- United States

- /

- Machinery

- /

- NYSE:CMI

Should Cummins' (CMI) Latest Natural Gas Truck Demo Shape Its Role in Cleaner Transport?

Reviewed by Sasha Jovanovic

- Clean Energy Fuels Corp. recently announced the launch of its second heavy-duty truck demo program, featuring the 2026 Freightliner Cascadia Gen 5 day cab equipped with Cummins’ X15N natural gas engine, which will be showcased at a major trucking industry conference in San Diego.

- This collaboration provides national fleets with hands-on access to Cummins’ advanced natural gas engine technology, underscoring growing industry interest in cleaner transport solutions.

- We'll explore how national fleet trials of Cummins' X15N engine may reinforce its market position in sustainable transportation solutions.

Find companies with promising cash flow potential yet trading below their fair value.

Cummins Investment Narrative Recap

To be a Cummins shareholder, you need confidence in the company's ability to navigate evolving emissions standards and leverage its leadership in cleaner, diversified power solutions. The Clean Energy Fuels demo announcement spotlights growing demand for low-emission alternatives, but the most important short-term catalyst, regulatory clarity on emissions mandates, remains untouched, leaving persistent uncertainty as a key business risk for now.

In the context of ongoing catalysts, Cummins’ recent dividend affirmation at US$2.00 per share reinforces its track record of returning capital to shareholders. This steady payout, alongside its efforts in advanced engine trials and alternative power, gives investors a sense of stability as Cummins positions itself for long-term growth through innovation and reliable cash flow.

However, against expanding opportunities in decarbonization, many investors should be aware of the unresolved regulatory and tariff uncertainties that...

Read the full narrative on Cummins (it's free!)

Cummins' outlook forecasts $40.6 billion in revenue and $4.3 billion in earnings by 2028. This is based on an anticipated annual revenue growth rate of 6.4% and a $1.4 billion increase in earnings from the current $2.9 billion level.

Uncover how Cummins' forecasts yield a $444.74 fair value, a 6% upside to its current price.

Exploring Other Perspectives

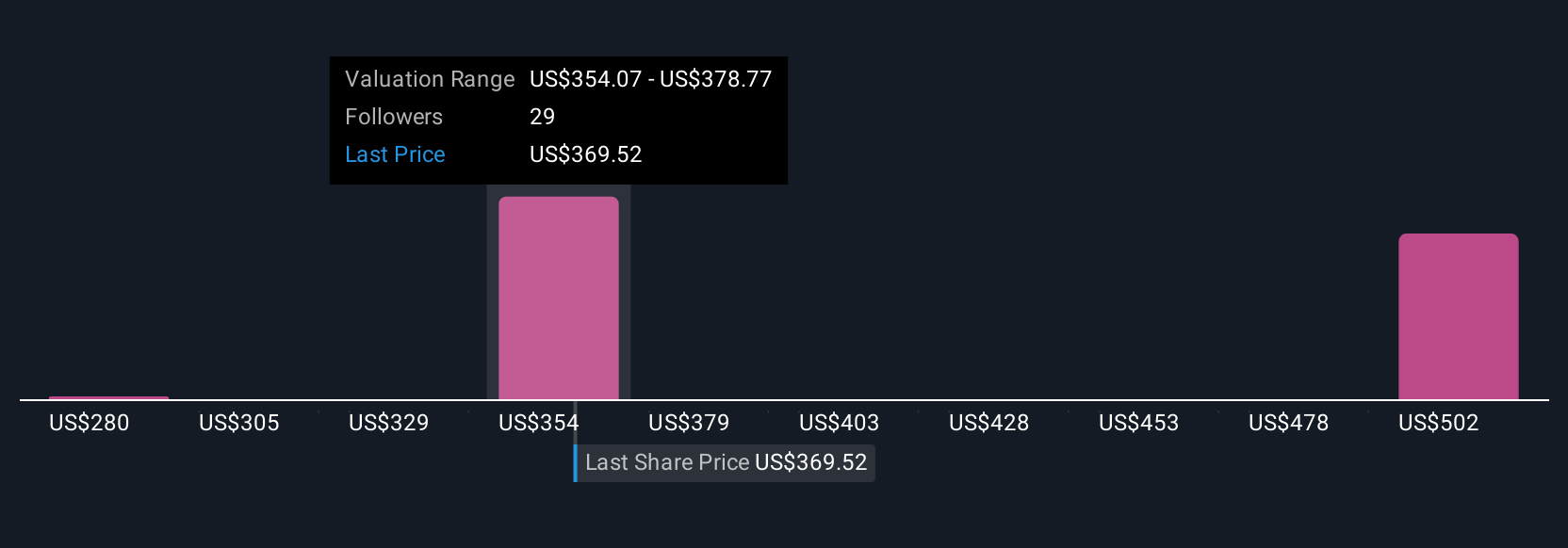

Simply Wall St Community members shared five fair value estimates for Cummins, ranging from US$280 to US$607 per share. While expectations for clean energy product adoption are rising, unclear regulatory timelines could still influence Cummins’ ability to capture future earnings growth, invite yourself to explore these competing perspectives on potential outcomes.

Explore 5 other fair value estimates on Cummins - why the stock might be worth as much as 44% more than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives