- United States

- /

- Industrials

- /

- NYSE:BBUC

Brookfield Business (NYSE:BBUC) Has Affirmed Its Dividend Of $0.0625

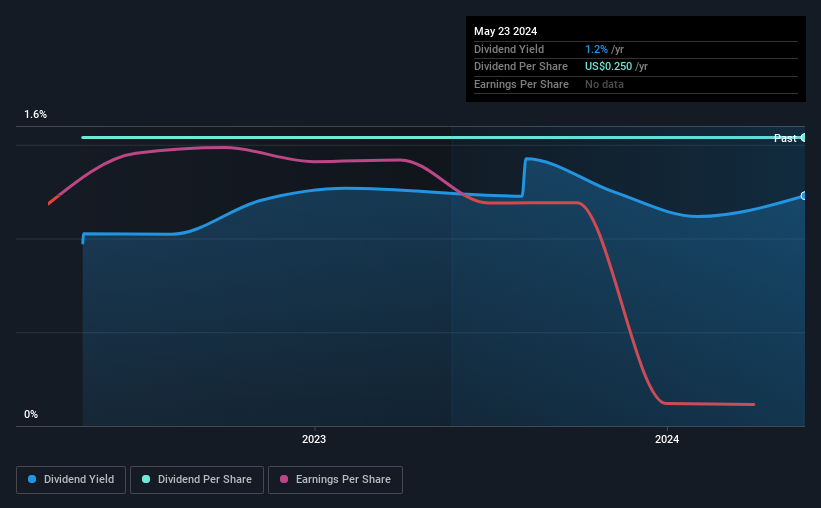

Brookfield Business Corporation's (NYSE:BBUC) investors are due to receive a payment of $0.0625 per share on 28th of June. This means the annual payment will be 1.2% of the current stock price, which is lower than the industry average.

View our latest analysis for Brookfield Business

Brookfield Business Might Find It Hard To Continue The Dividend

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Even in the absence of profits, Brookfield Business is paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Over the next year, EPS could fall pretty quickly unless something improves in the business. This could mean that the management team has to make some tough choices about cutting the dividend or putting extra pressure on the balance sheet.

Brookfield Business Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 2 years, which isn't that long in the grand scheme of things. The most recent annual payment of $0.25 is about the same as the annual payment 2 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the last year, Brookfield Business' EPS has fallen by 692%. Such a large drop can indicate that the business has run into some trouble and might end up in the dividend having to be reduced. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

We're Not Big Fans Of Brookfield Business' Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Brookfield Business that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Business might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBUC

Brookfield Business

Owns and operates services and industrials operations in the United States, Australia, Brazil, the United Kingdom, and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives