- United States

- /

- Aerospace & Defense

- /

- NYSE:ATI

Will ATI's (ATI) Trigger Shell Innovation Reinforce Its Case for Sustainable Earnings and Sector Leadership?

Reviewed by Sasha Jovanovic

- ATI recently introduced lightweight Trigger Shells designed to integrate with its 7-inch, three-ring Super Dampers, offering enhanced crank signal solutions for modern ECUs and expanded compatibility options for various engine management systems.

- This product launch comes as investors anticipate ATI's upcoming October 28, 2025 earnings release, where forecasts suggest a 25% year-over-year increase in earnings per share and revenue growth amid attractive valuation metrics.

- We'll explore how expectations for strong earnings growth and a favorable industry valuation shape ATI's overall investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

ATI Investment Narrative Recap

To be an ATI shareholder, you have to believe in the company's long-term ability to deliver high-margin growth through aerospace contracts and specialty alloy innovation, despite its cyclical exposure outside aerospace and renewed supply chain challenges. The latest lightweight Trigger Shells product launch is unlikely to overshadow the upcoming earnings release, which remains the key near-term catalyst as investors weigh forecasts of strong EPS and revenue growth against ongoing risks like industrial end-market softness.

Of particular relevance is the recent multi-year titanium supply agreement with Airbus, which reinforces ATI’s position in commercial aerospace and supports the volume growth underpinning current earnings forecasts. This type of contract directly aligns with investors’ focus on predictable revenue and margin streams, especially as sector valuations remain attractive relative to peers.

By contrast, investors should be conscious of ongoing concentration risks tied to large aerospace OEMs, as shifting customer priorities could quickly change ATI’s outlook if ...

Read the full narrative on ATI (it's free!)

ATI's outlook forecasts $5.5 billion in revenue and $635.6 million in earnings by 2028. This reflects annual revenue growth of 6.7% and an earnings increase of $218.1 million from the current earnings of $417.5 million.

Uncover how ATI's forecasts yield a $102.43 fair value, a 22% upside to its current price.

Exploring Other Perspectives

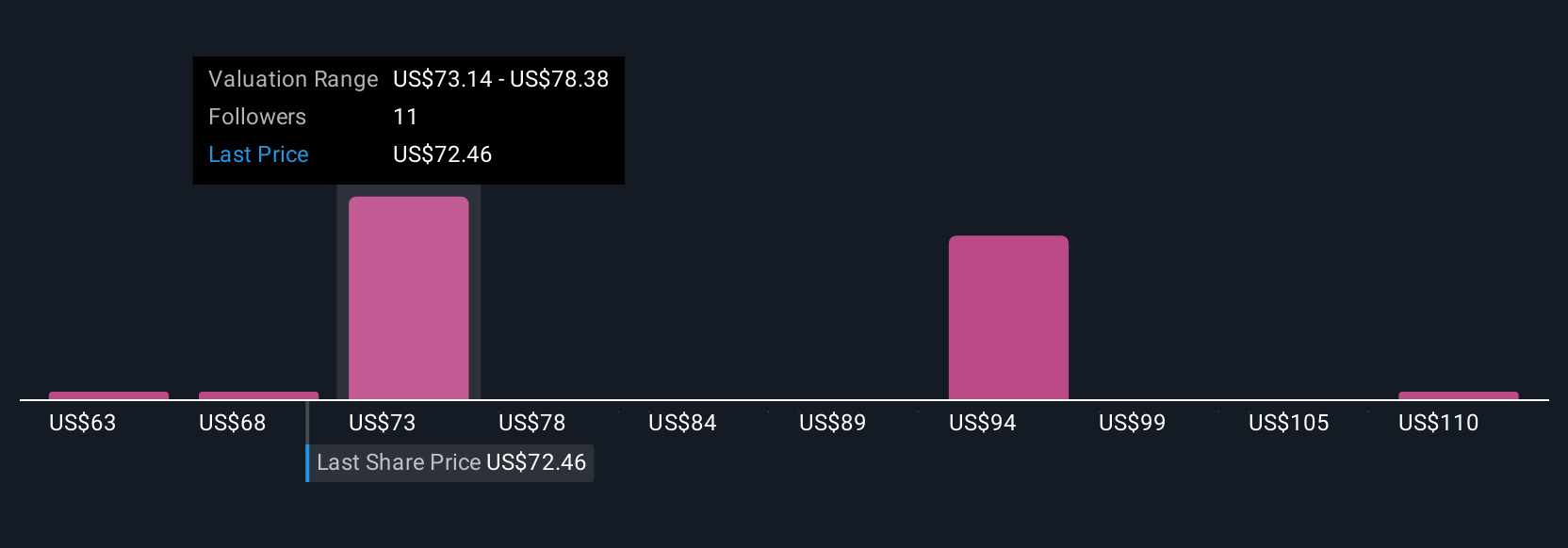

Five fair value estimates from the Simply Wall St Community span a wide range from US$62.68 to US$115 per share. While opinions differ, major long-term supply contracts with Boeing and Airbus remain a factor that could influence ATI's resilience beyond short-term earnings updates.

Explore 5 other fair value estimates on ATI - why the stock might be worth 25% less than the current price!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATI

ATI

Produces and sells specialty materials and complex components worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives