- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Is Boeing’s Recent 18% Rally Justified by Its Cash Flow and Sales Valuation?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Boeing is finally trading at a price that actually makes sense after years of turbulence, you are not alone. This article is here to unpack exactly that.

- After climbing 8.4% over the last week and 17.8% year to date, Boeing shares sit around $202.54, even though the 5 year return is still down 12.7%. This hints that the market might be rethinking the company’s future.

- Much of this shift in sentiment ties back to ongoing progress in resolving safety and regulatory issues, alongside renewed optimism around long term demand for commercial aircraft as airlines refresh fleets and global travel continues to recover. At the same time, Boeing’s defense and space contracts have kept it central to US and allied government spending plans and this provides a strategic backdrop to the stock’s recent moves.

- Right now, Boeing earns a valuation score of 6/6 on our checklist of under or overvaluation signals. Next, we will walk through the key valuation approaches behind that score before exploring an additional way to think about what the stock is really worth.

Approach 1: Boeing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back into today’s dollars, aiming to estimate what the whole business is worth right now. For Boeing, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

Today, Boeing is still burning cash, with last twelve month free cash flow around $5.9 Billion in the red. Analysts expect this to swing strongly positive over the next few years, with projected free cash flow climbing into the low tens of Billions. By 2029, Simply Wall St’s model, which extends analyst forecasts out to 10 years, estimates free cash flow of about $11.6 Billion, with later years continuing to grow but at a slowing pace.

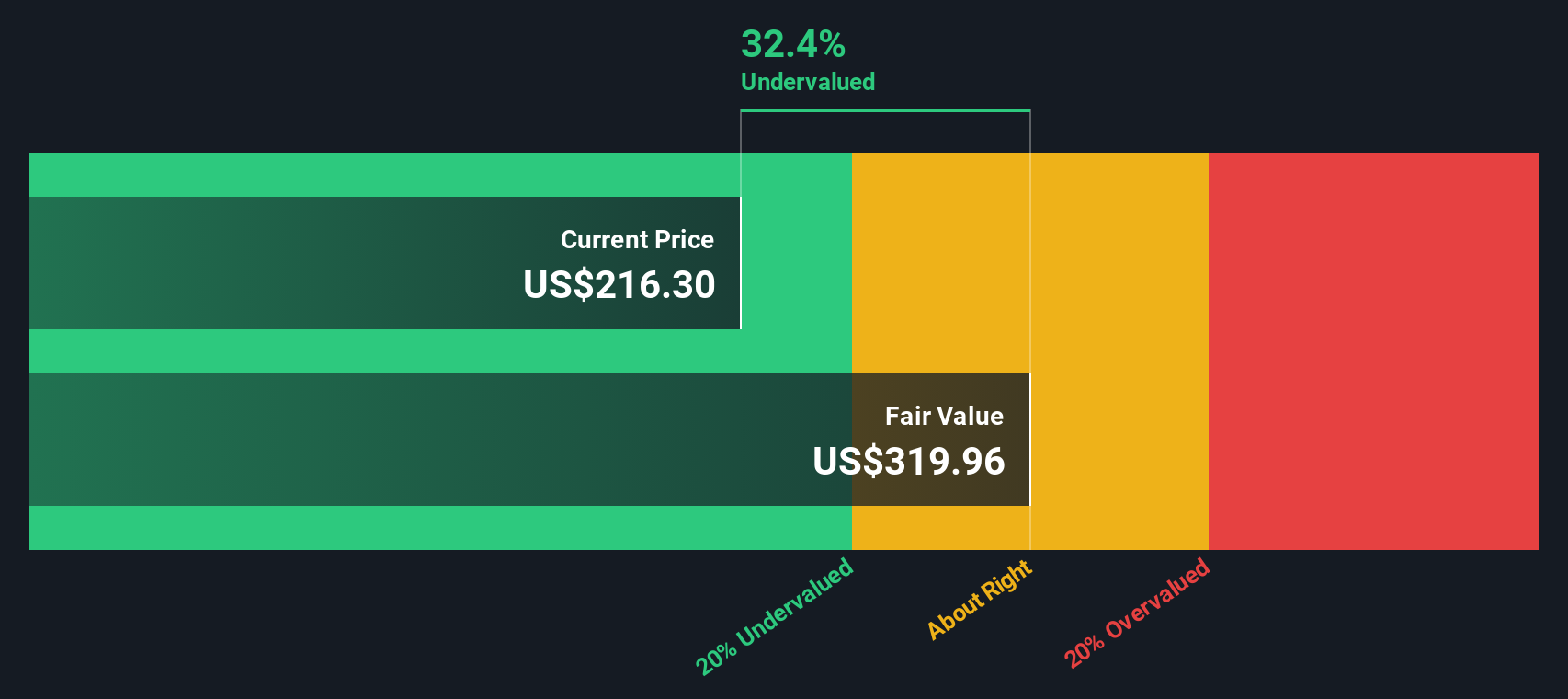

When all those projected cash flows are discounted back, the intrinsic value comes out at roughly $300.39 per share, compared with the current share price near $202. This implies Boeing is about 32.6% undervalued based on cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boeing is undervalued by 32.6%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Boeing Price vs Sales

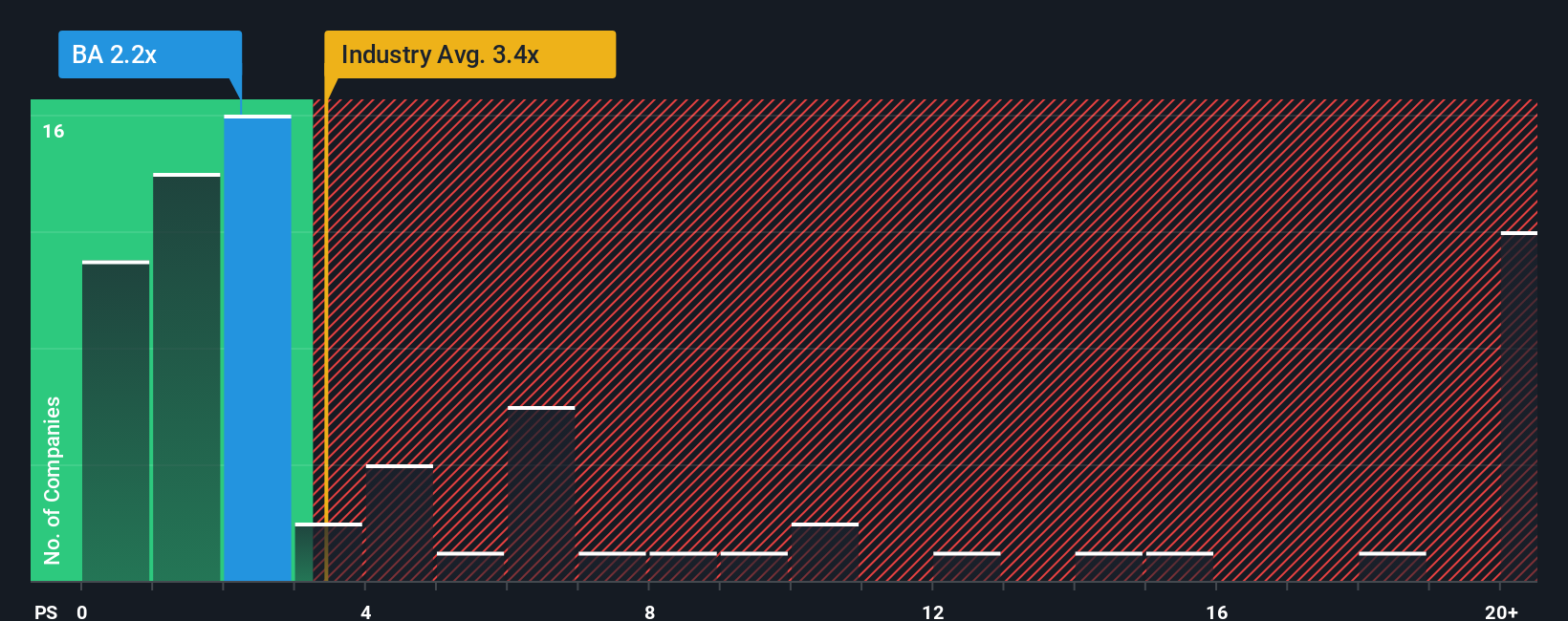

For companies like Boeing that are still rebuilding profitability, the price to sales ratio is a useful way to value the business because it focuses on revenue, which tends to be more stable than earnings during a turnaround. Investors usually expect higher growth and lower risk to justify a higher multiple, while slower growth or greater uncertainty tends to pull a normal or fair price to sales ratio down.

Boeing currently trades on a price to sales ratio of 1.91x, which is slightly below both the Aerospace and Defense industry average of 3.02x and the peer average of 1.93x. Simply Wall St also calculates a Fair Ratio of 2.07x for Boeing, which is the multiple the company might reasonably trade at given its growth outlook, margins, industry positioning, market cap and risk profile.

This Fair Ratio is more informative than simple peer or industry comparisons because it adjusts for Boeing’s specific fundamentals rather than assuming all companies deserve the same multiple. With the current 1.91x price to sales ratio sitting below the 2.07x Fair Ratio, Boeing appears modestly undervalued on this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

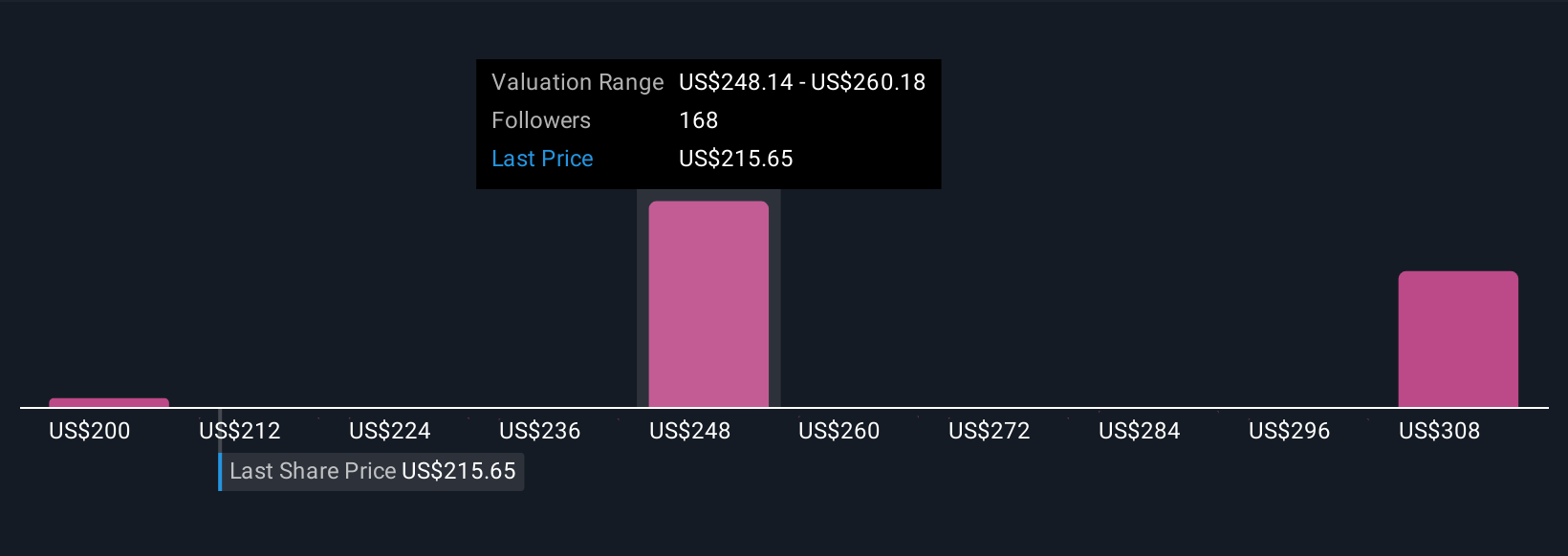

Upgrade Your Decision Making: Choose your Boeing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Boeing’s story with concrete numbers like future revenue, earnings, margins and a fair value estimate. A Narrative on Simply Wall St’s Community page is your own storyline for the company, translated into a financial forecast and then into a Fair Value that you can compare to the current share price to inform your decision to buy, hold or sell. Because Narratives are updated dynamically as new news, earnings and guidance arrive, they stay relevant rather than going stale. For Boeing, one investor might build a bullish Narrative around accelerating 737 MAX production, expanding defense contracts and mid teens revenue growth that supports a Fair Value closer to the higher analyst targets. Another might focus on execution risks, debt and thinner margins that justify a Fair Value nearer the lowest estimates. Seeing those different Narratives side by side helps you decide which story, and which price, you actually find more compelling.

Do you think there's more to the story for Boeing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026