- United States

- /

- Machinery

- /

- NYSE:CMI

What Cummins (CMI)'s AI-Driven Analyst Upgrade Means For Shareholders

Reviewed by Sasha Jovanovic

- In September 2025, Melius Research upgraded Cummins Inc. to Buy, highlighting robust growth prospects tied to demand from artificial intelligence applications, operational improvements, and expanded engine capacity for generator sets.

- This analyst upgrade signaled increased confidence that Cummins' initiatives in emerging markets and focus on clean energy could sustain its future growth, even amid mixed industry sentiment.

- We'll examine how the analyst's emphasis on AI-driven demand could influence Cummins' long-term investment outlook and risk profile.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cummins Investment Narrative Recap

To be a shareholder in Cummins today, you must believe that diversified demand for power solutions, particularly from AI and data centers, can help offset truck market headwinds and regulatory uncertainty. The recent analyst upgrade does not meaningfully change the biggest short-term catalyst: sustained power systems growth remains key, while persistent weakness in North American truck demand still poses the largest risk to near-term earnings stability.

Among recent announcements, Cummins' expanded alliances in cleaner, hybrid powertrains (including the Komatsu mining partnership) stand out. These moves align closely with the upgrade's focus on clean energy and AI-related demand, reinforcing Cummins’ long-term potential to broaden its addressable markets, even as legacy markets remain challenged.

However, while optimism is warranted, investors should recognize the possible downsides if regulatory and tariff uncertainty worsens...

Read the full narrative on Cummins (it's free!)

Cummins' narrative projects $40.6 billion revenue and $4.3 billion earnings by 2028. This requires 6.4% yearly revenue growth and a $1.4 billion earnings increase from $2.9 billion today.

Uncover how Cummins' forecasts yield a $424.98 fair value, in line with its current price.

Exploring Other Perspectives

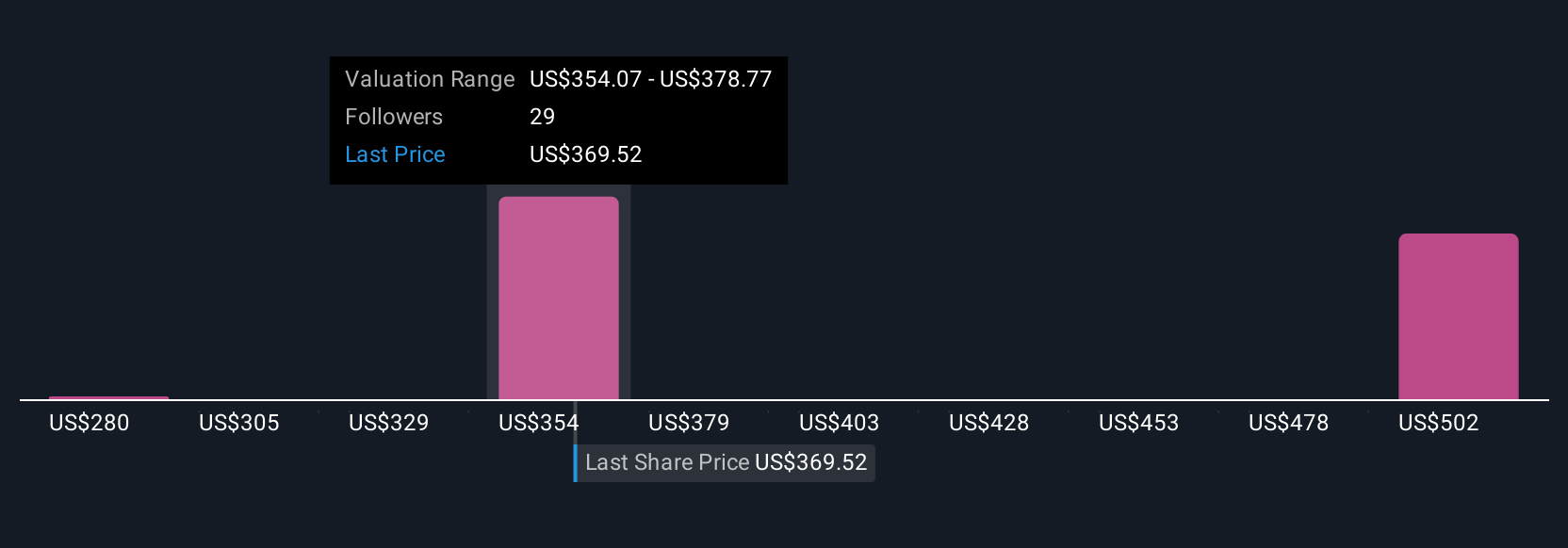

Fair value estimates from four Simply Wall St Community members span from US$280 to US$612, showing wide variations in outlook. Many see Cummins’ power systems backlog as a catalyst, but differing views remind you to explore diverse opinions before deciding on your own expectations.

Explore 4 other fair value estimates on Cummins - why the stock might be worth 35% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives