- United States

- /

- Machinery

- /

- NYSE:CAT

Are Recent Infrastructure Contracts Enough to Justify Caterpillar’s Current Price in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Caterpillar is a smart buy right now? Let’s dig into whether the current price stacks up to its real underlying value.

- After climbing 59.5% year-to-date and delivering an impressive 43.4% return over the last year, Caterpillar’s stock has shown strong momentum. However, the past month saw a modest 2% slip.

- Recently, Caterpillar has made headlines for securing major contracts tied to infrastructure spending and advancing its sustainable machinery lineup. Both developments have kept investor enthusiasm high and contributed to recent price moves.

- On our checklist of six major valuation signals, Caterpillar only scores 1 out of 6 for being undervalued. Let’s explore what the usual and some unconventional valuation methods reveal, and why there might be an even sharper way to understand the stock’s worth by the end of this article.

Caterpillar scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Caterpillar Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model helps estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method aims to provide a realistic view of what the business could be worth if all future growth expectations are met.

For Caterpillar, the latest reported Free Cash Flow is a robust $8.3 billion. Analysts forecast substantial growth, with projections taking Free Cash Flow to approximately $13.9 billion by 2029. Internal estimates suggest further gains to just under $20 billion over the next decade. The first five years of growth estimates are supported by analyst consensus, while projections beyond that are extrapolated to reflect potential long-term trends.

Based on these cash flow projections, the DCF model calculates Caterpillar’s fair value at $548.58 per share. Currently, the market is pricing Caterpillar about 4.6% above this figure, which signals the stock is slightly overvalued when measured strictly by its cash flow outlook.

Result: ABOUT RIGHT

Caterpillar is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Caterpillar Price vs Earnings

For established, profitable companies like Caterpillar, the Price-to-Earnings (PE) ratio is an effective way to gauge whether the stock is trading at a reasonable value. The PE ratio tells investors how much they are paying for each dollar of the company’s current earnings, making it especially relevant when evaluating businesses with strong profit histories.

A company's "normal" or fair PE ratio depends not only on current profits, but also on market expectations for future earnings growth and the level of risk investors perceive. Higher expected growth and lower risk typically justify a higher PE multiple, while low growth or greater risk push this number down.

Caterpillar currently trades on a PE ratio of 29x. To put this in context, the average for the Machinery industry is around 25x, while key peers average approximately 22x. At first glance, Caterpillar’s premium might seem high, but raw comparisons can miss crucial nuances like the company's scale, growth trajectory, and financial strength.

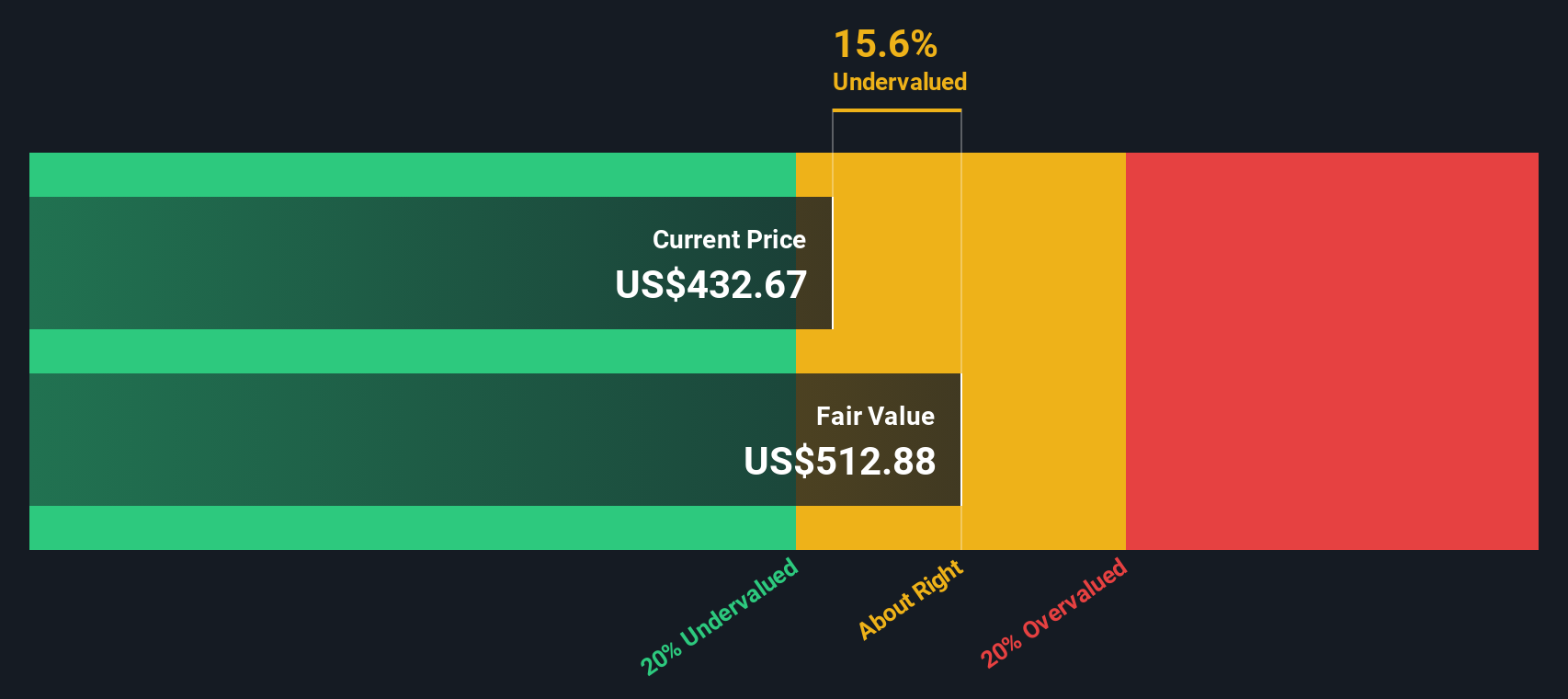

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio for Caterpillar is calculated at 41x, reflecting factors such as its future earnings growth, profit margin resilience, industry position, and market capitalization. Unlike simple industry or peer averages, the Fair Ratio is tailored to each company and gives investors a much richer perspective on what the multiple should be given all these dynamics.

Since Caterpillar’s current PE of 29x is well below its Fair Ratio of 41x, this suggests the market is undervaluing the company's fundamental strengths and growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Caterpillar Narrative

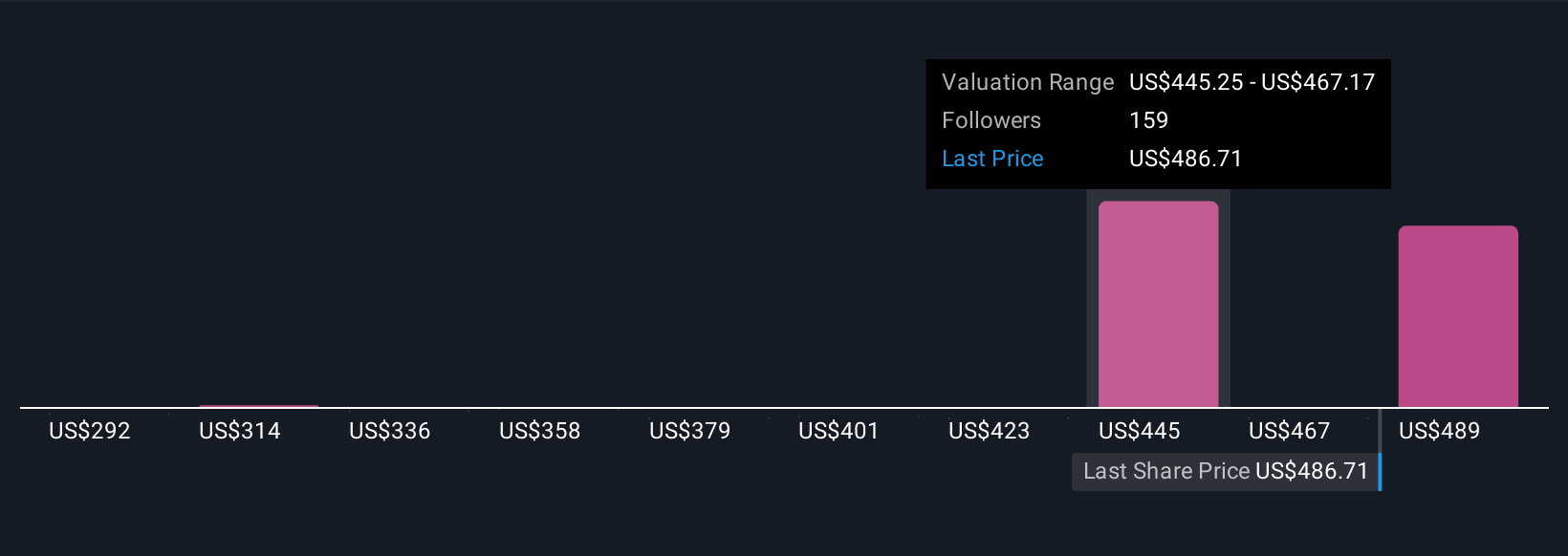

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let you shape your view of Caterpillar by connecting your own story about the company, including how you see its prospects, risks, and future catalysts, with real forecasts and fair value calculations. Rather than relying on a single number, Narratives help you visualize how your expectations for future revenue, margins, and earnings flow through to a price you believe is fair.

On Simply Wall St's Community page, Narratives are easy to use and enable millions of investors to compare their perspectives, update them with the latest news or earnings, and see how fair value changes as the facts evolve. When new information hits, such as a surprise order backlog or tariff update, Narratives quickly reflect how these factors alter the outlook, letting you decide if the current price justifies buying, holding, or selling.

For example, some users believe Caterpillar's strong global demand and margin expansion could justify a fair value near $588 per share, while others see risks from tariffs and assign a value closer to $350. Narratives make it simple and dynamic to map your view to a price, so you can upgrade your investment decision-making in real time.

Do you think there's more to the story for Caterpillar? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.