- United States

- /

- Machinery

- /

- NYSE:CAT

The Bull Case For Caterpillar (CAT) Could Change Following Indiana Workforce and Facility Expansion Announcement

Reviewed by Sasha Jovanovic

- Earlier this month, Caterpillar Inc. announced Indiana as one of the first states to receive funding from its US$100 million workforce pledge, dedicating up to US$5 million to training and upskilling initiatives alongside a US$725 million capital expansion at its Lafayette engine facility.

- This substantial investment highlights Caterpillar’s commitment to growing advanced manufacturing careers and workforce readiness while also expanding production capacity to address rising power needs.

- We’ll examine how Caterpillar’s workforce and manufacturing expansion in Indiana could influence the company’s long-term investment outlook.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Caterpillar Investment Narrative Recap

To be a shareholder in Caterpillar, you need to believe in the long-term demand for global infrastructure, energy, and advanced manufacturing, backed by the company’s market leadership and broad product offering. While Caterpillar’s US$100 million workforce pledge and major Lafayette facility expansion reflect ongoing capacity investment and skilled labor development, this announcement does not materially affect the dominant short-term catalyst: robust infrastructure and energy project activity driven by record order backlogs. The largest risk remains potential margin pressure from new tariffs and volatile global trade policy, which has yet to be resolved by these announcements. The Indiana workforce initiative closely relates to recent capacity investments, such as Caterpillar’s US$725 million expansion in Lafayette, supporting growth in power solutions to serve heightened data center and infrastructure needs. These moves reinforce the importance of backlog-driven production, yet also underline the operational complexity and cost management challenges that could affect profitability as large capital expansions ramp up. However, before investors focus solely on these growth stories, it’s critical to consider the ongoing tariff uncertainty and how persistent trade disruptions could pressure Caterpillar’s margins if…

Read the full narrative on Caterpillar (it's free!)

Caterpillar's outlook anticipates $74.0 billion in revenue and $13.5 billion in earnings by 2028. This is based on a 5.5% annual revenue growth rate and a $4.1 billion increase in earnings from the current level of $9.4 billion.

Uncover how Caterpillar's forecasts yield a $498.48 fair value, a 5% downside to its current price.

Exploring Other Perspectives

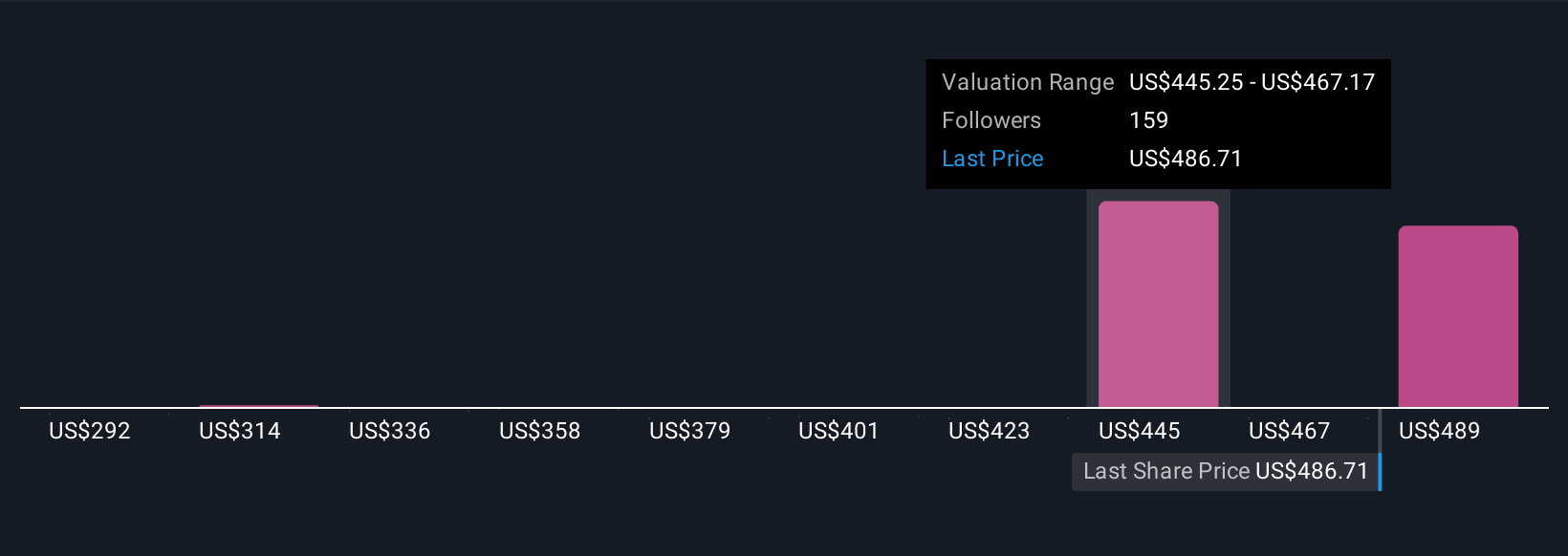

Seventeen members of the Simply Wall St Community estimate Caterpillar’s fair value between US$297.44 and US$512.99. With tariff risks clouding margin prospects, your view on global trade outcomes could make the difference.

Explore 17 other fair value estimates on Caterpillar - why the stock might be worth 44% less than the current price!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives