Last Update 09 Dec 25

Fair value Increased 2.26%CMI: Data Center Demand And Truck Cycle Trough Will Shape Outlook

Analysts have nudged their fair value estimate for Cummins higher to approximately $522 from about $510, citing a strengthening outlook for data center driven power demand, improving unit profitability across the portfolio, and early signs that the North America truck cycle is nearing a trough.

Analyst Commentary

Recent Street research on Cummins underscores a constructive but balanced outlook, with growing confidence in the company’s ability to monetize secular data center demand while navigating a soft on highway and truck cycle.

Bullish Takeaways

- Bullish analysts highlight a sizable, multi year data center and AI related power opportunity, which they see as a key driver of incremental revenue and mix led margin expansion.

- Successive price target increases, including moves into the low to mid $500s and one initiation near $600, reflect rising confidence in Cummins’ execution and earnings power despite macro crosscurrents.

- Improving unit profitability across Power Systems and Distribution, particularly tied to data center shipments, is viewed as evidence that management can drive earnings growth even at a challenging point in the U.S. truck cycle.

- Several firms note that the North America commercial vehicle and on highway markets appear near a trough, supporting the case for multiple stability today and potential upside as end markets normalize.

Bearish Takeaways

- Bearish analysts, while lifting price targets, maintain more neutral or Hold stances, arguing that a softer North America truck and engine backdrop still constrains near term growth and justifies only modest valuation expansion.

- Some research suggests that, following a strong run in industrials and machinery, the sector is entering an estimate revision rather than multiple expansion phase, limiting further re rating potential for Cummins without clear upside surprises.

- Concerns around macro and policy risks, including the potential impact of tariffs and slower industrial activity after Federal Reserve policy shifts, temper expectations for outperformance versus peers.

- A subset of cautious views emphasizes that parts of the portfolio, particularly Engine and Components, remain exposed to cyclical downdrafts, which could offset some of the gains from data center related strength if the cycle weakens further.

What's in the News

- EPA signaled it will propose a revised heavy duty NOx rule in spring 2026, keeping the Model Year 2027 start but aiming to lower compliance costs, with Cummins shares moving higher on the news (Commercial Carrier Journal / EPA via periodical).

- North American Class 8 truck orders fell 32% year over year in September to 20,500 units, underscoring a softer truck demand backdrop that directly affects Cummins' engine and components volumes (Bloomberg via periodical).

- Cummins and Komatsu, along with drive system supplier Wabtec, signed an MOU to co develop hybrid powertrains for large mining haul trucks, accelerating decarbonization offerings in off highway markets (Strategic Alliances key development).

- Allison Transmission successfully integrated its 4500 Rugged Duty Series automatic transmission with the Cummins X15N natural gas engine in multiple heavy duty truck platforms, supporting the shift toward lower emission fleet solutions (Client Announcements key development).

- Cummins completed a share repurchase program launched in 2019, retiring more than 7.6 million shares, while undertaking no additional buybacks under a separate 2021 authorization in the latest quarter (Buyback Tranche Update key developments).

Valuation Changes

- The fair value estimate has risen slightly to approximately $522 from about $510, reflecting modestly higher long-term earnings expectations.

- The discount rate has inched up to roughly 8.58% from about 8.57%, a minimal change that slightly tempers the valuation uplift.

- Revenue growth has increased marginally to about 6.03% from roughly 6.02%, indicating a slightly stronger top-line outlook.

- The net profit margin has risen modestly to around 11.57% from about 11.50%, signaling incremental improvement in expected profitability.

- The future P/E has moved up slightly to roughly 20.0x from about 19.7x, pointing to a small expansion in the valuation multiple applied to forward earnings.

Key Takeaways

- Diversified growth in power systems and clean energy investments is offsetting weakness in traditional truck markets, supporting stronger margins and resilience.

- Regulatory changes and new product launches are fueling pricing power and future revenue growth, as the company manages costs and expands production capacity.

- Cummins faces cyclical demand risks, regulatory and tariff uncertainty, weak alternative powertrain growth, rising competition, and vulnerability in key international markets.

Catalysts

About Cummins- Offers various power solutions worldwide.

- Cummins is experiencing strong and steadily growing demand for power generation equipment, especially from the data center sector, driven by increasing urbanization, digital infrastructure expansion, and the global shift toward cleaner, efficient energy solutions; this diversification is lifting revenue and supporting higher EBITDA margins, offsetting softness in the traditional truck markets.

- The company's two-year-plus backlog and continued capacity expansions in Power Systems position it to sustain elevated sales growth and margins, especially as additional production capacity comes online in 2026, directly benefiting future revenue and margin expansion.

- Tightening global emissions regulations and anticipated adoption of new product platforms (such as EPA27-compliant engines) create an opportunity for pricing power and market share stabilization as fleets upgrade, supporting future revenue growth and premium product margins as regulatory clarity emerges.

- Cummins' disciplined cost management, operational improvements, and ability to mitigate tariff headwinds-even as North American truck volumes decline-demonstrate resilient net earnings and margin protection, highlighting underlying operating leverage when cyclical markets recover.

- Ongoing investments in electrification, hydrogen, and stationary energy storage broaden Cummins' long-term addressable market; as secular decarbonization trends accelerate, these initiatives can unlock new revenue streams and recurring income (aftersales, services), ultimately supporting long-term earnings growth.

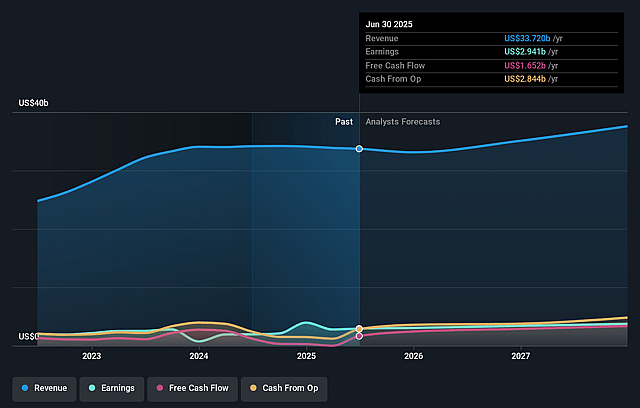

Cummins Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cummins's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 10.6% in 3 years time.

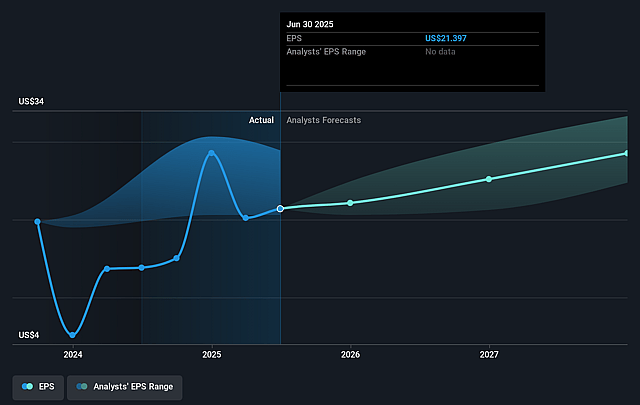

- Analysts expect earnings to reach $4.3 billion (and earnings per share of $32.25) by about September 2028, up from $2.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $3.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, down from 18.5x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Cummins Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and worsening weakness in North American heavy

- and medium-duty truck demand (with order rates at multiyear lows and OEMs cutting production) exposes Cummins to large cyclical declines in core engine and component revenues and puts significant pressure on segment margins and earnings, especially if an economic or regulatory recovery is delayed.

- Regulatory and tariff uncertainty, with no clarity on the timeline or details of EPA27 emissions standards and ongoing unpredictable international tariff changes, is elevating costs, disrupting investment planning, and forcing duplicative engineering/development work; this increases SG&A and R&D expenses and could compress net margins until the policy environment stabilizes.

- Slowing growth and sustained EBITDA losses in Accelera (alternative powertrains and electrolyzers) indicate that Cummins is not yet capturing significant share or profitability in key zero-emission technologies, risking long-term revenue and market share erosion as the industry migrates away from legacy diesel platforms.

- Increasing competitive intensity from both traditional peers and new entrants in electrification, hydrogen, and backup power/microgrid solutions may lead to price compression, reduced pricing power, and margin pressure-particularly as pure-play EV and hydrogen firms ramp up offerings, threatening Cummins' ability to maintain its historical premium and long-term gross margins.

- International market strength (notably China and data center-driven power systems) currently underpins earnings, but these are vulnerable to de-globalization, shifting government incentives, macroeconomic slowdown, and increased local competition-any reversal in these secular demand tailwinds would negatively impact diversified revenue streams and consolidated profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $418.529 for Cummins based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $500.0, and the most bearish reporting a price target of just $350.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $40.6 billion, earnings will come to $4.3 billion, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of $394.78, the analyst price target of $418.53 is 5.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Cummins?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.