- United States

- /

- Electrical

- /

- NYSE:BE

Can Bloom Energy’s (BE) AI Data Center Strategy Strengthen Its Long-Term Competitive Position?

Reviewed by Simply Wall St

- Bloom Energy recently presented at SEMICON India 2025 in New Delhi, with CEO K. R. Sridhar highlighting the company's clean power offerings for AI-driven data centers and distributed energy needs.

- This event emphasizes Bloom Energy's expanding international profile and increasing relevance in meeting the rising global demand for resilient, on-site clean energy solutions.

- We'll now examine how Bloom's focus on AI-powered data center demand could influence its investment narrative and future growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Bloom Energy Investment Narrative Recap

To be a Bloom Energy shareholder, you need to believe that accelerating demand for clean, resilient power from AI-driven data centers will continue, and that the company can deliver reliable, scalable solutions faster than competing technologies. While the recent SEMICON India presentation highlights Bloom’s global ambitions, it does not materially alter the immediate importance of securing more hyperscaler partnerships or the ongoing risk that advances in competing zero-emission energy sources could challenge Bloom’s natural gas-based positioning.

Among recent announcements, Bloom’s Oracle Cloud partnership is particularly relevant, solidifying its position as a go-to provider for data center power, an area closely tied to the hype seen at SEMICON. This tie-up directly supports a major business catalyst, as real-world deployments with hyperscale clients could accelerate both adoption rates and earnings stability, helping to offset near-term market volatility and valuation debate for many investors.

Yet, for all the growth potential, investors should be aware that if zero-emission technologies make faster-than-expected gains in performance or cost…

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's narrative projects $2.7 billion in revenue and $395.4 million in earnings by 2028. This requires 19.0% yearly revenue growth and a $371.7 million earnings increase from $23.7 million today.

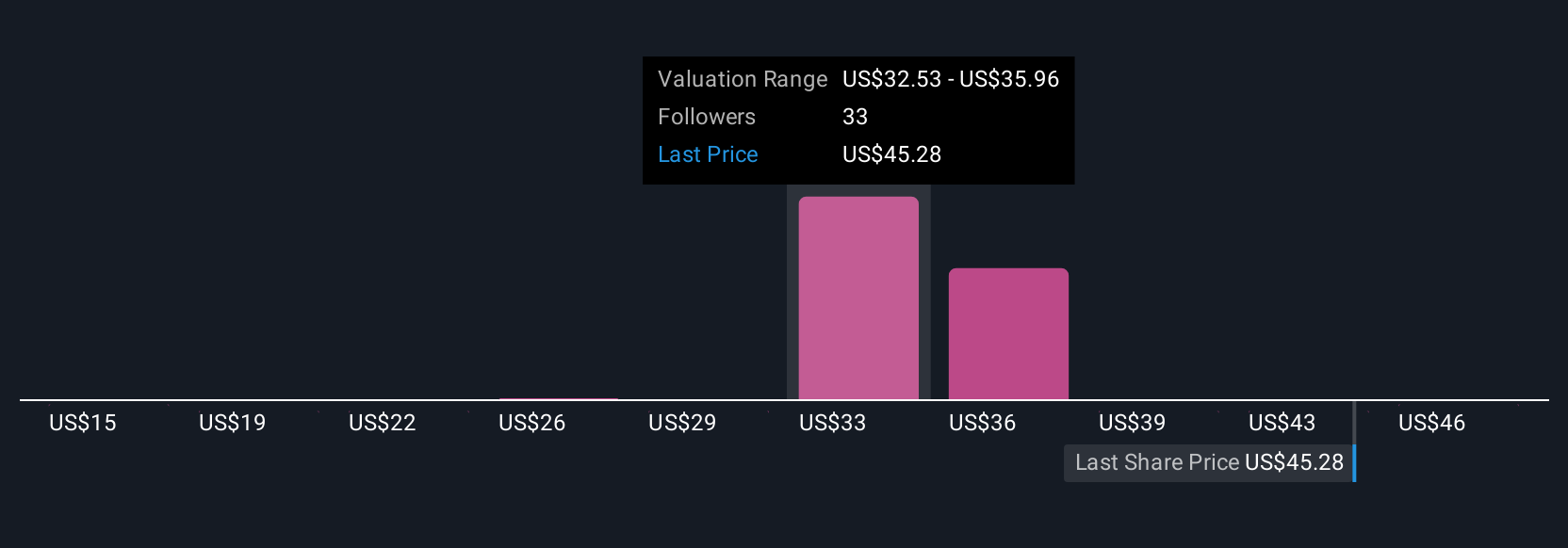

Uncover how Bloom Energy's forecasts yield a $34.77 fair value, a 39% downside to its current price.

Exploring Other Perspectives

Seven individual fair value estimates from the Simply Wall St Community for Bloom Energy range widely from US$15.38 up to US$58.93. These diverse views exist alongside optimism about growing cloud data center demand, but fast-moving rivals could still reshape the outlook ahead; explore more community perspectives to see how views compare.

Explore 7 other fair value estimates on Bloom Energy - why the stock might be worth as much as $58.93!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026