- United States

- /

- Electrical

- /

- NYSE:BE

Bloom Energy (NYSE:BE) shareholders are still up 276% over 3 years despite pulling back 12% in the past week

Bloom Energy Corporation (NYSE:BE) shareholders have seen the share price descend 17% over the month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In fact, the share price is up a full 276% compared to three years ago. It's not uncommon to see a share price retrace a bit, after a big gain. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

See our latest analysis for Bloom Energy

Bloom Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Bloom Energy's revenue trended up 14% each year over three years. That's pretty nice growth. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 55% per year over three years. The business has made good progress on the top line, but the market is extrapolating the growth. It would be worth thinking about when profits will flow, since that milestone will attract more attention.

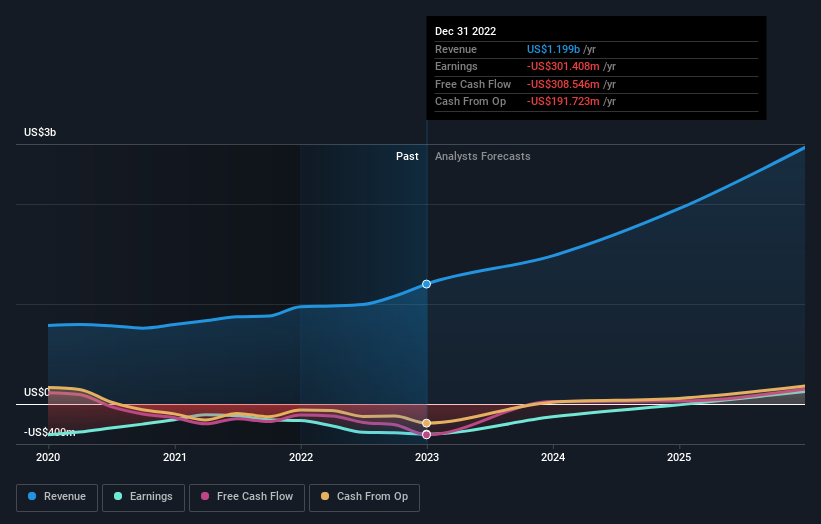

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Bloom Energy is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Bloom Energy in this interactive graph of future profit estimates.

A Different Perspective

Bloom Energy shareholders may not have made money over the last year, but their total loss of 3.5% isn't as bad as the market loss of around 3.5%. Shareholders who have held for three years might be relatively sanguine about the recent weakness, given they have made 55% per year for three years. It's possible that the recent share price decline has more to do with the negative broader market returns than any company specific development. It's always interesting to track share price performance over the longer term. But to understand Bloom Energy better, we need to consider many other factors. Even so, be aware that Bloom Energy is showing 2 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives