- United States

- /

- Machinery

- /

- NYSE:CMI

Is Growing Data Center Demand Changing Cummins' (CMI) Long-Term Value Proposition?

Reviewed by Sasha Jovanovic

- Earlier this month, Cummins Inc. reported third quarter 2025 earnings showing sales of US$8.32 billion and net income of US$536 million, both down from the same period last year, while confirming no recent share buybacks under its existing programs.

- Industry commentary has drawn fresh attention to Cummins’ role in providing critical backup power for data centers, highlighting a segment that is increasingly viewed as central to the company's long-term growth profile.

- We’ll assess how stronger recognition of Cummins’ data center exposure could impact the company’s investment outlook moving forward.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Cummins Investment Narrative Recap

To hold Cummins shares, I’d need to believe in the company’s shift from legacy engine markets toward growth in power systems, especially for data centers, a segment now in the spotlight. While weaker third-quarter earnings may reflect cyclical truck demand softness, they don’t fundamentally alter the primary short-term catalyst: data center-related power demand. However, the biggest risk remains cyclical declines in North American heavy and medium-duty truck orders, which could see continued pressure if the economic environment stays muted.

The company's announcement that it repurchased zero shares last quarter is especially relevant, as it suggests Cummins is prioritizing cash preservation in light of ongoing industry challenges. With capital being held back rather than used for buybacks, Cummins appears to be focusing resources on navigating market uncertainties and supporting growth initiatives such as its data center and power systems exposure.

But investors should also be aware that, despite optimism around the data center segment, the threat of ongoing weakness in core North American truck demand remains a key risk to watch...

Read the full narrative on Cummins (it's free!)

Cummins' outlook anticipates $40.6 billion in revenue and $4.3 billion in earnings by 2028. This is based on a projected 6.4% annual revenue growth, representing an increase of $1.4 billion in earnings from the current $2.9 billion.

Uncover how Cummins' forecasts yield a $469.04 fair value, in line with its current price.

Exploring Other Perspectives

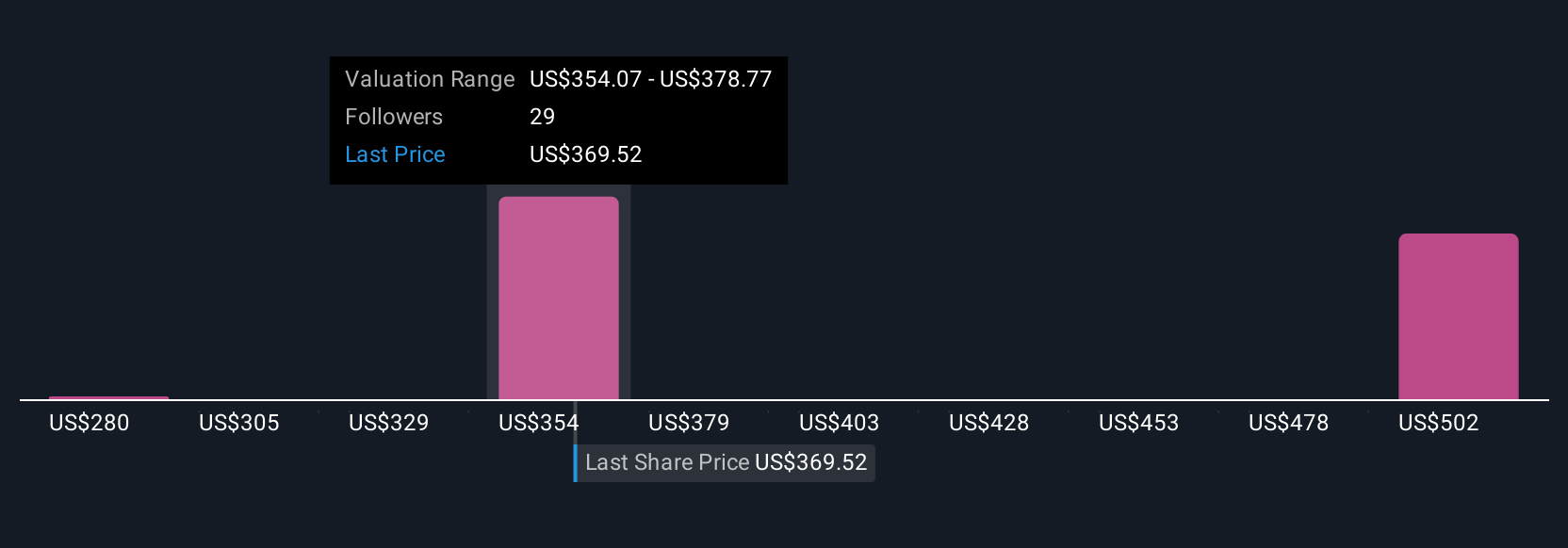

Five members of the Simply Wall St Community estimate Cummins’ fair value between US$280 and US$750, showing a wide span of investor views. With truck market weakness a central risk, you can see how much opinions about future company performance can vary.

Explore 5 other fair value estimates on Cummins - why the stock might be worth 40% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

No Opportunity In Cummins?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives