- United States

- /

- Aerospace & Defense

- /

- NYSE:BWXT

Assessing BWXT’s Valuation After 77% Surge and Record Nuclear Contract Wins

Reviewed by Bailey Pemberton

If you’ve been watching BWX Technologies lately, you’re probably asking the question that’s on a lot of investors’ minds: is this the right moment to jump in, hold tight, or turn cautious? The stock has grabbed headlines with a robust 76.7% year-to-date return and a one-year climb of nearly 68%. Even just this past month, shares rocketed up by more than 20%. It’s clear that market sentiment has shifted, and a series of sector tailwinds such as increasing demand for nuclear energy and global security concerns have played a role in boosting investor confidence.

With all that momentum, it’s no wonder people wonder if BWX Technologies still has room to run or if it’s sitting at a lofty plateau. That’s where the numbers matter. When we look at valuation and consider how much you’re paying compared to what you’re getting, the company recently scored a 0 out of 6 on our value checklist. In other words, by the standard metrics, BWX Tech isn’t undervalued in any major category right now. But does that tell the whole story?

Next, we’ll dig into each approach to valuation to see what’s driving that score and how traditional methods stack up. And stick around, because there’s an even better way to make sense of a stock’s worth that you won’t want to miss.

BWX Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BWX Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation approach that estimates what a company is worth today based on its predicted future cash flows. These cash flows are projected and then discounted back to their present value. Essentially, it tries to answer this: given all the money BWX Technologies might generate in the coming years, what is that stream of cash worth right now?

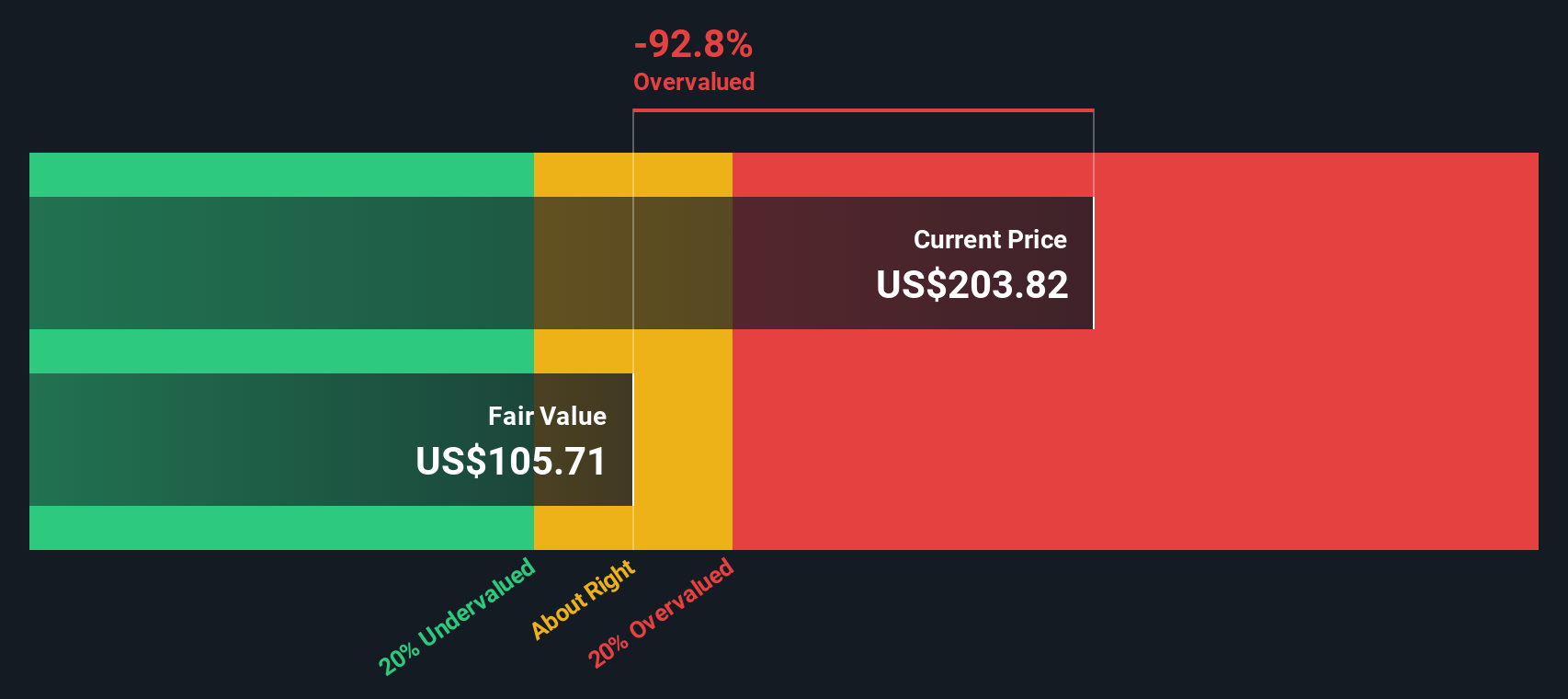

BWX Technologies' most recent reported Free Cash Flow (FCF) stands at $344.8 Million. Analyst forecasts and further extrapolations see this figure rising steadily, with projected FCF reaching $633.4 Million ten years from now. While only five years of actual analyst estimates are available, longer-range projections are based on established forecasting models that extend these trends using reasonable growth rates. All cash flows are denominated in US dollars.

When these projected cash flows are all tallied up and discounted accordingly, the DCF model calculates an intrinsic value for BWX Technologies of $105.02 per share. However, with the current share price running significantly higher, this model suggests the stock is about 87.6% overvalued according to today's assumptions and projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BWX Technologies may be overvalued by 87.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BWX Technologies Price vs Earnings

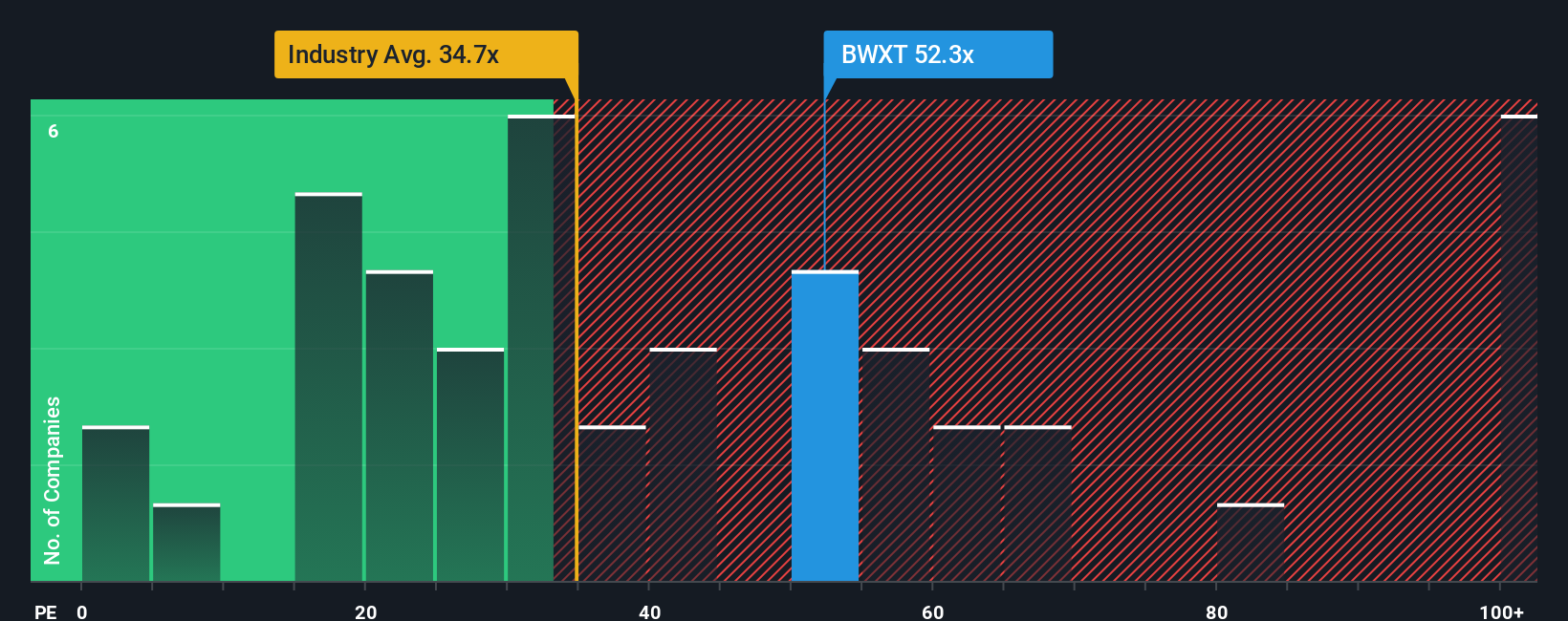

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies like BWX Technologies because it relates a company’s share price directly to its earnings. For businesses generating consistent profits, the PE ratio helps investors gauge how much they’re paying for each dollar of earnings, making it a key indicator of whether a stock is expensive or a bargain.

What counts as a “normal” or “fair” PE depends heavily on growth prospects and risk. Generally, higher expected growth or lower risk justifies a higher PE, while slower growth or greater uncertainty pushes it down. For BWX Technologies, the current PE ratio stands at 61.17x, which is well above the Aerospace & Defense industry average of 39.35x and higher than the peer group average of 38.15x.

To dig deeper, Simply Wall St offers a proprietary “Fair Ratio” for each company, which is 30.04x for BWX Technologies. This Fair Ratio doesn’t just look at industry norms or what competitors command; it factors in the company’s own earnings growth, risk profile, profit margins, market capitalization and more. That means it offers a much more specific benchmark for what investors should be willing to pay given BWX Technologies' unique strengths and risks.

Comparing the Fair Ratio to the company’s actual PE shows BWX Technologies trading well above this custom benchmark. This suggests the stock appears overvalued using the price-to-earnings approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BWX Technologies Narrative

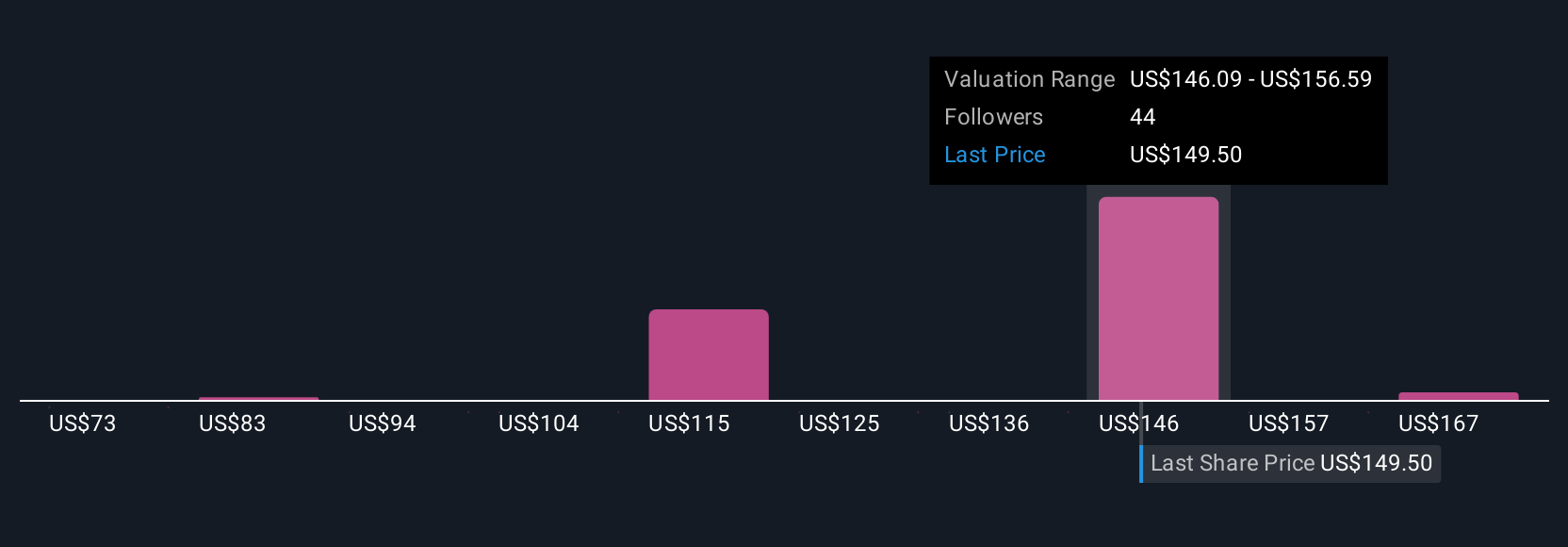

Earlier we mentioned that there is an even better way to understand a stock’s worth, so let’s introduce you to Narratives, a powerful tool designed to bridge the gap between the numbers and the story behind a company. A Narrative is your personal perspective on BWX Technologies. This allows you to combine your own assumptions about future growth, margins, and risks with a reasoned financial forecast to produce a unique fair value. By linking the story you believe in to clear numbers, Narratives make investment decisions far more actionable and transparent.

On Simply Wall St’s Community page, millions of investors use Narratives to openly share their outlook and instantly compare their Fair Value with the current share price. Since Narratives update automatically as new earnings or news stories appear, your views adapt automatically. No spreadsheets, just clarity. For example, some investors see strong long-term government contracts and defense sector monopolies driving fair values as high as $220 per share. Others, cautious about valuation and growth risks, value BWX Technologies closer to $120. Narratives help you see both sides so you can decide when the price is right for your goals.

For BWX Technologies, however, we'll make it really easy for you with previews of two leading BWX Technologies Narratives:

- 🐂 BWX Technologies Bull Case

Fair Value: $220.00

Current price is approximately 10.5% above fair value

Assumed Revenue Growth Rate: 16.45%

- Government nuclear contracts and the company’s dominant position in SMRs (small modular reactors) are viewed as long-term growth drivers, bolstered by US and Canadian policy support.

- Recent acquisitions (Aerojet Ordinance Tennessee and Kinectrics) are seen as strategic for expansion and revenue diversification, with positive impacts expected over the coming years.

- Key risks include potential cuts to US defense and nuclear infrastructure spending, regulatory changes, and persistent public concerns over nuclear safety slowing sector growth.

- 🐻 BWX Technologies Bear Case

Fair Value: $190.00

Current price is approximately 3.7% above fair value

Assumed Revenue Growth Rate: 11.15%

- Recurring defense contracts, a strong $6 billion backlog, and exposure to advanced nuclear technologies are seen as supportive of future revenue and margin growth.

- Risks revolve around heavy dependence on government contracts, potential for margin compression from commercial operations, and talent or supply chain constraints impacting long-term profitability.

- The narrative notes that at current valuations, especially relative to earnings and cash flow, upside is limited and the stock may be priced for perfection.

Do you think there's more to the story for BWX Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWX Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BWXT

BWX Technologies

Manufactures and sells nuclear components in the United States, Canada, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives