- United States

- /

- Machinery

- /

- NYSE:CMI

Will Cummins' (CMI) Push Into Sustainable Power and New Dividend Shape Its Long-Term Narrative?

Reviewed by Sasha Jovanovic

- The Board of Directors of Cummins Inc. declared a quarterly cash dividend of US$2.00 per share payable on December 4, 2025, to shareholders of record as of November 21, 2025.

- Allison Transmission recently announced the successful integration of its 4500 Rugged Duty Series transmission with the Cummins X15N natural gas engine, providing new sustainable heavy-duty vehicle options for commercial fleets.

- To understand how Cummins' rising involvement in sustainable power for AI-driven data centers could impact its outlook, we'll review the investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Cummins Investment Narrative Recap

To be a Cummins shareholder, you need to believe in its ability to grow through power generation demand, especially as data center expansion surges, while navigating cyclical truck market pressures and evolving regulatory environments. The recently affirmed US$2.00 dividend signals stability, yet does not materially change the most important near-term catalyst: sustained demand from critical infrastructure customers, nor does it diminish the ongoing risks from uncertain North American truck volumes and regulatory shifts.

Among the latest announcements, Allison Transmission's integration of its 4500 series with Cummins’ X15N natural gas engine stands out. This collaboration highlights Cummins’ commitment to offering attractive low-emission solutions, which could support demand in heavy-duty segments and help diversify revenue streams as traditional truck markets soften.

Yet, in contrast, investors should be aware there remain significant uncertainties for Cummins if North American truck order rates stay at multiyear lows and…

Read the full narrative on Cummins (it's free!)

Cummins' narrative projects $40.6 billion revenue and $4.3 billion earnings by 2028. This requires 6.4% yearly revenue growth and a $1.4 billion earnings increase from $2.9 billion today.

Uncover how Cummins' forecasts yield a $431.98 fair value, a 5% upside to its current price.

Exploring Other Perspectives

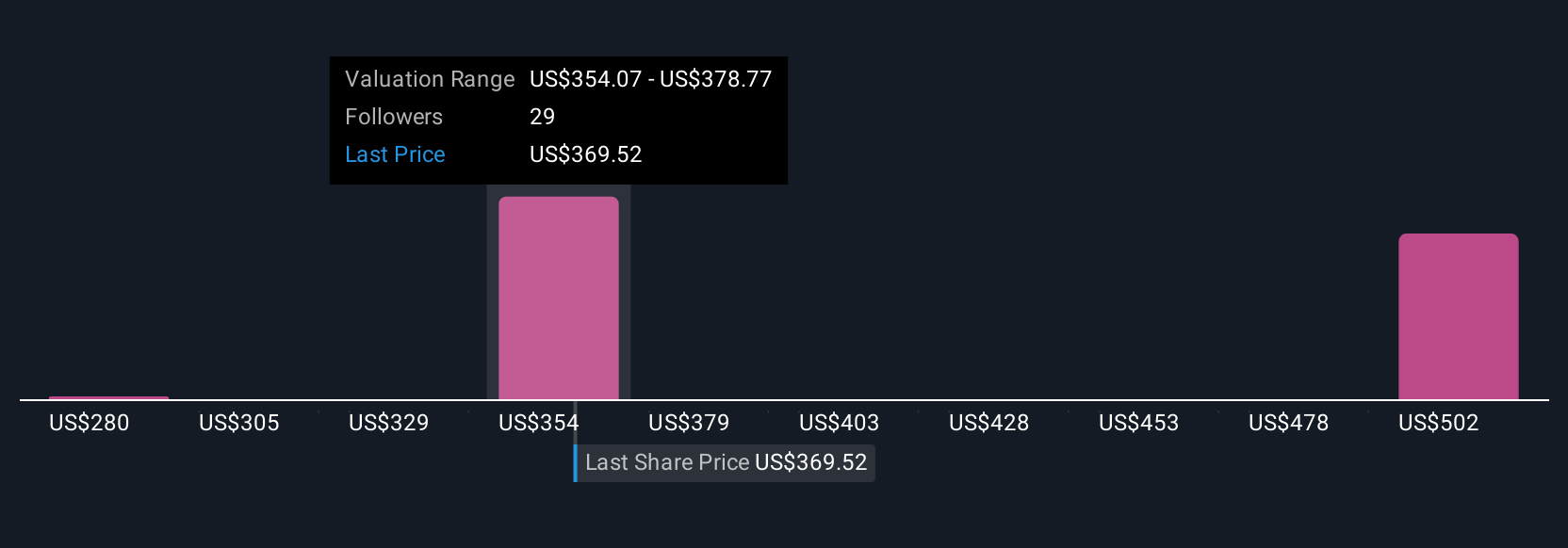

Five Simply Wall St Community members place Cummins’ fair value between US$280 and US$605, reflecting a broad spectrum of private forecasts. Many see revenue diversification from the data center sector as a key factor shaping future growth; weigh several viewpoints here.

Explore 5 other fair value estimates on Cummins - why the stock might be worth 32% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives