- United States

- /

- Construction

- /

- NYSE:AMRC

Ameresco (AMRC) Is Up 9.0% After Securing $197M Navy Deal and Chicago Project Wins – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this month, Ameresco announced a US$197 million Energy Savings Performance Contract with the U.S. Naval Research Laboratory to modernize infrastructure, alongside completing a multi-phase building optimization project with the Art Institute of Chicago enhancing building performance using machine learning and advanced tracking systems.

- The collaboration with the Naval Research Laboratory is expected to generate substantial, long-term cost savings and highlights Ameresco's ability to deliver advanced, resilient energy solutions for mission-critical government clients.

- We'll take a look at how the major federal contract win with the U.S. Naval Research Laboratory shapes Ameresco's updated investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ameresco Investment Narrative Recap

To be an Ameresco shareholder, you need to believe that accelerating demand for grid resilience, public sector energy upgrades, and expanded government incentives will drive steady, profitable growth despite margin and execution risks. The US$197 million contract with the U.S. Naval Research Laboratory directly addresses key public sector catalysts, but does not fully resolve ongoing concerns around supply chain disruptions and input costs, the biggest near-term risk to execution and profit margin stability.

Of the recent announcements, Ameresco's collaboration with the Art Institute of Chicago stands out for showcasing how its advanced energy optimization technologies can enhance recurring operations and maintenance revenues, a growing catalyst that supports longer-term financial resilience regardless of the lumpiness of individual project wins.

However, while project backlogs look robust, the risk of delays from equipment shortages and supplier instability remains something investors should be aware of...

Read the full narrative on Ameresco (it's free!)

Ameresco's narrative projects $2.4 billion revenue and $87.4 million earnings by 2028. This requires 8.8% yearly revenue growth and a $25.4 million increase in earnings from $62.0 million.

Uncover how Ameresco's forecasts yield a $35.67 fair value, a 14% downside to its current price.

Exploring Other Perspectives

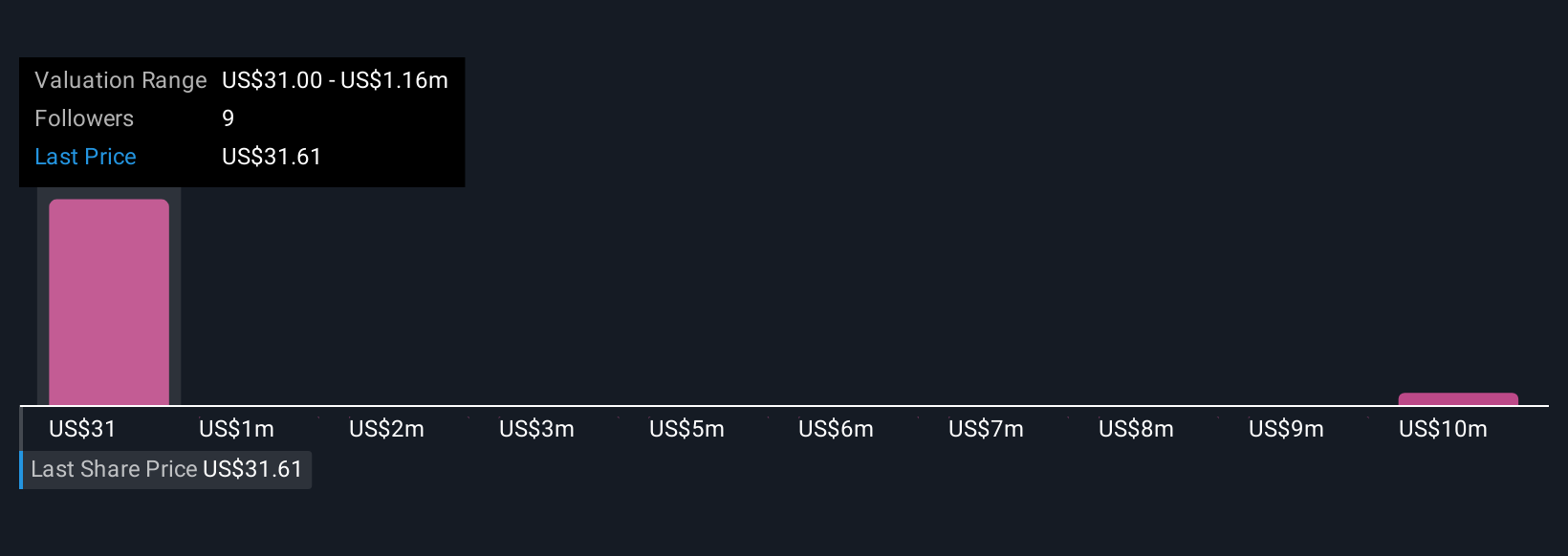

Four members of the Simply Wall St Community provided fair value estimates for Ameresco, ranging from US$35.67 to over US$11,587,157.66. While opinions are wide, recent public sector wins highlight how government incentives and project pipeline conversion may influence perceptions of Ameresco’s value, consider exploring these varied viewpoints for a more complete understanding.

Explore 4 other fair value estimates on Ameresco - why the stock might be worth 14% less than the current price!

Build Your Own Ameresco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ameresco research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ameresco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ameresco's overall financial health at a glance.

No Opportunity In Ameresco?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives