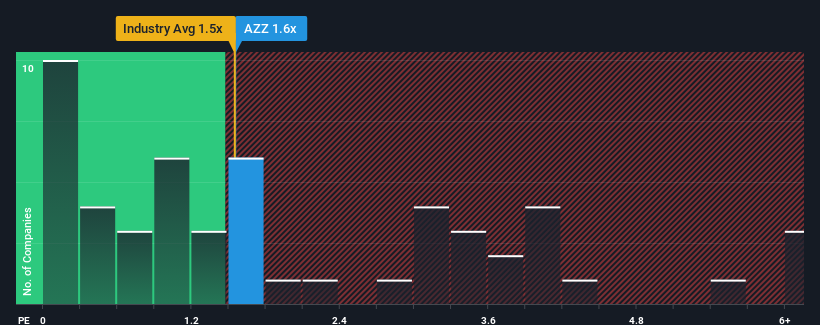

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Building industry in the United States, you could be forgiven for feeling indifferent about AZZ Inc.'s (NYSE:AZZ) P/S ratio of 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for AZZ

What Does AZZ's Recent Performance Look Like?

There hasn't been much to differentiate AZZ's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AZZ.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like AZZ's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 4.4% as estimated by the seven analysts watching the company. With the industry predicted to deliver 5.7% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that AZZ's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On AZZ's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that AZZ maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 4 warning signs for AZZ (1 is a bit concerning!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AZZ

AZZ

Provides hot-dip galvanizing and coil coating solutions in North America.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives