- United States

- /

- Building

- /

- NYSE:BLDR

We Ran A Stock Scan For Earnings Growth And Builders FirstSource (NYSE:BLDR) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Builders FirstSource (NYSE:BLDR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Builders FirstSource with the means to add long-term value to shareholders.

See our latest analysis for Builders FirstSource

How Fast Is Builders FirstSource Growing Its Earnings Per Share?

Over the last three years, Builders FirstSource has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Builders FirstSource's EPS shot from US$8.55 to US$19.92, over the last year. Year on year growth of 133% is certainly a sight to behold.

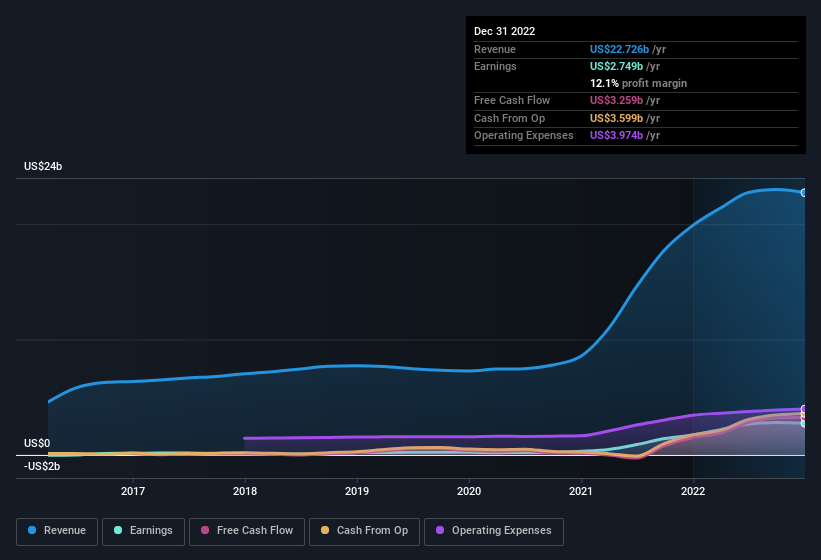

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Builders FirstSource shareholders can take confidence from the fact that EBIT margins are up from 12% to 17%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Builders FirstSource's future EPS 100% free.

Are Builders FirstSource Insiders Aligned With All Shareholders?

Since Builders FirstSource has a market capitalisation of US$12b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. We note that their impressive stake in the company is worth US$225m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Builders FirstSource To Your Watchlist?

Builders FirstSource's earnings have taken off in quite an impressive fashion. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering Builders FirstSource for a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Builders FirstSource (1 can't be ignored) you should be aware of.

Although Builders FirstSource certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Builders FirstSource might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BLDR

Builders FirstSource

Manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives