- United States

- /

- Machinery

- /

- NYSE:CAT

A Fresh Look at Caterpillar (CAT) Valuation as AI Data Centers Power New Growth Narrative

Reviewed by Kshitija Bhandaru

Caterpillar, a U.S. industrial giant, is drawing increased attention as demand for its turbines climbs as a result of the rapid expansion of AI-powered data centers. Investors see this as a meaningful new growth path for the company.

See our latest analysis for Caterpillar.

Caterpillar shares have been on an impressive upward run, propelled lately by optimism around its power-generation business as AI data centers ramp up demand, and supported by steady revenue from its expanding services segment. While recent ESG-driven divestments grabbed headlines, investor focus has remained fixed on long-term opportunities. The company’s one-year total shareholder return of 27% shows solid momentum, with performance outpacing the broader market and signaling confidence that these new growth drivers could have staying power.

If news about Caterpillar’s AI tailwinds interests you, now is a great time to discover other fast movers. Broaden your search and explore fast growing stocks with high insider ownership.

The question now is whether Caterpillar’s current rally reflects a still-undervalued growth story, or if the market has already accounted for its AI-driven upside and left little room for further gains ahead.

Most Popular Narrative: 6.9% Overvalued

Measured against the widely referenced narrative, Caterpillar's fair value is pegged at $458.91, compared to a last close of $490.57. That signals the narrative sees the shares modestly above what the company’s fundamentals and future prospects justify, setting up a debate about what is priced in.

Record backlog growth across all three primary segments, driven by strong global infrastructure demand (particularly in North America, Africa, and the Middle East), positions Caterpillar for above-trend sales growth in late 2025 and into 2026, supporting top-line revenue expansion.

Curious how analysts arrive at this punchy valuation? Their thesis hinges on a major infrastructure pipeline and bullish estimates for future sales and profit margins. But what are the surprising assumptions underneath? Find out what really fuels their confidence in the premium price target.

Result: Fair Value of $458.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff headwinds and unpredictable pricing dynamics could act as catalysts that challenge even this optimistic growth trajectory for Caterpillar.

Find out about the key risks to this Caterpillar narrative.

Another View: What Does Our DCF Model Say?

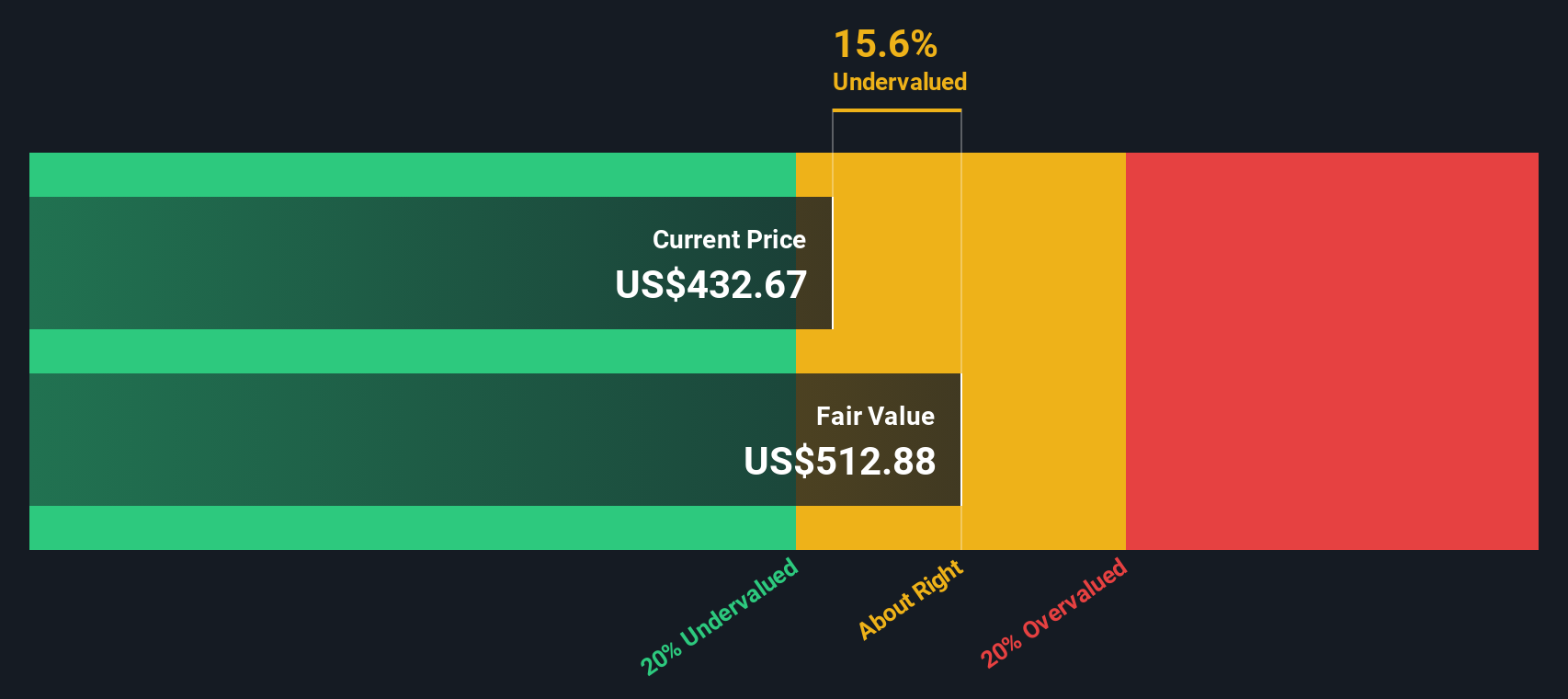

While the consensus valuation points to Caterpillar being overvalued, our SWS DCF model provides a different angle. According to this approach, the stock is trading about 5% below our estimate of fair value at $516.63, suggesting there may still be some upside potential. Could the market be missing something, or is this simply a case of differing assumptions playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Caterpillar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Caterpillar Narrative

If you want to dig deeper or weigh your own evidence differently, you can easily put together your own Caterpillar investment case in just minutes, and Do it your way.

A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stick to just one opportunity when smart investors are tracking trends across the market? Your next winning investment could be hiding just out of view. Use these targeted shortlists to get an edge:

- Capitalize on the momentum in artificial intelligence by checking out these 23 AI penny stocks, sparking innovation and redefining entire industries.

- Unlock reliable income streams by targeting these 19 dividend stocks with yields > 3% for stable yields that can enhance your portfolio’s cash flow.

- Get ahead of the curve with these 26 quantum computing stocks, uncovering companies at the forefront of groundbreaking quantum breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives