- United States

- /

- Machinery

- /

- NYSE:CMI

Cummins (CMI): Reassessing Valuation After Strategic Hybrid Powertrain Partnership With Komatsu

Reviewed by Kshitija Bhandaru

If you have been following Cummins (NYSE:CMI), the recent announcement of a memorandum of understanding with Komatsu to co-develop hybrid powertrains for mining equipment likely caught your attention. This strategic collaboration goes beyond routine partnership news and signals a meaningful push by Cummins into the clean energy space for heavy industry. The partnership also brings Wabtec on board and leverages the expertise of each company to accelerate the adoption of hybrid mining vehicles. This move addresses both decarbonization ambitions and operational efficiency for mining operators.

This move has put Cummins in the spotlight amid shifting market sentiment around industrial decarbonization. Over the past year, the stock has returned just over 30 percent, building on strong momentum from the past several months. While Cummins has seen ongoing headwinds in its traditional engine business, new partnerships and its growing clean-tech exposure appear to be driving fresh interest, as reflected in recent gains and ongoing sustainability-focused initiatives.

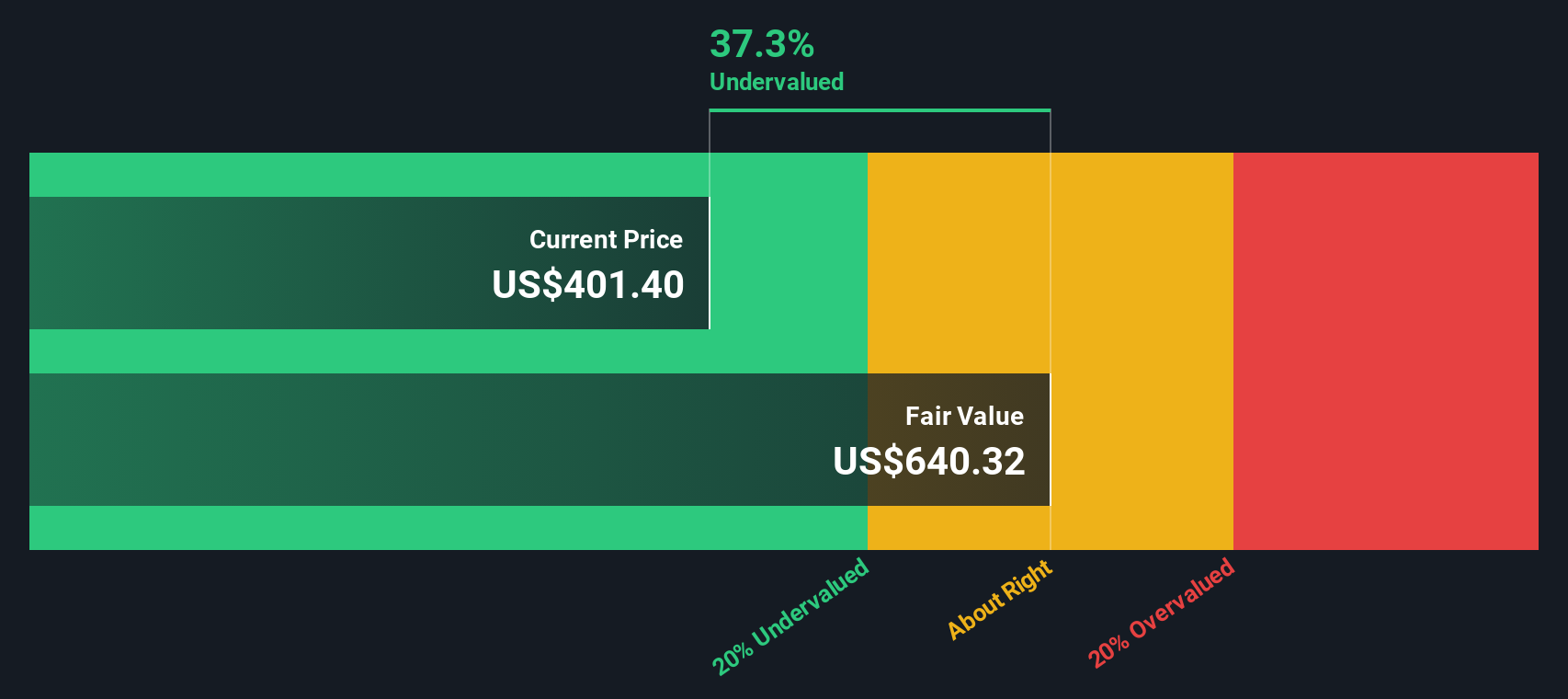

With the stock’s recent rally and a high-profile strategic alliance on the table, the critical question is whether Cummins is trading at an attractive entry point or if the market is already factoring in its future growth potential.

Most Popular Narrative: 10% Undervalued

The prevailing narrative views Cummins as undervalued, with a projected fair value about 10% higher than the current share price. This perspective is based on its future growth dynamics.

Cummins is experiencing strong and steadily growing demand for power generation equipment, especially from the data center sector. This demand is driven by increasing urbanization, digital infrastructure expansion, and the global shift toward cleaner, efficient energy solutions. This diversification is lifting revenue and supporting higher EBITDA margins, offsetting softness in the traditional truck markets.

Want the secrets behind this bullish price target? The big story hinges on ambitious expectations for future revenue, climbing profit margins, and a key shift in product mix. The calculations at the heart of this narrative could surprise. See what drives the math and why some think Cummins is just getting started.

Result: Fair Value of $418.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing weakness in truck demand or regulatory uncertainty could quickly challenge these upbeat assumptions and put pressure on Cummins’ growth story.

Find out about the key risks to this Cummins narrative.Another View: What Does the SWS DCF Model Say?

While analysts lean on future earnings and margins for their pricing view, our DCF model paints a starker picture. It suggests Cummins could be even more undervalued than consensus expects. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cummins for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cummins Narrative

If you see the story differently or want to dig into the numbers on your own terms, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to step ahead of the crowd, don’t settle for the obvious choices. Broaden your horizon with winning stocks leading hot trends that most investors miss.

- Capture the potential of tomorrow’s tech disruptors by spotting the next wave of advancements with AI penny stocks in your arsenal.

- Tap into reliable income streams by selecting companies committed to rewarding shareholders with dividend stocks with yields > 3% that outperform in any market climate.

- Zero in on hidden gems trading below fair value and seize smart opportunities with undervalued stocks based on cash flows fueling your strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives