- United States

- /

- Trade Distributors

- /

- NYSE:CNM

Does Investor Optimism Ahead of Earnings Signal Shifting Expectations for Core & Main (CNM)?

Reviewed by Sasha Jovanovic

- Core & Main recently closed at US$51.77, rising 1.81% from its previous session and outperforming the S&P 500, as investors focus on its upcoming earnings report with expectations for higher EPS and revenue compared to the prior-year quarter.

- Despite trading at a premium relative to industry peers, Core & Main currently has a low Zacks Rank, highlighting reduced near-term earnings expectations ahead of its earnings announcement.

- We'll explore how the market's anticipation of Core & Main's earnings report and shifting expectations may impact its investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Core & Main Investment Narrative Recap

To be a Core & Main shareholder, you must believe in the company's ability to drive steady growth through expansion, acquisitions, and municipal infrastructure investments. While the recent share price rise ahead of earnings underscores market interest, the real catalyst remains the upcoming earnings report. The biggest near-term risk is the downward revision in earnings guidance, which tempers expectations; however, this news event by itself does not materially change that risk or the importance of the impending results.

Among recent company announcements, the lowered earnings guidance for fiscal 2025 stands out. This is directly relevant to the current market anticipation, as it signals moderated growth expectations and shapes the context in which the next earnings report will be judged as a potential driver for short-term sentiment and valuation.

In contrast, investors should be aware of how management transitions and new guidance could intersect to affect execution of growth plans and...

Read the full narrative on Core & Main (it's free!)

Core & Main's outlook anticipates $8.7 billion in revenue and $645.7 million in earnings by 2028. This projection is based on a 4.4% annual revenue growth rate and a $229.7 million increase in earnings from the current $416.0 million.

Uncover how Core & Main's forecasts yield a $59.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

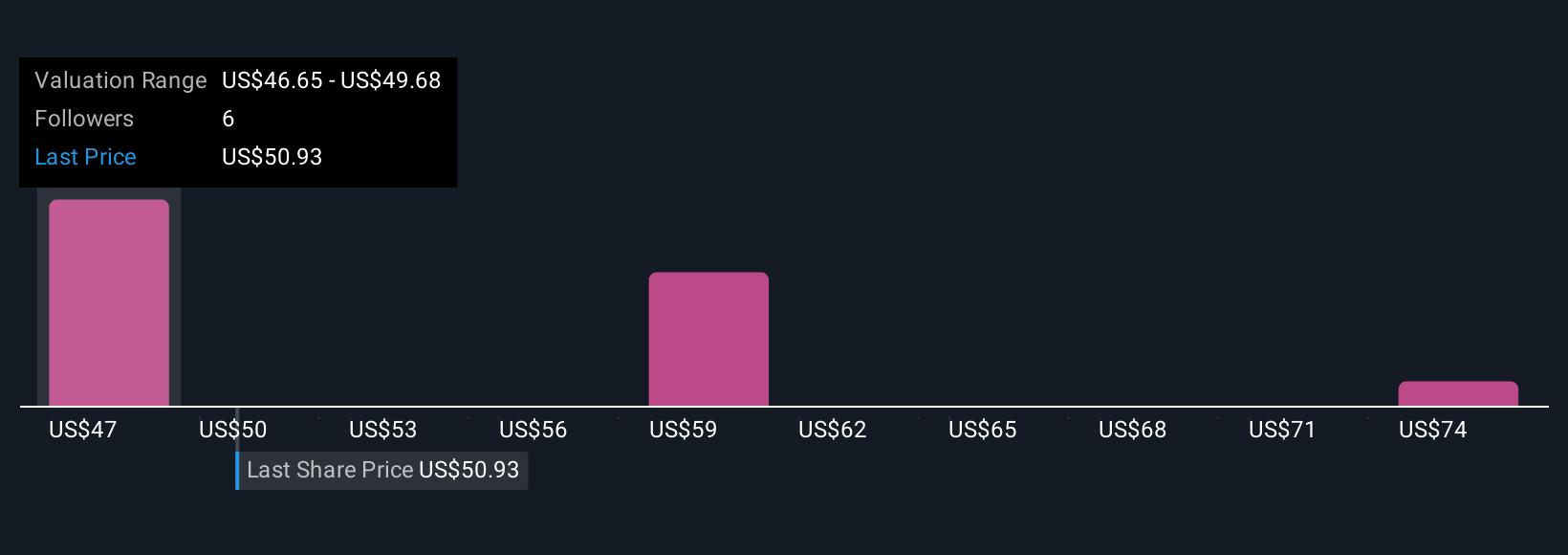

Three Simply Wall St Community members estimate Core & Main’s fair value anywhere from US$46.94 up to US$77. This contrasts with recent company guidance and highlights why you should explore several viewpoints before weighing the impact of lowered earnings expectations.

Explore 3 other fair value estimates on Core & Main - why the stock might be worth as much as 51% more than the current price!

Build Your Own Core & Main Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core & Main research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Core & Main research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core & Main's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNM

Core & Main

Distributes water, wastewater, storm drainage, and fire protection products and related services in the United States.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives