- United States

- /

- Aerospace & Defense

- /

- NYSE:CRS

Assessing Carpenter Technology (CRS) Valuation After Recent Share Price Moves

Reviewed by Kshitija Bhandaru

Carpenter Technology (CRS) has recently drawn investor interest, with shares showing some movement over the past week. Its stock price has reflected a mix of recent gains and minor pullbacks, prompting investors to take a closer look at what is driving performance.

See our latest analysis for Carpenter Technology.

Carpenter Technology’s recent stock movement comes amid a broader trend of long-term growth, with its 1-year total shareholder return sitting at an impressive 61%. The current momentum signals that investors are still factoring in both strong results and evolving opportunities in the business.

If you’re interested in discovering what else savvy investors are eyeing right now, use this moment to broaden your perspective and explore fast growing stocks with high insider ownership

But with shares up more than 60 percent over the past year and still trading below analyst targets, investors must ask whether Carpenter Technology is undervalued right now or if the market has fully priced in future growth.

Most Popular Narrative: 24.2% Undervalued

Carpenter Technology's most widely followed narrative assigns a fair value of $325.72, which is considerably above the last close of $246.95. This suggests potential room for upside based on analyst projections and company fundamentals.

The ongoing ramp in global aerospace demand, highlighted by extended lead times, urgent defense orders, and robust multi-year supply contracts, positions Carpenter to accelerate revenue growth as OEM build rates increase, particularly in next-generation and more fuel-efficient aircraft. This supports both top-line expansion and recurring revenues.

Want to know the growth blueprint behind this high valuation? The narrative’s fair value is based on ambitious financial projections and an earnings multiple that rivals industry giants. Which bold forecasts about revenue, profits, and margins justify the analysts’ optimism? Find out what’s fueling this price target and judge the story for yourself.

Result: Fair Value of $325.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy exposure to aerospace cycles and the risk of underwhelming returns from expansion projects could quickly shift sentiment regarding Carpenter Technology’s outlook.

Find out about the key risks to this Carpenter Technology narrative.

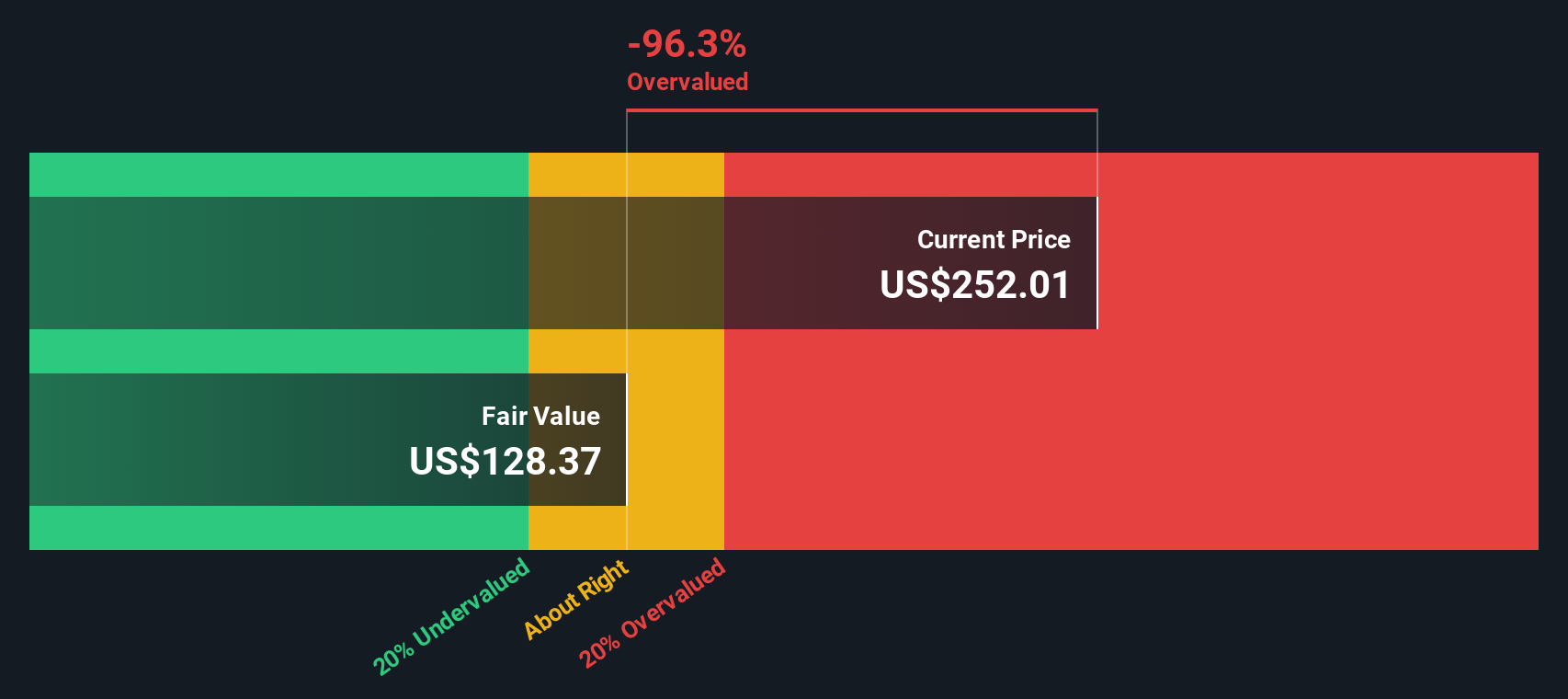

Another View: Discounted Cash Flow Perspective

While the analyst consensus sees Carpenter Technology as undervalued, our DCF model tells a different story. According to this approach, CRS is currently trading above its estimated fair value. This raises the question: Is the market simply more optimistic than the underlying cash flows suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carpenter Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carpenter Technology Narrative

If you view the numbers differently or prefer to draw your own conclusions, you can easily craft a personalized narrative in just a few minutes with our tools. So why not Do it your way?

A great starting point for your Carpenter Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons and power up your portfolio with these unique stock ideas hand-picked for growth and potential.

- Uncover overlooked growth by checking out these 3568 penny stocks with strong financials, which combine strong financials with substantial upside for bold investors.

- Catch the next big wave in innovation by examining these 24 AI penny stocks, which are poised to disrupt industries and transform technology as we know it.

- Secure consistent returns by reviewing these 19 dividend stocks with yields > 3%, offering yields above 3 percent and providing options for those seeking steady income from reliable companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRS

Carpenter Technology

Engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.