- United States

- /

- Aerospace & Defense

- /

- NYSE:BA

Is Boeing Still a Turnaround Opportunity After Its 2025 Recovery Rally?

Reviewed by Bailey Pemberton

- Wondering if Boeing at around $198 is still a turnaround story worth backing or if the easy money has already been made? This breakdown will walk you through what the current price is really baking in.

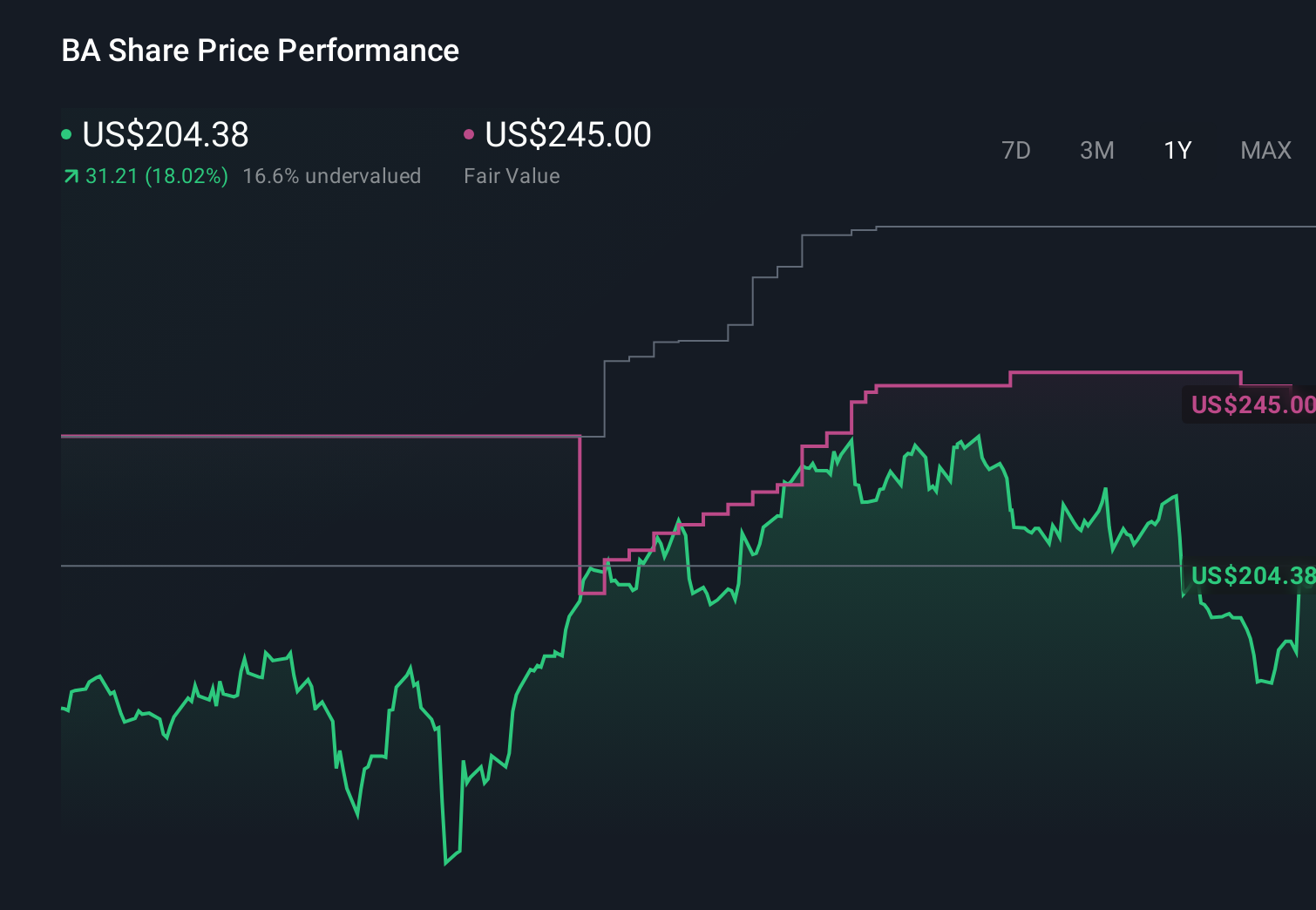

- Despite a bumpy ride with a 1-week return of -1.9% and a flat-ish 2.0% over 30 days, the stock is still up 15.6% year to date and 19.7% over the last year. This hints that sentiment has quietly shifted even though the 5-year return is still -12.0%.

- Recent headlines have centered on Boeing's efforts to stabilize its production pipeline, regain regulator and airline confidence, and secure new commercial and defense orders. All of these directly affect how investors price future cash flows and risk. At the same time, ongoing safety scrutiny and program delays remain in focus, reminding the market that this is still very much a recovery thesis rather than a finished turnaround.

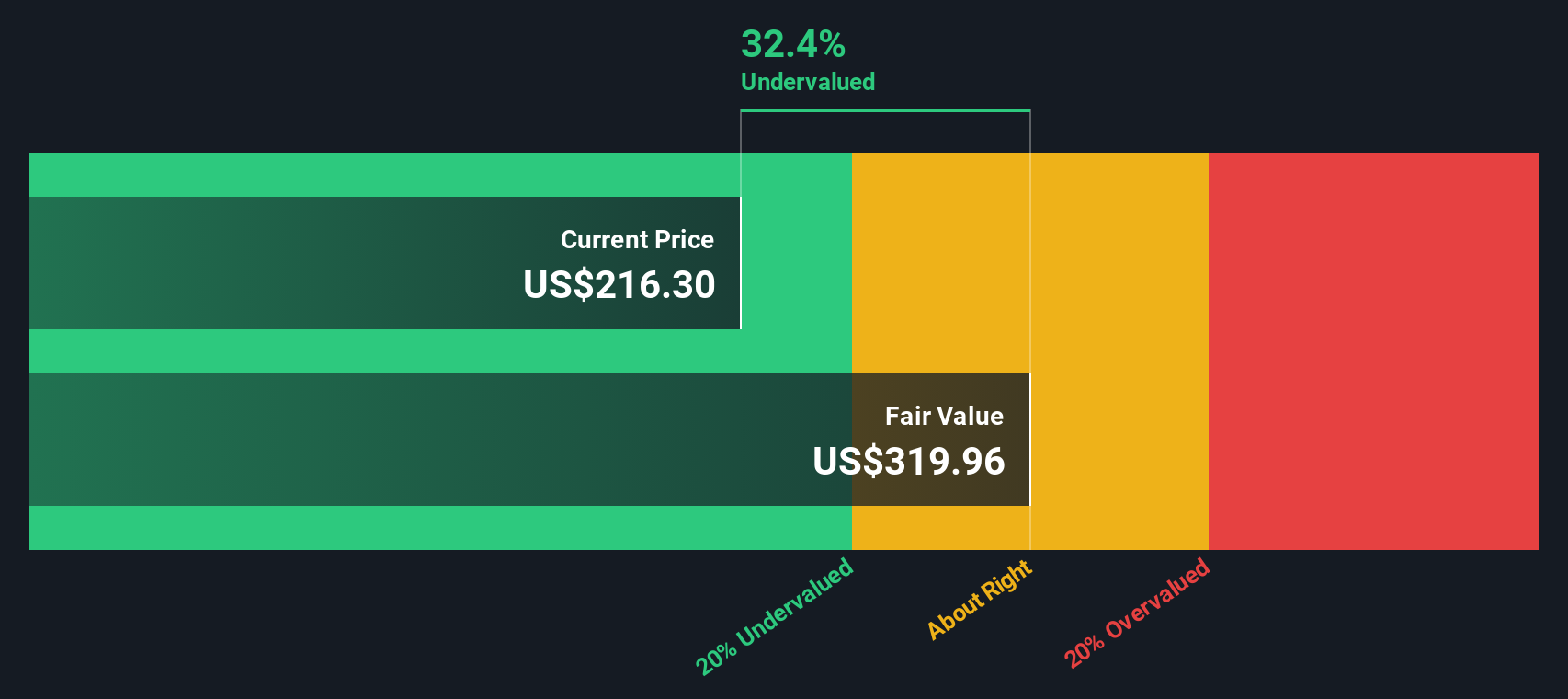

- On our framework Boeing currently scores a 6 out of 6 valuation check score, suggesting it screens as undervalued across every key test we run. Next, we will unpack what that means using multiple valuation approaches while also flagging a more powerful way to think about fair value later in the article.

Find out why Boeing's 19.7% return over the last year is lagging behind its peers.

Approach 1: Boeing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present. For Boeing, the model used is a 2 stage Free Cash Flow to Equity approach, built on cash flow projections in $.

Right now, Boeing is still burning cash, with last twelve month free cash flow at roughly $5.9 Billion negative, which reflects the depth of its recovery phase. Analysts expect this to swing strongly into positive territory over the coming years, with free cash flow projected to reach about $11.6 Billion by 2029. Beyond the explicit analyst window, Simply Wall St extrapolates cash flows out to 10 years and tapers growth as the business matures.

When all of those projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $301 per share. Compared with the current price near $198, that implies the stock trades at roughly a 34.0% discount to its DCF estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boeing is undervalued by 34.0%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

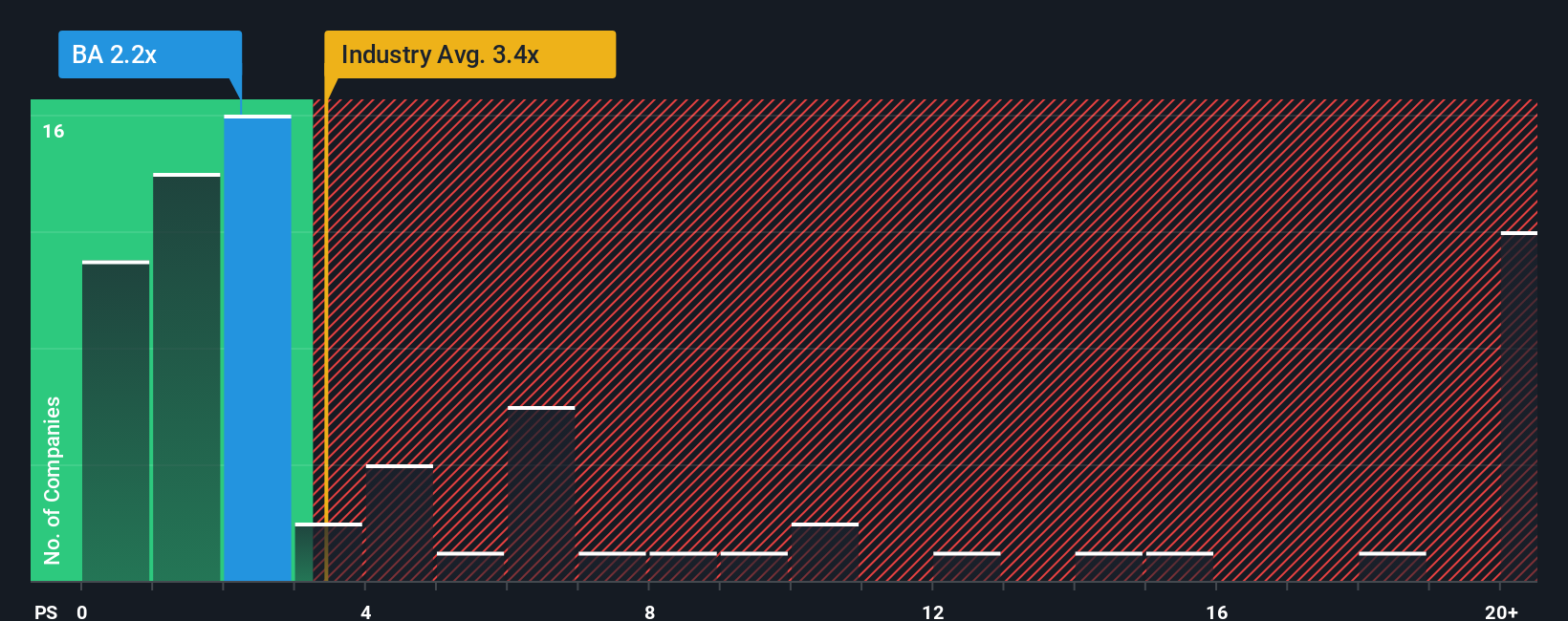

Approach 2: Boeing Price vs Sales

For companies like Boeing that are not yet consistently profitable, Price to Sales is often a more reliable yardstick because it focuses on the revenue base the business is rebuilding rather than volatile or negative earnings. Investors typically accept a higher or lower sales multiple depending on how fast that revenue is expected to grow and how risky the turnaround looks.

Boeing currently trades on a Price to Sales ratio of about 1.87x, which is slightly below both the Aerospace and Defense industry average of roughly 3.10x and the peer group average near 1.98x. Simply Wall St also calculates a proprietary Fair Ratio for Boeing of around 2.05x. This is the sales multiple you might expect given its growth outlook, margins, scale, industry and risk profile. Because this Fair Ratio is built on Boeing specific fundamentals rather than simple comparisons, it can provide a more nuanced anchor than raw peer or sector averages.

With the current 1.87x multiple sitting below the 2.05x Fair Ratio, Boeing still screens as modestly undervalued on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boeing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple, story driven investment cases you or other investors build on Simply Wall St's Community page by linking a view of Boeing's future revenue, earnings and margins to a forecast, a fair value, and ultimately a buy or sell decision that updates automatically as new news or earnings arrive. This allows, for example, one investor to create a bullish Boeing Narrative built around accelerating defense contracts, rising output and a fair value closer to the most optimistic analyst target near $287. Another investor might build a more cautious Narrative that leans on execution and balance sheet risks to arrive at a fair value closer to the lowest target near $150. By comparing each Narrative's Fair Value with Boeing's current share price, you can quickly see which story you believe and whether the stock looks priced for upside, downside, or something in between.

Do you think there's more to the story for Boeing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boeing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BA

Boeing

Designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026