- United States

- /

- Building

- /

- NYSE:CNR

Cornerstone Building Brands (NYSE:CNR) Share Prices Have Dropped 34% In The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the Cornerstone Building Brands, Inc. (NYSE:CNR) share price up 23% in a single quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 34% in the last three years, falling well short of the market return.

Check out our latest analysis for Cornerstone Building Brands

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Cornerstone Building Brands has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

Revenue is actually up 41% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Cornerstone Building Brands more closely, as sometimes stocks fall unfairly. This could present an opportunity.

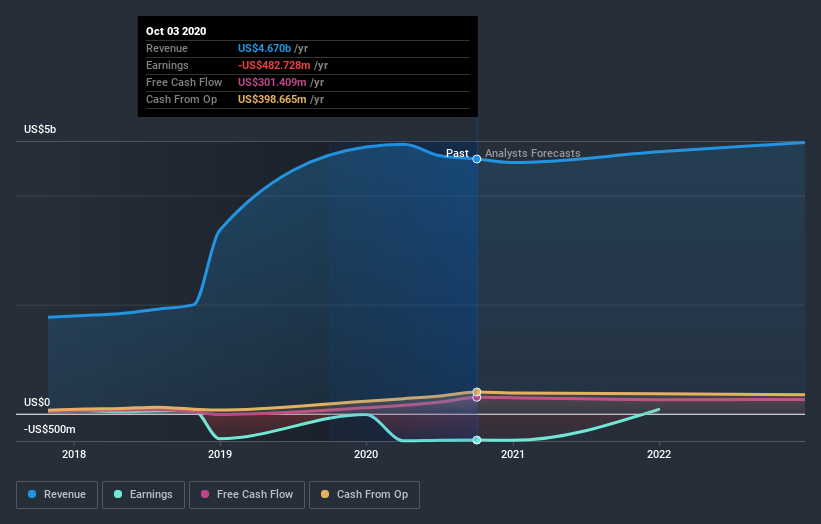

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Cornerstone Building Brands in this interactive graph of future profit estimates.

A Different Perspective

Cornerstone Building Brands shareholders are up 23% for the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 0.9% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Cornerstone Building Brands is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Cornerstone Building Brands, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CNR

Cornerstone Building Brands

Cornerstone Building Brands, Inc., together with its subsidiaries, designs, engineers, manufactures, markets, and installs external building products for the commercial, residential, and repair and remodel markets in the United States, Canada, Mexico, and internationally.

Proven track record and slightly overvalued.