- United States

- /

- Construction

- /

- NYSE:AMRC

A Look at Ameresco’s Valuation After Securing $197 Million U.S. Naval Research Laboratory Contract

Reviewed by Kshitija Bhandaru

Ameresco has secured a $197 million energy savings performance contract with the U.S. Naval Research Laboratory to modernize infrastructure at key sites. The project is expected to generate $362 million in savings over 21 years.

See our latest analysis for Ameresco.

Ameresco’s win at the U.S. Naval Research Laboratory comes just after several notable collaborations, including a comprehensive project at the Art Institute of Chicago and new partnerships focused on advanced micro-modular reactor siting. This wave of strategic momentum has fueled a remarkable 39% one-month share price return, with the stock surging 105% over the last three months. However, even with major recent gains, the one-year total shareholder return stands at just under 10%, reflecting both the stock’s strong comeback and the challenges it faced earlier in this cycle.

If government contracts and innovation stories like Ameresco’s have you curious, this could be the moment to broaden your investing lens and check out fast growing stocks with high insider ownership.

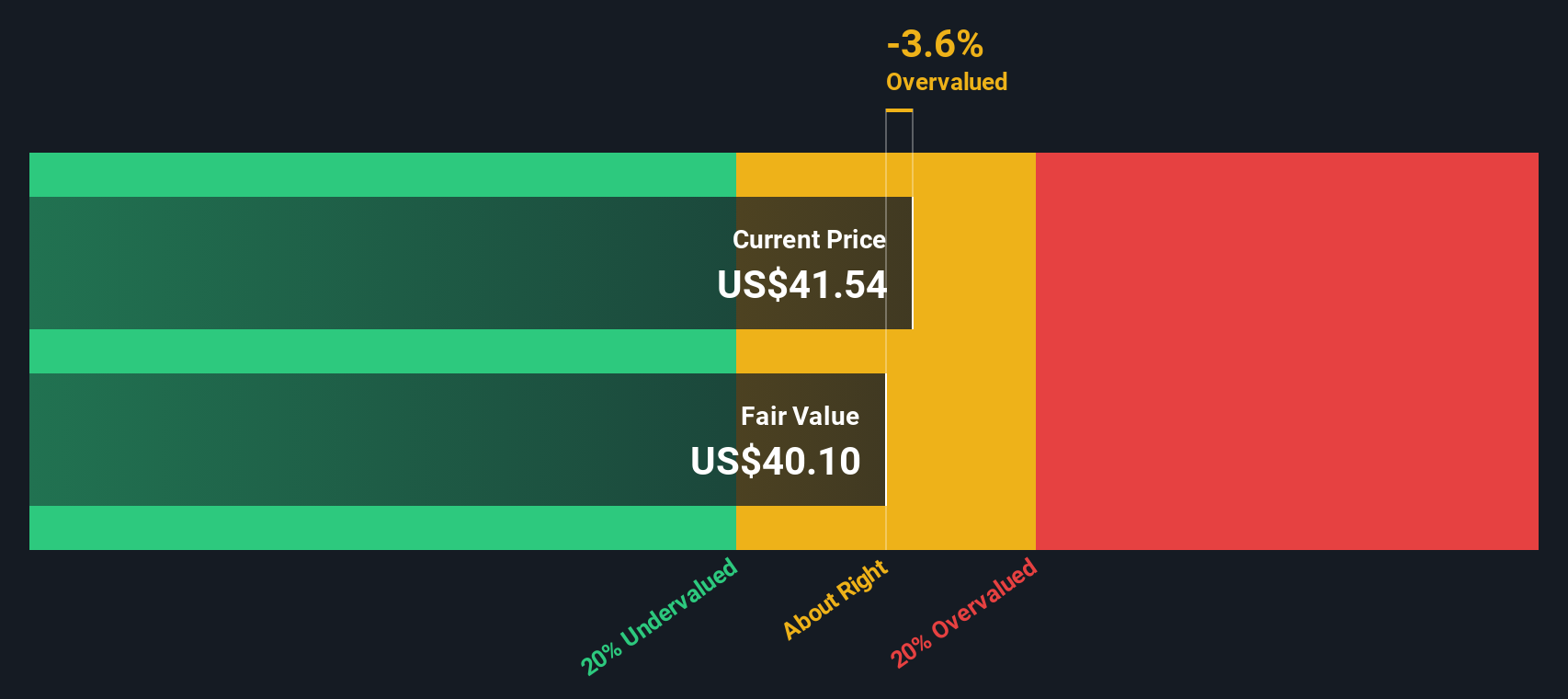

With shares on a dramatic upswing following recent federal contracts, investors now face a pivotal question: is Ameresco’s rally leaving untapped value on the table, or is the market already factoring in all the future growth?

Most Popular Narrative: 11.6% Overvalued

Ameresco’s most followed narrative sets its fair value at just over $34, compared to a recent close near $38. This suggests that the market is currently pricing in more optimism than the consensus expectations, drawing renewed attention to the assumptions behind Ameresco’s future growth and profitability.

Expanded government incentives for clean energy and storage (including ITCs and the Inflation Reduction Act) have allowed Ameresco to monetize new projects more quickly and enhance project economics. This has improved both revenue predictability and net margins through increased operating leverage.

Want to know the real reason behind this valuation? The narrative hinges on ambitious growth expectations, increased margins, and a surprisingly aggressive profit forecast. Can Ameresco achieve these numbers and justify this price? Click through for the crucial financial details.

Result: Fair Value of $34.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain delays and shifting government policy could challenge Ameresco’s growth path. These factors may potentially pressure revenue predictability and project margins going forward.

Find out about the key risks to this Ameresco narrative.

Another View: A Different Take on Value

While the narrative-based valuation points to Ameresco being overvalued, our DCF model finds the current share price is actually slightly below its estimated fair value of $38.82. This suggests investors may be underappreciating long-term cash flow potential. The question is which outlook will prove right as new earnings and contracts roll in?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ameresco Narrative

If you’re not convinced by these conclusions or want to dig into the numbers yourself, you can quickly craft your own narrative and see how your take stacks up, all in just a few minutes. Do it your way

A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the opportunity to rethink your portfolio. Broaden your horizons with a handpicked selection of stocks tailored to fresh investment themes and market potential.

- Pinpoint stocks offering steady cash flow and robust yields by scanning the latest picks in these 19 dividend stocks with yields > 3%.

- Uncover tomorrow’s disruptive innovators among these 24 AI penny stocks, and take advantage of groundbreaking progress in artificial intelligence.

- Spot undervalued gems before the crowd catches on by browsing these 892 undervalued stocks based on cash flows based on their real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMRC

Ameresco

Provides energy solutions in the United States, Canada, and Europe.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives