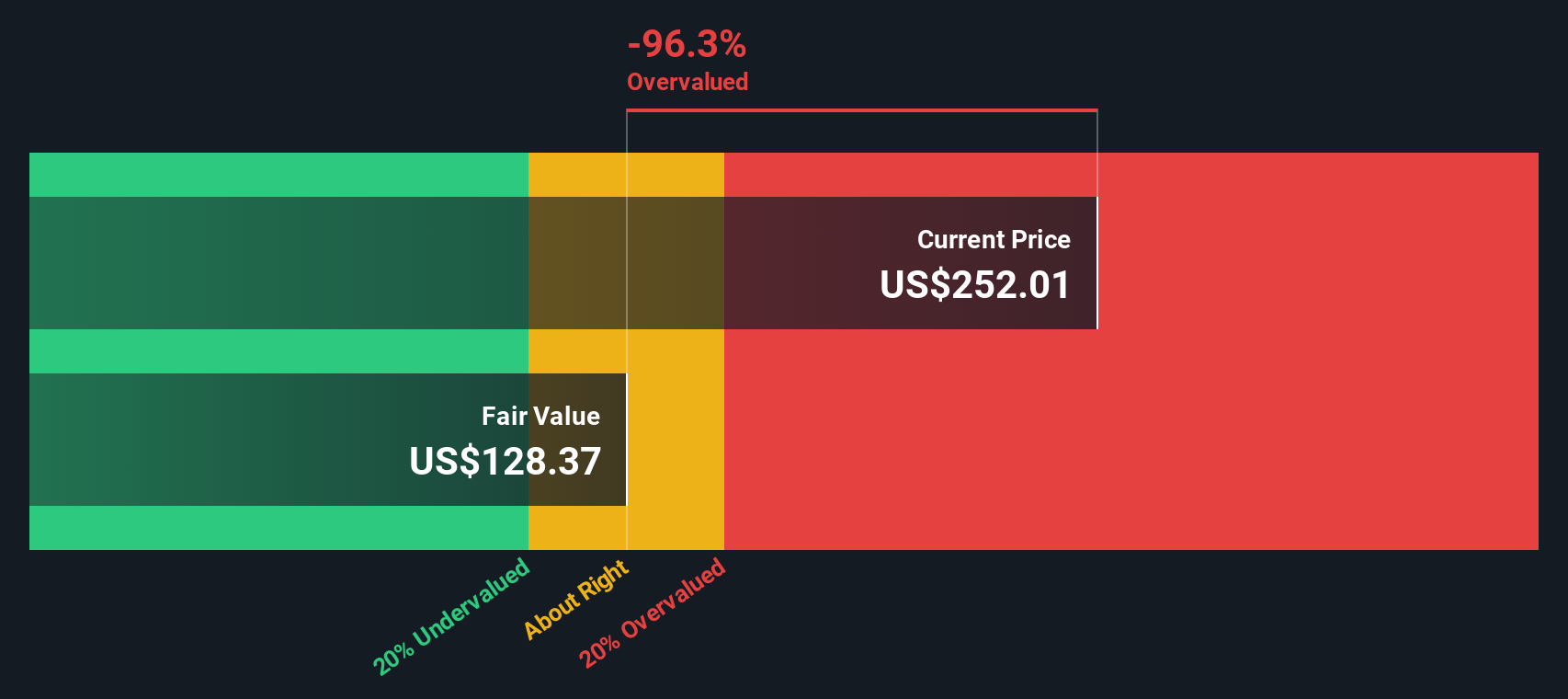

Looking at Carpenter Technology through the lens of our DCF model paints a more cautious picture. While the consensus price target suggests the stock is undervalued, our SWS DCF model points to Carpenter’s current price being well above its estimated fair value. This hints at greater downside risk if optimistic assumptions do not materialize. Is the market’s confidence too far ahead of itself, or is there more upside to unlock?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carpenter Technology Narrative

If you’d rather dig into the facts firsthand and shape your own perspective, you can craft a Carpenter Technology narrative with your own analysis in just minutes. Do it your way

A great starting point for your Carpenter Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their options. Stay ahead of market shifts by seizing opportunities others overlook with these powerful stock screeners from Simply Wall St:

- Catch rising tech trends and fuel your portfolio with momentum by checking out these 24 AI penny stocks, unlocking the biggest breakthroughs in artificial intelligence.

- Lock in steady income and secure your financial future by scouting these 17 dividend stocks with yields > 3%, with reliable yields above 3 percent.

- Step ahead of the curve and position yourself for growth with these 877 undervalued stocks based on cash flows, which are currently trading beneath their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives