- United States

- /

- Machinery

- /

- NYSE:CMI

AI and Energy Storage Upgrade Might Change The Case For Investing In Cummins (CMI)

Reviewed by Sasha Jovanovic

- Melius Research recently upgraded Cummins Inc., highlighting the company's ability to benefit from growing demand for artificial intelligence and energy storage markets amid an ongoing truck sector downturn.

- This upgrade underscores investor confidence in Cummins' operational enhancements and diversification through investments in electrification, hydrogen, and battery energy storage systems.

- We'll explore how the latest analyst upgrade, focused on AI-driven growth, could influence Cummins' forward-looking investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cummins Investment Narrative Recap

Cummins shareholders are likely believers in the company's power technology leadership and its ability to offset truck sector weakness by capturing growth in energy storage and AI-enabled power demand. While the Melius Research upgrade reinforces this longer-term narrative, the news does not materially change the most immediate catalyst, steady performance in the power generation segment, nor does it mitigate the primary risk of further declines in truck engine demand.

One announcement that ties directly to the AI and energy theme is Cummins’ launch of its Battery Energy Storage Systems, which addresses the demand for reliable, low-emission backup power solutions. This supports Cummins’ broader effort to serve sectors facing grid instability and positions its power systems business as a potential buffer against challenges in legacy markets.

However, investors should also watch for the ongoing risk in the traditional truck segment, especially if truck orders remain at multiyear lows and...

Read the full narrative on Cummins (it's free!)

Cummins' narrative projects $40.6 billion revenue and $4.3 billion earnings by 2028. This requires 6.4% yearly revenue growth and a $1.4 billion earnings increase from $2.9 billion today.

Uncover how Cummins' forecasts yield a $424.98 fair value, in line with its current price.

Exploring Other Perspectives

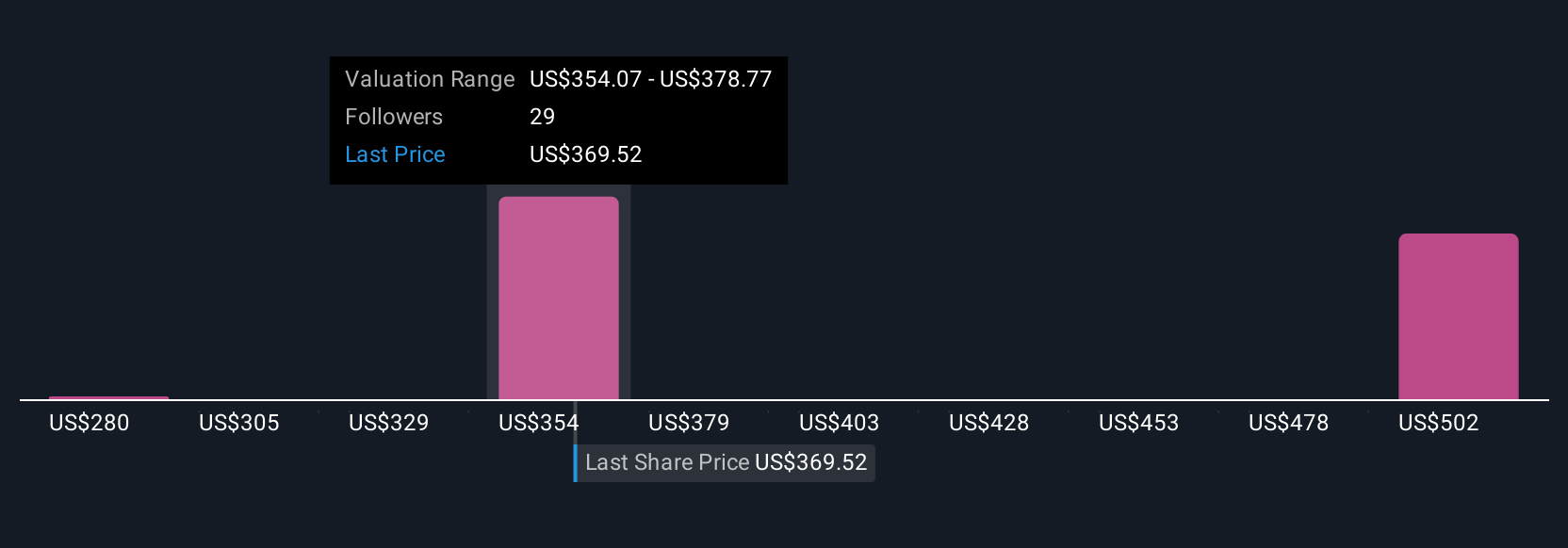

Four fair value estimates from the Simply Wall St Community range from US$280 up to US$612.54 per share. These differing views come as Cummins faces both optimism from AI-driven power systems and potential headwinds from unstable truck demand.

Explore 4 other fair value estimates on Cummins - why the stock might be worth 35% less than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cummins' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives