- United States

- /

- Machinery

- /

- NYSE:CMI

Assessing Cummins (CMI) Valuation as Data Center Demand and Hydrogen Engine Initiatives Drive Investor Interest

Reviewed by Simply Wall St

Cummins (CMI) has caught investors attention as demand surges for its power systems and generator business, especially from data centers, while its Accelera unit pushes further into hydrogen engines and hybrid powertrains.

See our latest analysis for Cummins.

The stock has been climbing steadily, with a roughly 16 percent 1 month share price return and close to 47 percent year to date. A 5 year total shareholder return above 160 percent suggests momentum has been building over the long haul.

If Cummins recent run has you thinking about where the next wave of industrial growth could come from, it is worth exploring aerospace and defense stocks as another hunting ground for resilient power and infrastructure plays.

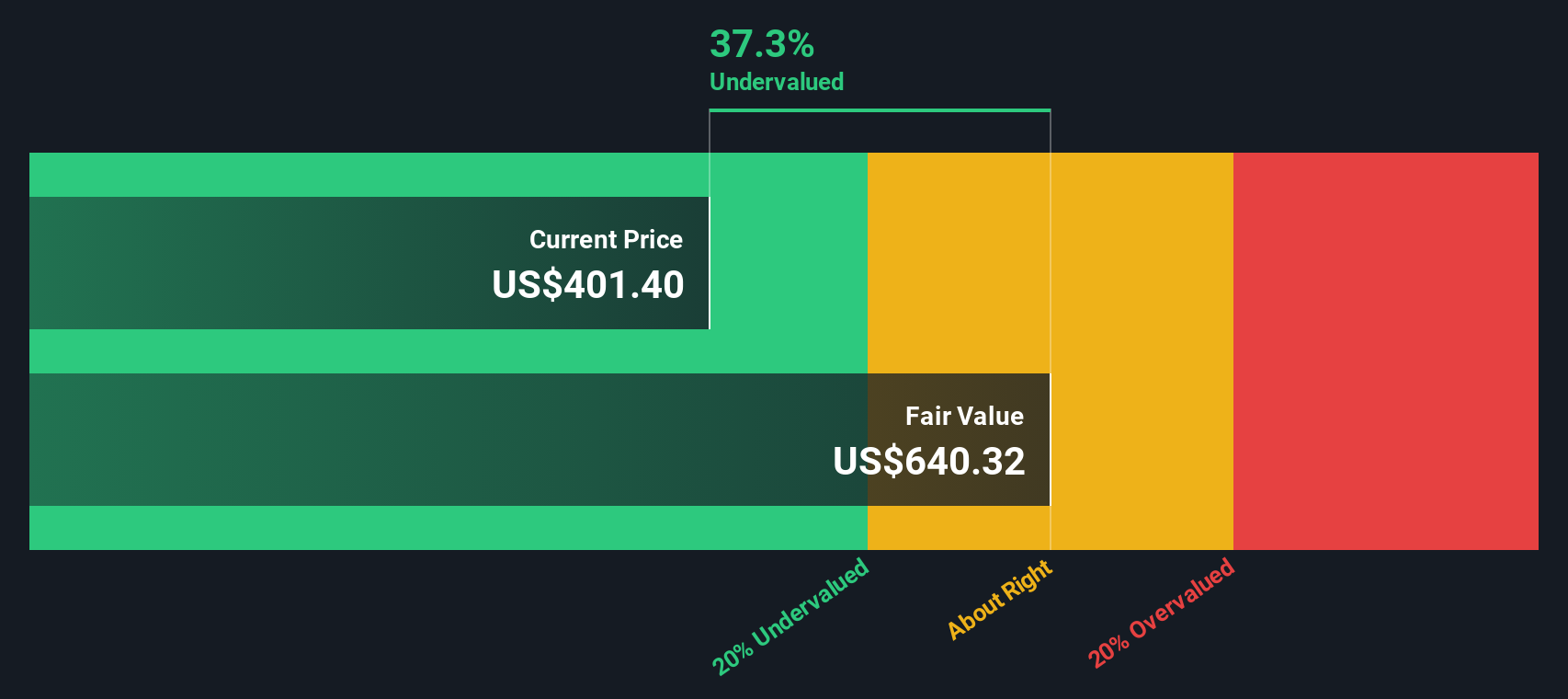

With shares hovering near Wall Street targets but still trading at a sizable intrinsic discount, the key question now is whether Cummins is quietly undervalued or if the market is already baking in years of future growth.

Most Popular Narrative Narrative: 10% Overvalued

Compared with Cummins last close around $510, the most widely followed narrative pegs fair value slightly lower and leans on ambitious profitability gains ahead.

Ongoing investments in electrification, hydrogen, and stationary energy storage broaden Cummins' long-term addressable market; as secular decarbonization trends accelerate, these initiatives can unlock new revenue streams and recurring income (aftersales, services), ultimately supporting long-term earnings growth.

Curious how modest revenue assumptions and a step up in profit margins can still justify a premium future earnings multiple for a cyclical industrial name? The narrative breaks down those moving parts, including the tug of war between slower top line growth and richer margins, and the valuation math that turns them into today’s elevated fair value estimate.

Result: Fair Value of $510.05 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in North American truck demand and ongoing regulatory or tariff uncertainty could quickly challenge those upbeat growth and margin assumptions.

Find out about the key risks to this Cummins narrative.

Another View: Market Ratios Tell a Different Story

Our SWS DCF model says Cummins, at about $510, still trades roughly 20 percent below its estimated fair value of $638, pointing to meaningful upside even after the rally. If cash flows are right and growth proves durable, is the real risk in waiting on the sidelines?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cummins for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cummins Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cummins.

Looking for more investment ideas?

If Cummins intrigues you, do not stop here, use the Simply Wall Street Screener to hunt for your next edge before everyone else catches on.

- Capture early stage growth potential by scanning these 3576 penny stocks with strong financials with improving fundamentals and room for multiple expansion.

- Position ahead of the next tech wave by tracking these 26 AI penny stocks building real businesses around artificial intelligence.

- Secure potential bargains by filtering for these 906 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026