- United States

- /

- Trade Distributors

- /

- NYSE:CNM

Core & Main, Inc.'s (NYSE:CNM) P/E Is Still On The Mark Following 29% Share Price Bounce

Despite an already strong run, Core & Main, Inc. (NYSE:CNM) shares have been powering on, with a gain of 29% in the last thirty days. The last month tops off a massive increase of 174% in the last year.

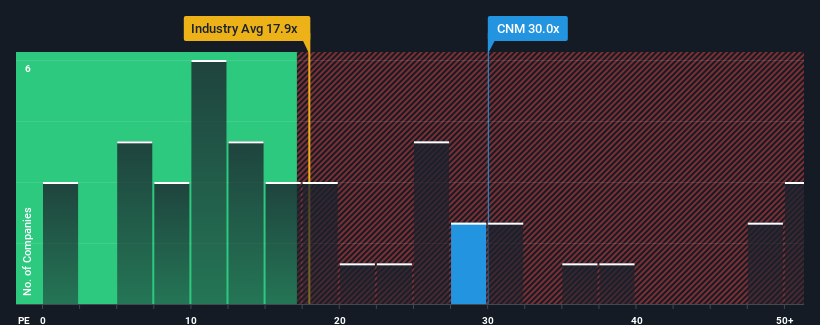

Since its price has surged higher, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Core & Main as a stock to avoid entirely with its 30x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

There hasn't been much to differentiate Core & Main's and the market's retreating earnings lately. It might be that many expect the company's earnings to strengthen positively despite the tough market conditions, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Core & Main

Is There Enough Growth For Core & Main?

The only time you'd be truly comfortable seeing a P/E as steep as Core & Main's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. However, a few strong years before that means that it was still able to grow EPS by an impressive 381% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 17% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

In light of this, it's understandable that Core & Main's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Core & Main's P/E?

The strong share price surge has got Core & Main's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Core & Main's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Core & Main you should be aware of.

Of course, you might also be able to find a better stock than Core & Main. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Core & Main, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNM

Core & Main

Distributes water, wastewater, storm drainage, and fire protection products and related services to municipalities, private water companies, and professional contractors in the municipal, non-residential, and residential end markets in the United States.

Good value with proven track record.